Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

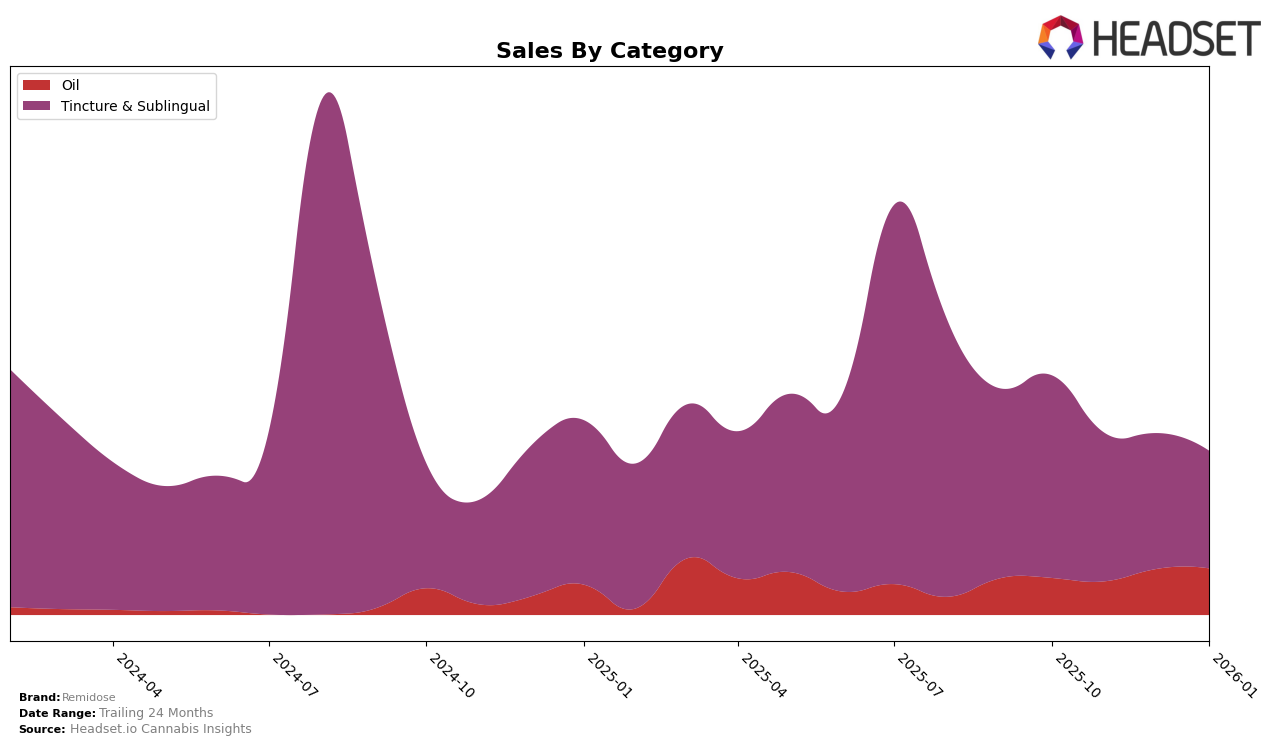

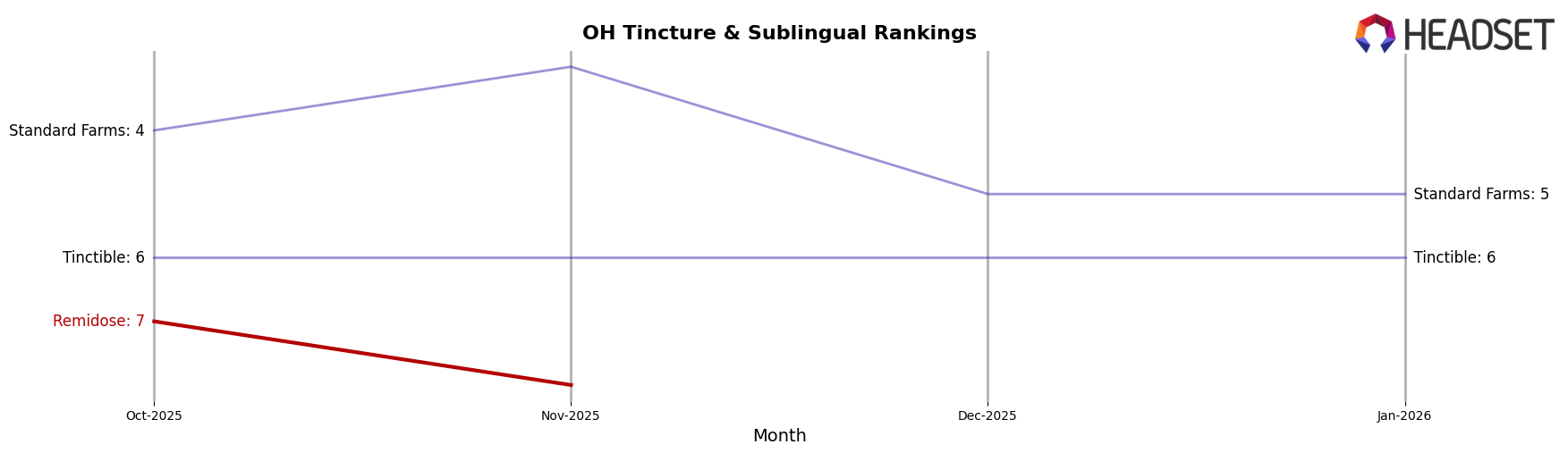

Remidose has shown a notable presence in the Ohio market, particularly in the Tincture & Sublingual category. In October 2025, the brand held the 7th position, which slightly declined to the 8th position by November 2025. Although the brand's sales figures decreased from $14,164 in October to $10,352 in November, it is important to note that Remidose maintained its position within the top 10, indicating a strong foothold in this category. However, the absence of rankings for December 2025 and January 2026 suggests that Remidose did not maintain a top 30 position in Ohio during these months, which could be a point of concern for the brand's continued competitiveness in this market.

The performance of Remidose across other states and categories remains undisclosed, but the available data highlights the brand's initial strength and subsequent challenges in maintaining its market position in Ohio. The drop in ranking and sales within two months raises questions about market dynamics and consumer preferences that may have influenced these results. While the decline in Ohio might suggest a need for strategic adjustments, it would be beneficial to explore whether similar trends are occurring in other states or categories to gain a comprehensive understanding of Remidose's overall market performance.

Competitive Landscape

