Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

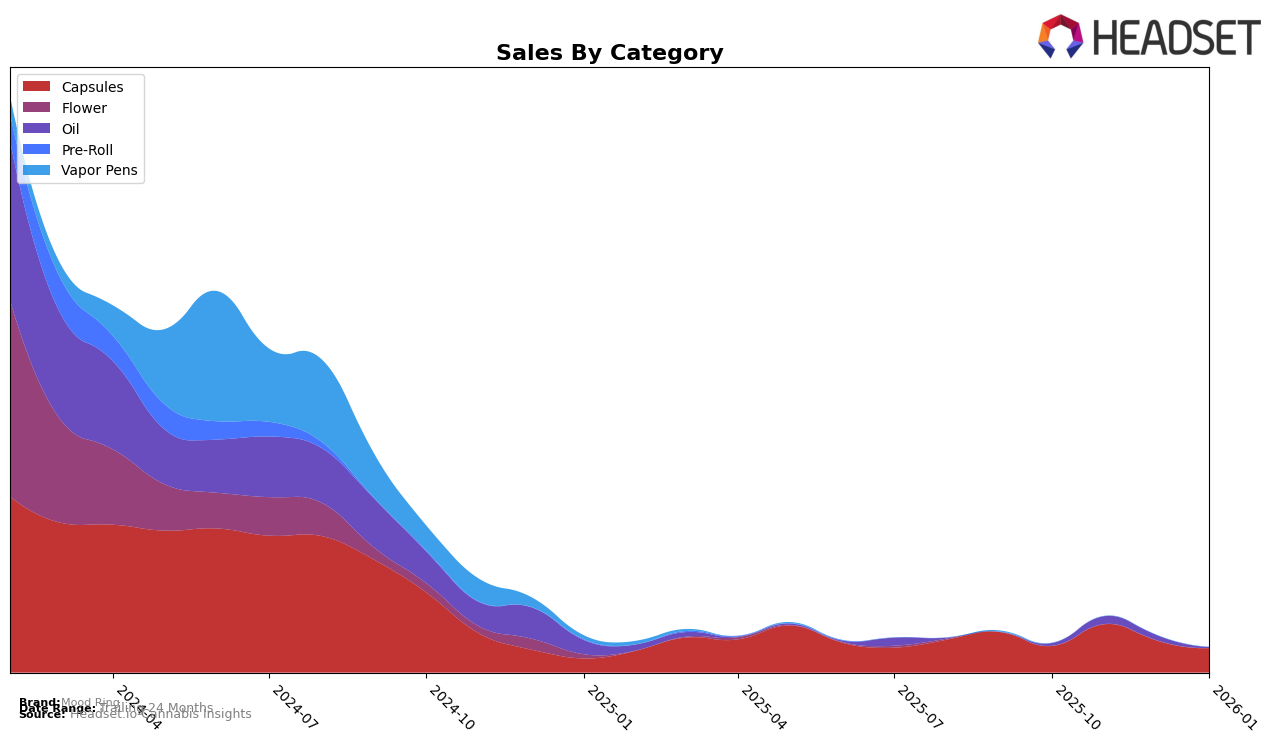

In the Canadian province of Ontario, Mood Ring has shown a notable presence in the Capsules category. Despite not ranking in the top 30 brands in October 2025, the brand made a significant leap to secure the 16th position by November 2025. This movement indicates a strong upward trend in consumer preference or market penetration for Mood Ring's capsules during this period. However, the absence of Mood Ring from the rankings in December 2025 and January 2026 suggests either a decline in market share or increased competition in the Capsules category.

The fluctuating rankings of Mood Ring in Ontario's Capsules category could point to seasonal variations or strategic shifts within the brand's marketing efforts. While the brand experienced a surge in November, maintaining consistent performance seems to be a challenge, as evidenced by its disappearance from the top 30 in subsequent months. This volatility could be an area of concern or an opportunity for Mood Ring to analyze market dynamics and consumer behavior to strengthen its foothold in the long term.

Competitive Landscape

In the competitive landscape of the Ontario capsules category, Mood Ring experienced fluctuations in its market presence, notably missing from the top 20 rankings in October 2025 and January 2026. This absence suggests a need for strategic adjustments to regain visibility. In contrast, Pennies maintained a consistent presence, ranking between 15th and 16th, with sales peaking in November 2025. Meanwhile, Persy showed resilience, reappearing in the rankings in December 2025 and January 2026, despite a dip in sales. These competitors' stability and resilience highlight the challenges Mood Ring faces in sustaining its market position and underscore the importance of strategic initiatives to enhance brand visibility and sales performance in the Ontario capsules market.

Notable Products

In January 2026, the top-performing product from Mood Ring was the High CBD Capsules 30-Pack (900mg CBD) in the Capsules category, maintaining its first-place ranking with sales of 154 units. The High THC Capsules 30-Pack (300mg) also retained its consistent second-place position, recording stable sales figures. The CBD/THC 15:15 Balanced Oil (30ml) improved its ranking to third place, up from fourth in December 2025, while the High CBD Oil and High THC Oil were not ranked in January. These changes highlight a stable demand for capsule products while oils experienced a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.