Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

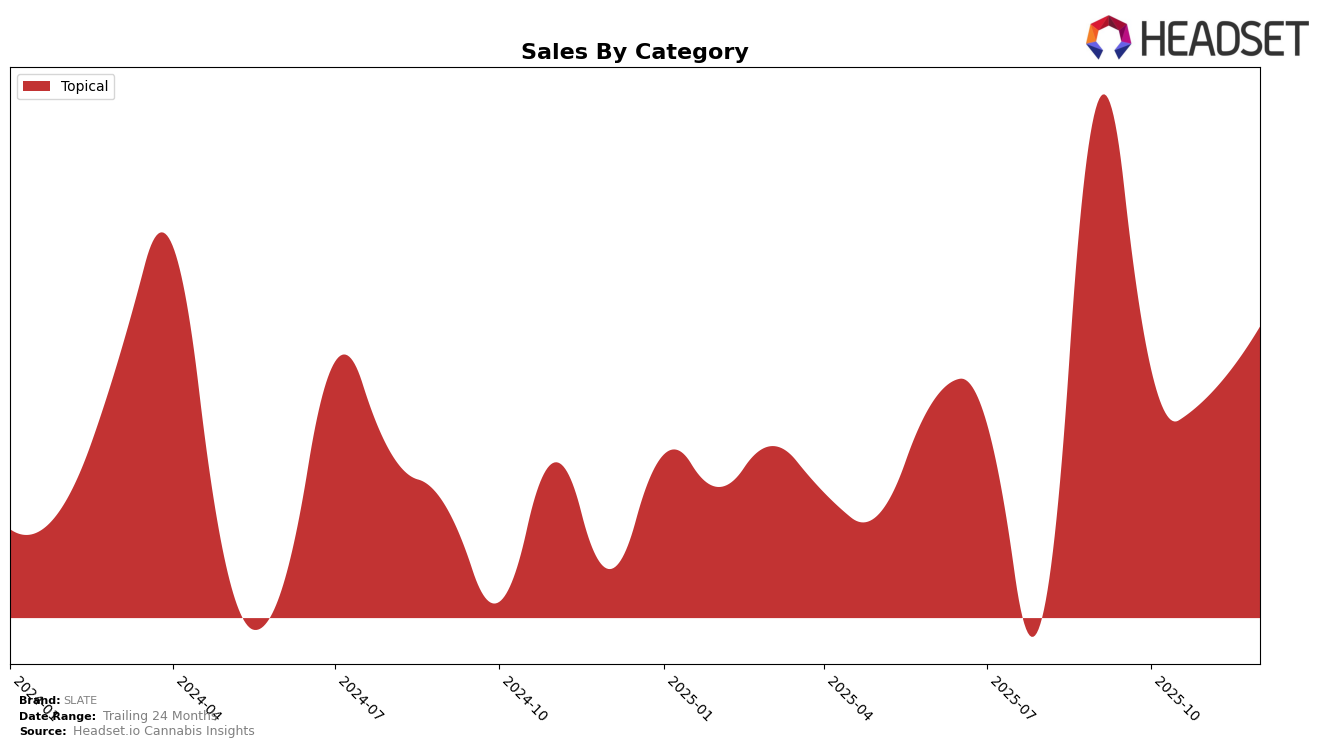

SLATE's performance in the Massachusetts market, particularly in the Topical category, has been noteworthy. In September 2025, SLATE secured the 5th position in the rankings, indicating a strong presence in this segment. However, the absence of rankings for October, November, and December suggests that SLATE did not maintain its position within the top 30 brands in the subsequent months. This drop could be a point of concern, as it implies a potential decline in market presence or increased competition in the Topical category within Massachusetts.

Despite the lack of detailed data for the following months, the initial ranking in September highlights SLATE's capability to capture consumer interest in the Topical category. The sales figure for September 2025, which was $15,496, provides some context to their initial success. However, without further data, it's challenging to ascertain the reasons behind the drop in rankings. This situation could prompt further investigation into market dynamics, competitive actions, or changes in consumer preferences that might have influenced SLATE's performance in Massachusetts. Observing these trends can offer valuable insights into the brand's strategic positioning and potential areas for improvement.

Competitive Landscape

In the Massachusetts topical cannabis market, SLATE experienced a notable shift in its competitive positioning from September to December 2025. Initially ranked 5th in September, SLATE's absence from the top 20 in subsequent months signals a significant decline in market presence. This contrasts with Nordic Goddess, which maintained a relatively stable ranking, fluctuating between 4th and 6th place, and The Healing Rose (THR), which emerged in December to capture the 5th spot. The consistent presence of these competitors, coupled with SLATE's drop, suggests a potential shift in consumer preferences or competitive strategies that may have impacted SLATE's sales trajectory. This dynamic highlights the importance of strategic adjustments for SLATE to regain its competitive edge in the Massachusetts topical market.

Notable Products

In December 2025, SLATE's CBD/THC 1:1 Wonder Balm (600mg CBD, 600mg THC, 6oz) maintained its position as the top-performing product in the Topical category, consistently ranking first since September 2025. This product saw a notable increase in sales to 162 units, highlighting its enduring popularity. Other products in SLATE's lineup showed varying performance, but none matched the consistent dominance of the Wonder Balm. Compared to previous months, there were no significant changes in the top rankings, indicating stable consumer preferences. SLATE's ability to maintain their leading product's rank demonstrates effective market positioning and customer loyalty.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.