Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

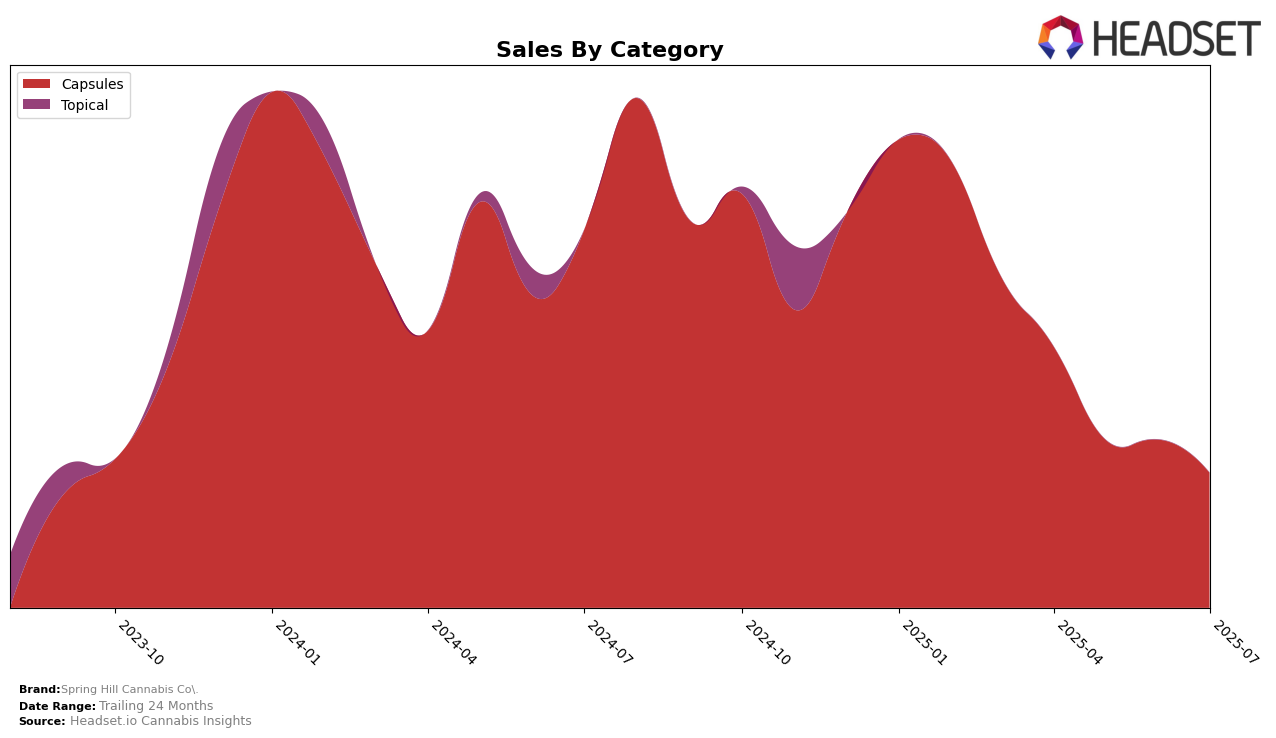

Spring Hill Cannabis Co. has shown varied performance across different categories and states, with noteworthy movements in some areas while remaining absent in others. In the capsules category in Ontario, the brand was ranked 18th in April 2025, but notably, it did not appear in the top 30 rankings for the subsequent months of May, June, and July. This indicates a decline in their market position within this category, which could be a point of concern for the brand's presence in Ontario. Such a drop suggests that Spring Hill Cannabis Co. might need to reassess its strategy in the capsules market to regain its standing.

While the absence from the top 30 in later months for Ontario's capsules category is significant, it also highlights the competitive nature of the cannabis market in the region. The initial presence in April demonstrates that the brand had a foothold, albeit briefly, which could be leveraged with strategic adjustments. This scenario underscores the importance of maintaining momentum and adapting to market demands to sustain or improve rankings. Understanding the factors behind these shifts could provide valuable insights for Spring Hill Cannabis Co. as it navigates the complexities of the cannabis industry across different regions and product categories.

Competitive Landscape

In the competitive landscape of the Ontario cannabis capsules market, Spring Hill Cannabis Co. has faced challenges in maintaining its rank within the top 20 brands. In April 2025, it was ranked 18th, but it did not appear in the top 20 in the subsequent months of May, June, and July, indicating a potential decline in market presence. In contrast, Nutra consistently held the 15th position throughout the same period, showcasing stable performance and possibly capturing a larger share of consumer loyalty. Meanwhile, Mood Ring maintained the 16th spot from April to June, although it also dropped out of the top 20 in July, suggesting some volatility. These insights highlight the competitive pressures Spring Hill Cannabis Co. faces, emphasizing the need for strategic adjustments to regain and sustain its market position.

Notable Products

In July 2025, the top-performing product for Spring Hill Cannabis Co. was CBD Capsules 30-Pack (3000mg CBD) in the Capsules category, maintaining its number one rank consistently from April through July. Despite a decrease in sales to 144 units in July, this product has shown remarkable stability in its ranking over the months. This indicates a strong and consistent demand for this product despite fluctuations in sales figures. The continuity in ranking highlights its popularity and potential customer loyalty. Observing its sales trend could provide insights into the seasonal or market factors affecting its performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.