Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

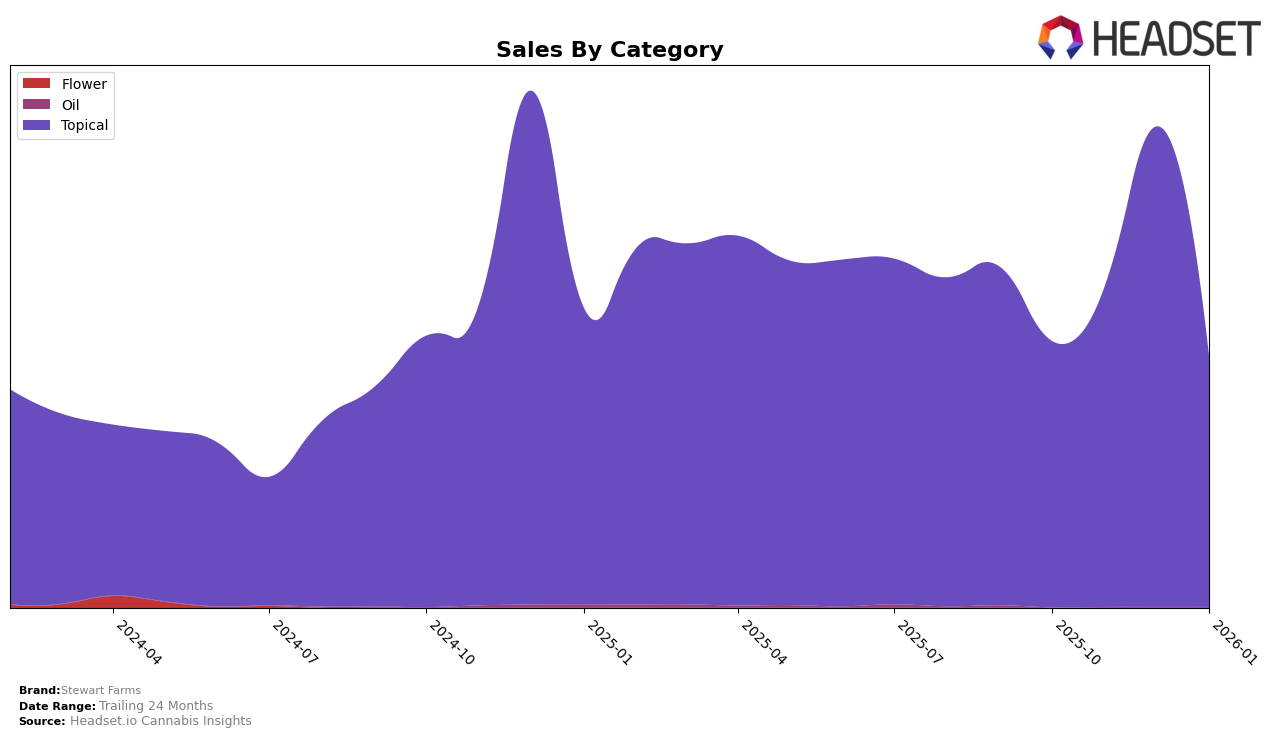

Stewart Farms has shown a consistent performance in the Topical category across several Canadian provinces. In Alberta, the brand maintained a strong presence, ranking second in October and November 2025, climbing to the top spot in December 2025, before slipping back to second in January 2026. This fluctuation in rankings is mirrored by a notable increase in sales from October to December, followed by a significant drop in January. Similarly, in British Columbia, Stewart Farms mirrored this trend by holding the second position in October and November, reaching the first rank in December, and then falling back to second in January. This suggests a strong seasonal performance in December, possibly driven by holiday demand.

In Ontario, Stewart Farms experienced a slight dip in November 2025, where it ranked third, but otherwise maintained a stable second position in the other months. This indicates a consistent consumer base in Ontario, despite the temporary dip in rank. It's important to note that Stewart Farms did not fall out of the top three rankings in any of these provinces, which underscores the brand's strength in the Topical category. However, the absence of Stewart Farms from the top 30 in any other categories or provinces could suggest opportunities for growth or areas where the brand is not currently focusing its efforts.

Competitive Landscape

In the Alberta topical cannabis market, Stewart Farms has shown a dynamic performance over the past few months, particularly in terms of rank and sales. Starting from October 2025, Stewart Farms maintained a strong position at rank 2, briefly climbing to the top spot in December 2025, before returning to rank 2 in January 2026. This fluctuation in rank is indicative of a competitive landscape, where Wildflower Canada consistently held the top position except for December. Despite this, Stewart Farms experienced a significant sales surge in December, surpassing Wildflower and Proofly, which remained stable at ranks 3 and 4 respectively. However, January 2026 saw a notable drop in Stewart Farms' sales, which could suggest a seasonal trend or increased competition pressure. This competitive analysis highlights the importance for Stewart Farms to strategize effectively to maintain its competitive edge in the Alberta market.

Notable Products

In January 2026, Stewart Farms' top-performing product was the CBD/THC 1:1 Blue Dream Bath Bomb (50mg CBD, 50mg THC, 130g) in the Topical category, maintaining its first-place rank from the previous months with sales figures reaching 2,882 units. The CBD:THC 1:1 Multipack Bath Bomb 3-Pack (150mg CBD,150mg THC) held steady in second place, following its consistent performance since November 2025. Rebound - CBD/THC 1:1 Arctic Heat Muscle Cream (500mg CBD, 500mg THC, 120g) remained in third place, despite a slight decline in sales compared to December. The CBD:THC 1:1 Multi Pack Bath Bomb 3-Pack (100mg CBD,100mg THC, 130g) secured the fourth position, maintaining its rank throughout the months. Notably, the Rebound - CBD Blueberry Sunset Salt Soak (250mg CBD, 125g) reappeared in fifth place, having been ranked only in November before January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.