Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

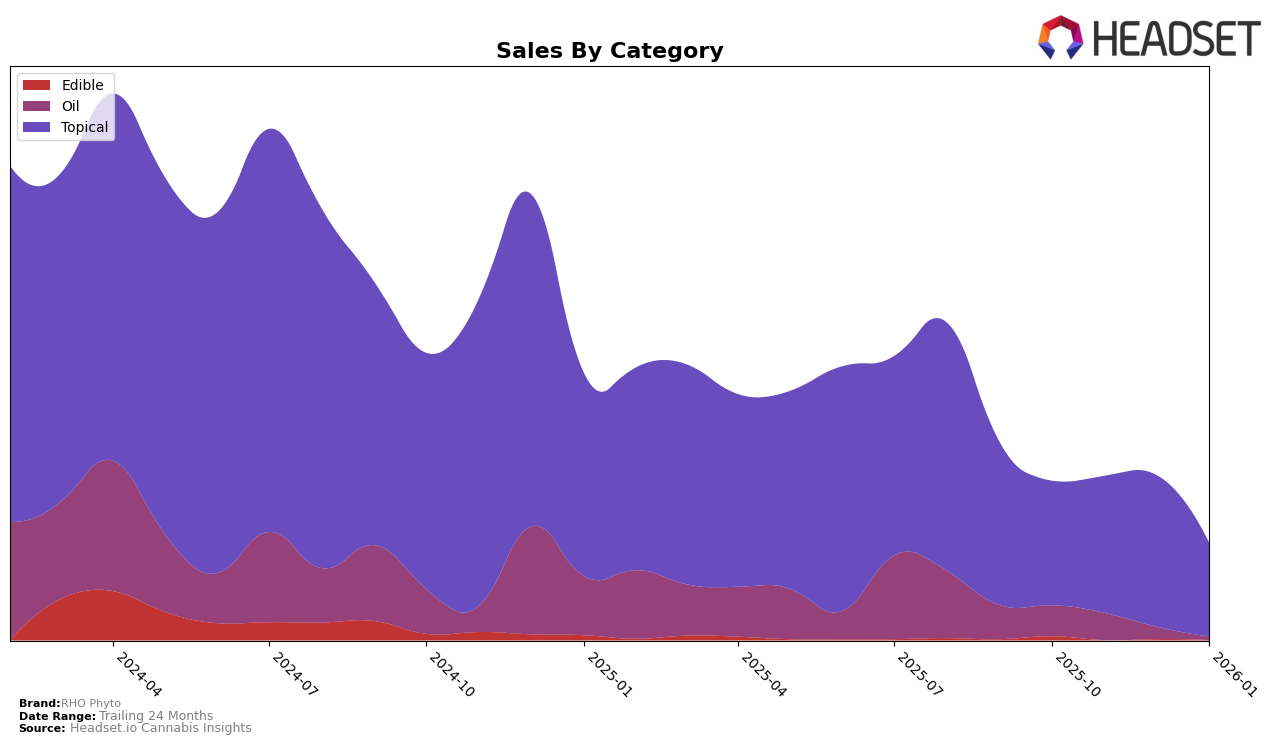

RHO Phyto has shown a notable presence in the Ontario market, specifically within the Topical category. By January 2026, the brand achieved a rank of 7, marking a successful entry into the top 10. This is a significant improvement considering the absence of RHO Phyto in the top 30 rankings in the preceding months of October, November, and December 2025. Such a movement suggests a positive reception of their products in Ontario, which could be attributed to strategic marketing efforts or product innovations that resonated well with consumers. The absence of rankings in previous months highlights a rapid upward trajectory, indicating that RHO Phyto may have introduced new products or enhancements that captured consumer interest effectively.

While the data provides a clear picture of RHO Phyto's progress in Ontario, it leaves room for further exploration into other states or provinces where the brand might be operating. The lack of information on rankings outside of Ontario suggests that RHO Phyto might not have yet made a significant impact in other regions, or they are focusing their efforts primarily within Ontario. This focused approach could be strategic, allowing the brand to consolidate its market presence before expanding. For stakeholders and potential investors, keeping an eye on RHO Phyto's expansion strategies and performance in other categories could provide insights into future growth opportunities and potential market shifts.

Competitive Landscape

In the Ontario topical cannabis market, RHO Phyto has shown a notable shift in its competitive standing over the last few months. As of January 2026, RHO Phyto ranked 7th, marking its first appearance in the top 20 since October 2025. This is a significant improvement, indicating a positive trend in both brand visibility and sales performance. In contrast, Dosecann held a steady position at 7th in October 2025 but did not maintain a top 20 rank in subsequent months, suggesting a potential decline in market presence. Meanwhile, LivRelief entered the top 20 in November 2025 at 7th but also did not sustain its ranking. This dynamic market movement highlights RHO Phyto's growing influence and potential to capture a larger market share as competitors like Dosecann and LivRelief experience fluctuations in their rankings.

Notable Products

In January 2026, the CBD/THC 25:1 Deep Tissue Extra Strength Gel from RHO Phyto maintained its position as the top-performing product, continuing its streak as the number one ranked product since October 2025, despite a decrease in sales to 232 units. The CBG Transdermal Relief Gel climbed to the second position, showing a notable improvement from its consistent third-place ranking in previous months. The THC:CBG Rapid Act Oral Spray dropped to third place, continuing its decline in sales from 77 units in October 2025 to just 8 units in January 2026. The CBD:THC 10:1 Daily Dose Gummies, which held the fourth rank in October and December 2025, was not ranked in January 2026, possibly indicating a lack of sales data or a discontinuation. Overall, the topical category showed strong performance, with both top-ranked products belonging to this category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.