Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

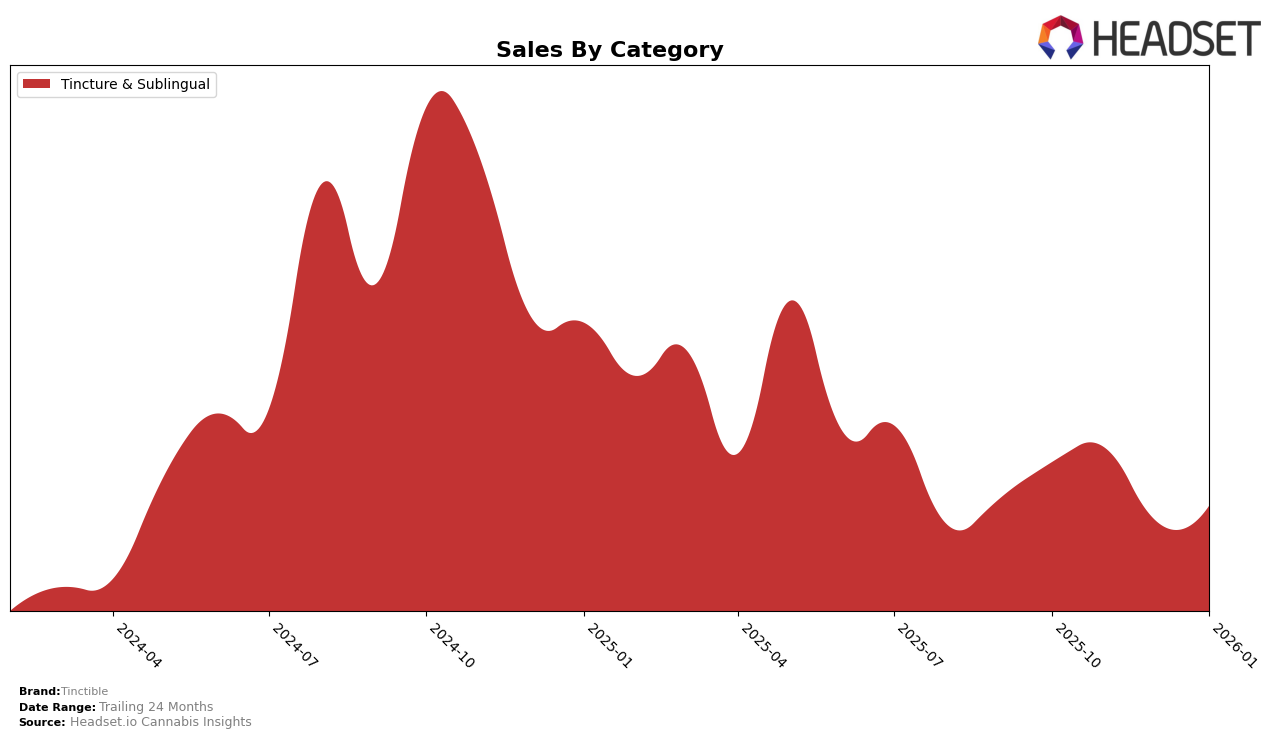

Tinctible has maintained a consistent presence in the Ohio market within the Tincture & Sublingual category, holding steady at the sixth position from October 2025 through January 2026. This stability indicates a strong foothold in the market, suggesting that Tinctible has successfully captured a loyal customer base in Ohio. Despite a slight dip in sales from November to December, the brand quickly rebounded in January, demonstrating resilience and effective market strategies. The consistent ranking in Ohio highlights the brand's ability to sustain its market position over several months, which is a positive indicator of its performance in this category.

However, Tinctible's absence from the top 30 brands in other states or provinces during this period indicates potential areas for growth and expansion. The lack of ranking in additional markets could be viewed as a missed opportunity for the brand to diversify its presence and increase its market share. This gap presents a strategic opportunity for Tinctible to explore new markets or enhance its offerings in existing ones. By analyzing consumer preferences and competitive landscapes in other regions, Tinctible could potentially replicate its Ohio success elsewhere, thereby enhancing its overall market performance.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Ohio, Tinctible consistently maintained its 6th rank from October 2025 to January 2026. Despite this steady positioning, Tinctible faces significant competition from brands like Standard Farms and Doctor Solomon's, both of which have fluctuated within the top 5 ranks during the same period. Notably, Standard Farms saw a slight decline in sales from November to January, while Doctor Solomon's experienced a peak in December, overtaking Standard Farms briefly. Meanwhile, Remidose dropped out of the top 20 after November, indicating a potential opportunity for Tinctible to capture some of its market share. Tinctible's consistent rank suggests a stable customer base, but the brand may need to innovate or increase marketing efforts to climb higher in the rankings and boost sales against these formidable competitors.

Notable Products

In January 2026, the top-performing product from Tinctible was Squeeze In - THC/CBN 3:1 Blueberry Lavender Sleep Gel 11-Pack, maintaining its position as the number one ranked product with notable sales of 510 units. This product climbed from the third position in October 2025 to the top by December 2025, showcasing a steady increase in popularity. The Squeeze In- CBD/THC 1:1 Spark Watermelon Gel 11-Pack was ranked second, experiencing a drop from its top position in November 2025. Meanwhile, the Squeeze In- THC/CBG/CBD 2:1:1 Relief Blue Raspberry Gel 11-Pack was third, having seen a decline from first place in October 2025. These shifts indicate dynamic consumer preferences within the Tincture & Sublingual category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.