Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

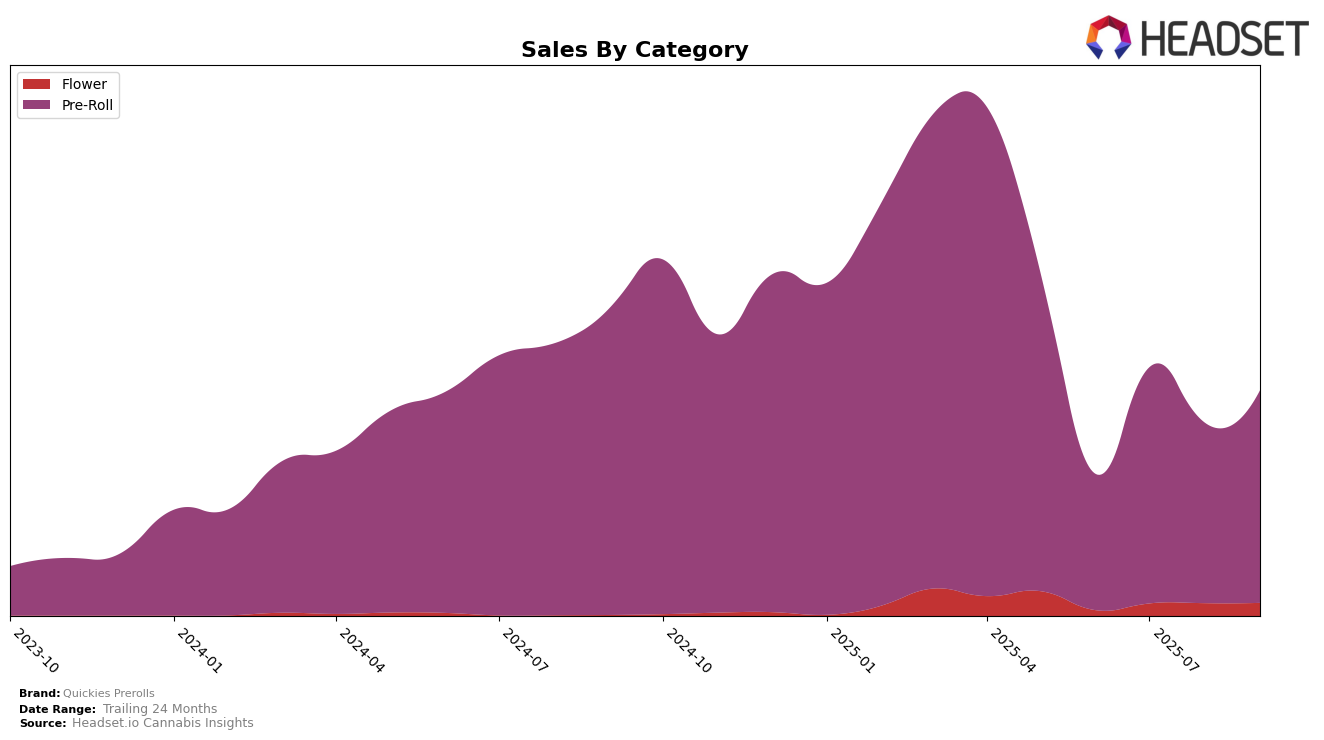

Quickies Prerolls has shown a dynamic performance across various categories and states, with notable movements in rankings. In California, the brand experienced a significant climb in the Pre-Roll category, moving from a rank of 40 in June 2025 to 24 by July, before slightly dipping to 31 in August and recovering to 25 in September. This fluctuation indicates a competitive market presence, with Quickies Prerolls managing to regain some lost ground towards the end of the period. The brand's ability to stay within the top 30 in California for most months suggests a solid consumer base, although the dip in August highlights potential challenges or increased competition during that time.

Despite not being listed in the top 30 in some months, the brand's overall trajectory in California suggests resilience and an upward trend in popularity. The sales figures reflect this movement, with a notable increase from June to July, followed by a slight decrease in August, and then a recovery in September. Such fluctuations might indicate seasonality or promotional activities that could have influenced consumer purchasing behavior. Understanding these patterns could be crucial for stakeholders looking to capitalize on emerging trends within the Pre-Roll category across different markets.

Competitive Landscape

In the competitive landscape of the California pre-roll category, Quickies Prerolls has shown a dynamic shift in rankings over the past few months. Starting from a rank of 40 in June 2025, Quickies Prerolls made a significant leap to 24 in July, demonstrating a positive trend in market presence. However, the brand experienced some fluctuations, dropping to 31 in August before slightly recovering to 25 in September. This volatility suggests Quickies Prerolls is actively competing for market share against established brands. Notably, Sunset Connect and Selfies have maintained relatively stable positions, with ranks hovering around the low 20s and high 20s, respectively, indicating consistent consumer preference. Meanwhile, Cizi has consistently outperformed Quickies Prerolls, holding ranks within the top 25, which may suggest a stronger brand loyalty or product differentiation. The data implies that while Quickies Prerolls is making strides, there is still room for growth in capturing a larger share of the pre-roll market in California.

Notable Products

In September 2025, Quickies Prerolls' top-performing product was the Indica Pre-Roll (1g), maintaining its consistent first-place ranking from previous months with sales of 34,448 units. The Sativa Pre-Roll (1g) held steady in second place, while the Hybrid Pre-Roll (1g) remained in third. Notably, the Indica Diamond Infused Pre-Roll (1g) improved its rank from fifth in August to fourth in September, reflecting a slight increase in sales. The Sativa Diamond Infused Pre-Roll (1g) entered the rankings for the first time at fifth place, indicating a successful launch or increased popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.