Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

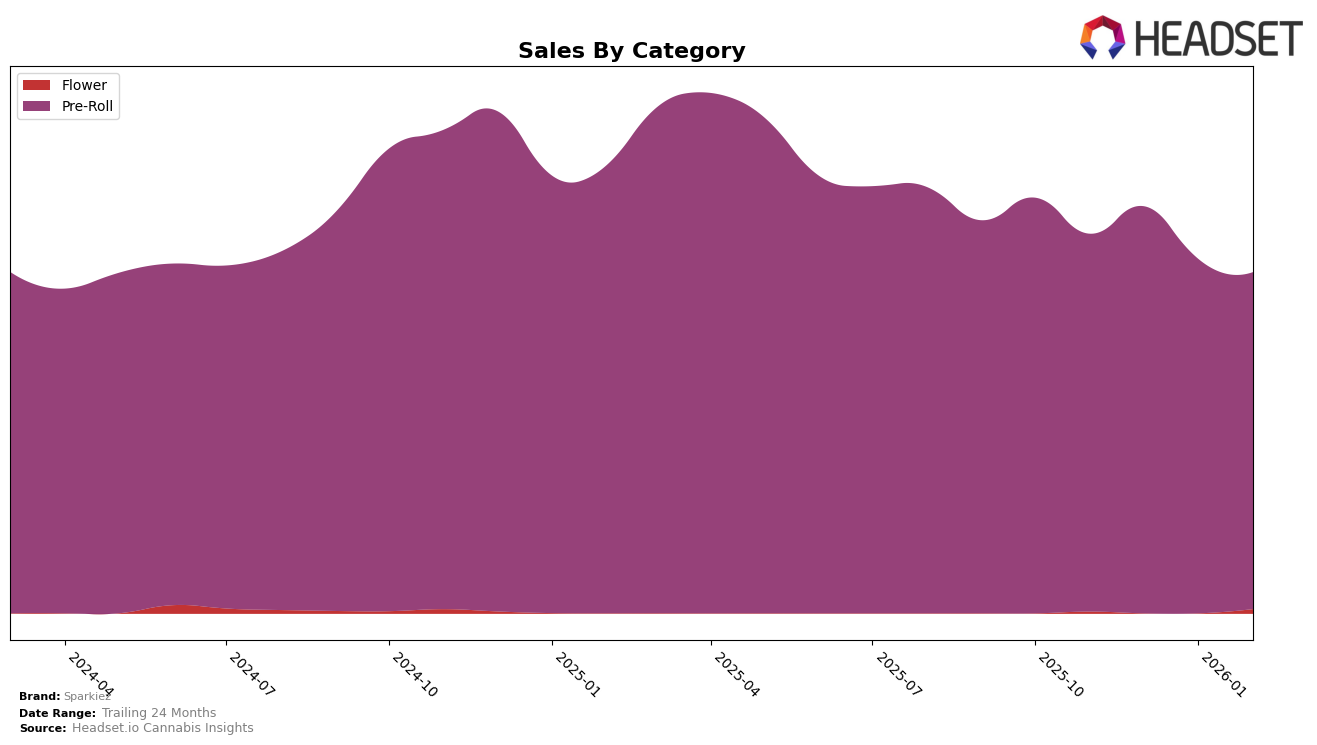

Sparkiez has shown a consistent presence in the California pre-roll market, maintaining a steady ranking at 17th place from November 2025 through January 2026, before improving to 14th place in February 2026. This upward movement in February suggests a positive reception among consumers, potentially driven by strategic marketing or product innovation. Despite a notable decrease in sales from January to February, the brand's ability to climb the rankings indicates resilience and a strong foothold in the competitive pre-roll category.

While Sparkiez has demonstrated stability in California, their absence from the top 30 rankings in other states and categories could be seen as a limitation in their market penetration. This lack of presence outside California may suggest a focus on consolidating their position within a single market rather than expanding geographically. However, this strategy might allow them to refine their product offerings and establish a loyal customer base before considering broader expansion.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Sparkiez has shown a steady performance with a notable improvement in its ranking from November 2025 to February 2026. Initially ranked 17th, Sparkiez climbed to 14th place by February 2026, indicating a positive trajectory in market presence. This upward movement is particularly significant when compared to brands like West Coast Cure, which maintained a relatively stable rank but saw a decline in sales over the same period. Meanwhile, UpNorth Humboldt consistently held the 15th position, suggesting a competitive tension with Sparkiez as they vie for market share. Time Machine has been a strong competitor, consistently ranking higher, though it experienced a slight dip in February 2026. The dynamic shifts in rankings and sales figures highlight Sparkiez's potential to capture more market share if it continues its current growth trajectory, especially as it outpaces Birdies, which has shown a more volatile rank improvement.

Notable Products

In February 2026, the top-performing product from Sparkiez was the Guava Pre-Roll (1g) in the Pre-Roll category, maintaining its number one rank from December 2025 and improving from its second position in January 2026. This product achieved a notable sales figure of 4455. The Guava Pre-Roll 14-Pack (14g) held steady in the second position, consistent with its January ranking, but dropped from its first place in November 2025. The Jack Pre-Roll 14-Pack (14g) remained stable in the third position throughout the last few months. Meanwhile, the Hindu Kush Pre-Roll 14-Pack (14g) has seen a slight decline from second in November to fourth in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.