Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

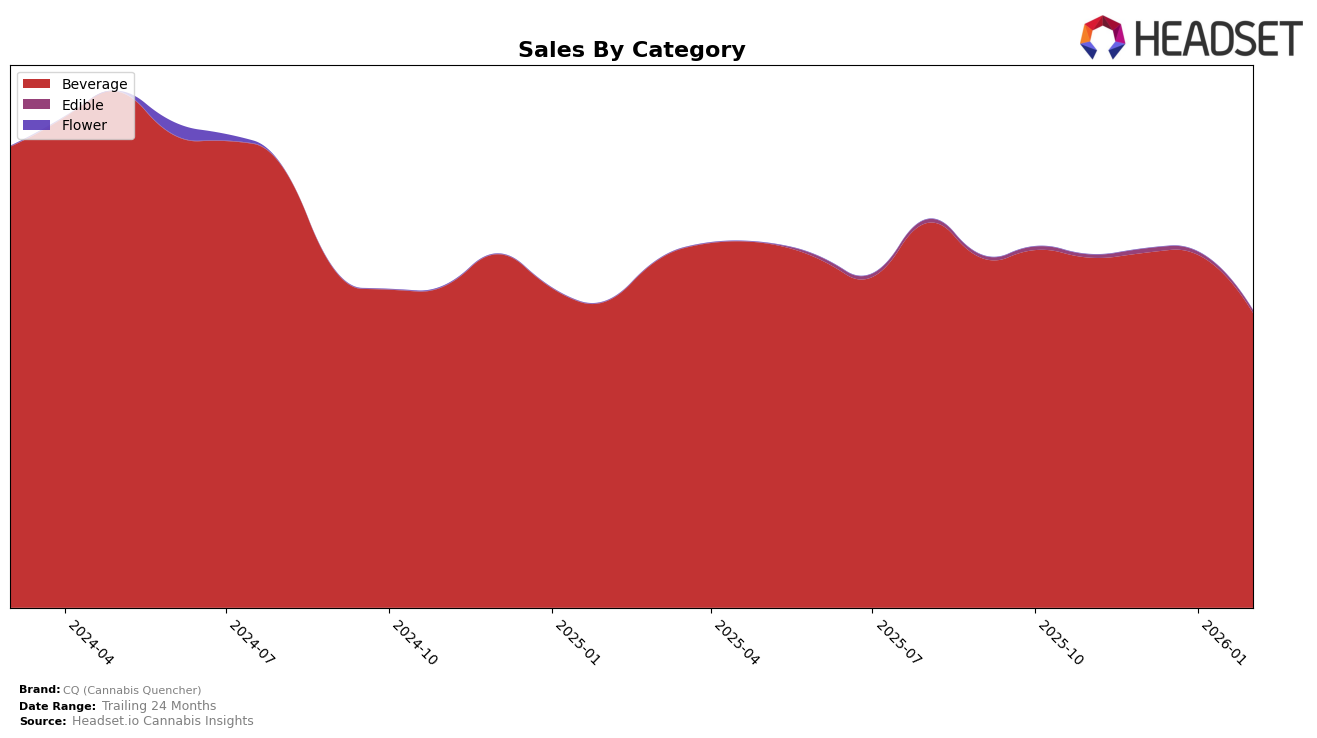

In the competitive landscape of cannabis-infused beverages, CQ (Cannabis Quencher) has demonstrated varying performance across different states and provinces. In California, the brand has shown a positive trajectory, climbing from the 14th position in November 2025 to the 11th by February 2026. This upward movement suggests a strengthening market presence, although the sales figures reflect a slight fluctuation. Meanwhile, in Illinois, CQ maintained a strong foothold, consistently ranking 4th until a slight dip to 5th in February 2026, which could be indicative of increasing competition or seasonal sales variations.

In Massachusetts, CQ has maintained a stable position, consistently ranking 10th over several months, indicating a steady consumer base. The situation in Michigan is quite promising, with the brand advancing from 5th to 4th place, suggesting a growing popularity. However, in Ontario, CQ's presence is less pronounced, with the brand only breaking into the top 30 as of December 2025. This could point to potential growth opportunities or challenges in market penetration. Lastly, in Washington, the brand's ranking has been relatively stable, although a notable dip in December 2025 suggests a temporary setback that was quickly recovered in subsequent months.

Competitive Landscape

In the Illinois beverage category, CQ (Cannabis Quencher) has maintained a competitive position, consistently ranking 4th from November 2025 through January 2026, before experiencing a slight dip to 5th place in February 2026. Despite this minor decline, CQ's sales have been robust, although they show a downward trend from November 2025 to February 2026. This shift in rank and sales can be attributed to the strong performance of competitors like Daze Off, which has consistently held the 3rd position with stable sales, and tonic, which improved its rank from 5th to 4th in February 2026. Meanwhile, Keef Cola has maintained a steady 6th place rank, indicating a stable presence but not posing an immediate threat to CQ's standing. These dynamics highlight the competitive pressures CQ faces in maintaining its market position amidst fluctuating sales and the strategic maneuvers of its rivals.

Notable Products

In February 2026, the top-performing product from CQ (Cannabis Quencher) was Ginger Ale Soda with 100mg THC, maintaining its number one rank for the fourth consecutive month, achieving sales of 4668 units. The Strawberry Lemonade Shot with 100mg THC climbed to the second position from fourth in January, indicating a surge in popularity. Caffeinated Classic Cola Soda with 100mg THC held steady at the third spot, despite a slight drop in sales figures compared to January. Strawberry Lemonade Spritzer with 5mg THC improved its rank from fifth in January to fourth in February. Dr. Quencher Soda with 100mg THC, which was at the second position in January, fell to the fifth rank, suggesting a decrease in consumer preference or competition from other products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.