In the Ohio Tincture & Sublingual category, Remidose has experienced a notable shift in its competitive standing, particularly when compared to brands like Standard Farms and Tinctible. While Remidose ranked 7th in October 2025 and slipped to 8th in November 2025, it did not appear in the top 20 rankings for December 2025 and January 2026, indicating a significant decline in market presence. In contrast, Standard Farms maintained a strong position, moving from 4th to 3rd in November 2025, before settling at 5th in December 2025 and January 2026, showcasing a relatively stable performance despite a slight sales decrease. Tinctible consistently held the 6th position throughout the same period, demonstrating steady sales figures. This competitive landscape suggests that Remidose may need to reassess its market strategies to regain its footing and improve sales performance in the Ohio market.

Notable Products

In January 2026, the top-performing product for Remidose was Berry Sublingual Oral Spray (500mgmg THC) from the Tincture & Sublingual category, maintaining its first-place rank from the previous two months with sales of 125 units. Citrus Live Resin Drops Oil (30ml) held steady at the second rank, showing a notable increase in sales compared to December 2025. Grape Sublingual Oral Spray (500mg THC) climbed to third place, improving from its previous fourth-place position. Pomegranate Sublingual Oral Spray (500mg) re-entered the rankings, securing the fourth position after not being ranked in November 2025. Strawberry Sublingual Oral Spray (500mg THC) experienced a decline, dropping to fifth place from its previous third-place ranking in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.