Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

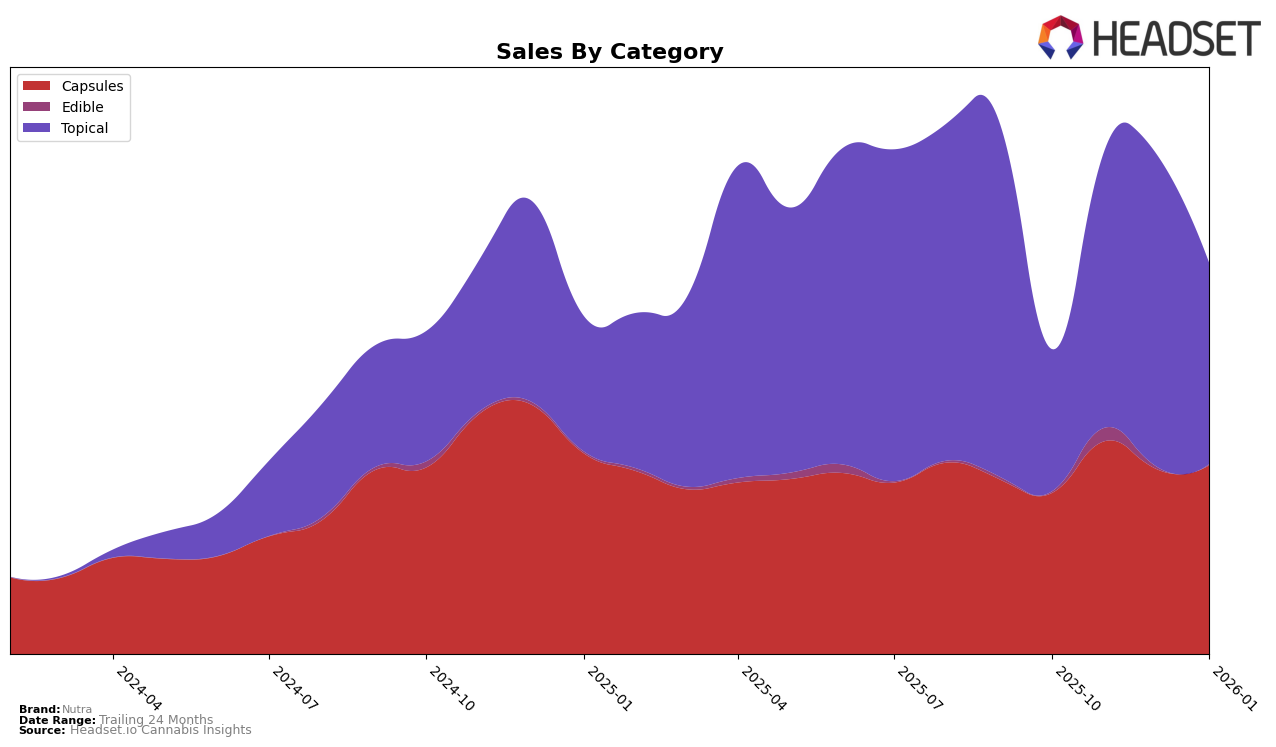

Nutra's performance in the British Columbia market shows a consistent presence in the top five rankings for both the Capsules and Topical categories. In the Capsules category, Nutra maintained a steady 5th place ranking from November 2025 through January 2026, despite a notable decline in sales from $26,004 in October 2025 to $18,734 in January 2026. This suggests that while their market position remains strong, there may be underlying challenges affecting sales volume. In the Topical category, Nutra also held a 5th place ranking in December 2025 and January 2026, after a slight drop from 4th place in November 2025, accompanied by a significant sales decrease from $42,319 in November 2025 to $23,559 in January 2026.

In Ontario, Nutra's performance in the Capsules category saw a modest improvement, climbing from 15th place in December 2025 to 12th place by January 2026. This upward trend in rankings coincides with a recovery in sales from $17,245 in December 2025 to $21,608 in January 2026, indicating a positive trajectory. Meanwhile, in the Topical category, Nutra maintained a stable 5th place ranking in December 2025 and January 2026, despite a fluctuating sales pattern, with a peak in December 2025 at $26,238. Notably, Nutra did not appear in the top 30 rankings in either category in October 2025, highlighting the brand's progress over the subsequent months in Ontario.

Competitive Landscape

In the competitive landscape of the Topical category in British Columbia, Nutra has experienced fluctuations in its rank, notably entering the top 5 in November 2025 and maintaining a presence through January 2026. Despite this achievement, Nutra faces stiff competition from brands like Wildflower and Wildflower Canada, both of which consistently rank higher. Notably, Wildflower Canada maintained a strong third position from October 2025 through January 2026, indicating a robust market presence. Nutra's sales have seen a downward trend, particularly in January 2026, which could be attributed to the competitive pressure from these established brands. Meanwhile, NaturalREM briefly appeared in the rankings in November 2025, suggesting emerging competition. This dynamic environment underscores the need for Nutra to innovate and differentiate its offerings to capture a larger market share and improve its ranking in the coming months.

Notable Products

In January 2026, the top-performing product from Nutra was the CBD Peppermint Lavender + MAG + Hyaluronic Acid Balm with 3000mg CBD, maintaining its number one rank from the previous months with sales of 845 units. The CBD Hemp Isolate Capsules 30-Pack with 3000mg CBD rose to the second rank, improving from its third position in December 2025, with a notable increase in sales to 291 units. The CBD Isolate Capsules 15-Pack with 1500mg CBD, which held the second position in December, dropped to third place. The CBD Isolate Capsules 60-Pack with 6000mg CBD improved its rank from fifth to fourth, despite a decrease in sales. Finally, the CBD/CBG/CBN 1:1:1 Balance Beam Capsules 30-Pack made its debut in the rankings at fifth place, indicating a new interest in balanced cannabinoid products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.