Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

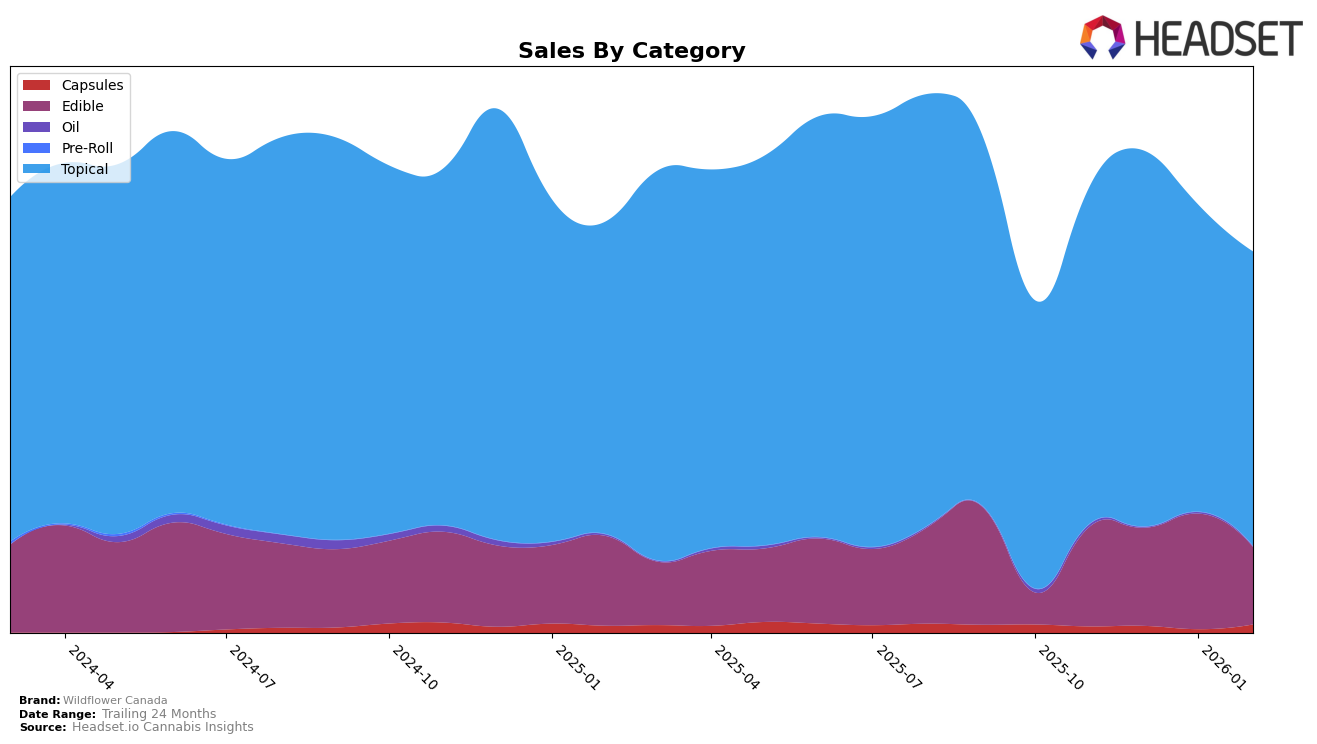

In the Alberta market, Wildflower Canada has consistently maintained a stronghold in the Topical category, holding the first rank for three out of four months and briefly slipping to the second position in December 2025. This indicates a solid consumer base and brand loyalty in the province. The sales figures show a slight decline from December 2025 to February 2026, which could be attributed to seasonal variations or market saturation. Meanwhile, in British Columbia, Wildflower Canada has experienced fluctuations in the Topical category, dropping from third to fifth position by February 2026, suggesting increasing competition or changes in consumer preferences.

In the Edible category in British Columbia, Wildflower Canada has shown resilience by climbing from the 14th position in December 2025 to the 11th position in January 2026, although it fell back to 13th in February 2026. This movement reflects potential volatility or market dynamics that may require strategic adjustments. In Ontario, the brand has maintained a steady third position in the Topical category throughout the observed period, indicating stability and consistent consumer demand. However, the sales figures reveal a noticeable dip in January 2026, which might warrant further investigation into market conditions or promotional strategies during that period.

Competitive Landscape

In the Alberta topical cannabis market, Wildflower Canada has demonstrated a strong presence, consistently maintaining a top-tier position over the past few months. As of February 2026, Wildflower Canada reclaimed the number one rank, a position it held in both November 2025 and January 2026, despite a brief slip to second place in December 2025. This fluctuation in rank highlights the competitive nature of the market, particularly with Stewart Farms, which briefly overtook Wildflower Canada in December 2025. While Wildflower Canada has shown resilience in maintaining its leadership, the sales figures indicate that Stewart Farms has been a formidable competitor, often posting higher sales numbers. This suggests that while Wildflower Canada is effectively capturing market share, there is a need for strategic initiatives to further boost sales and solidify its leading position against strong competitors like Stewart Farms.

Notable Products

In February 2026, Wildflower Canada's top-performing product was the Sweet Dreams - CBD/CBN/THC 10:10:2 Goji Berry Gummies 5-Pack, maintaining its first-place rank from previous months with sales of 5,955 units. The CBD Extra Strength Relief Stick held steady in second place, continuing its consistent performance across the months. The CBD Relief Stick also remained in third place, showing stability in its ranking. Notably, the CBD/CBN/THC 30:10:1 Sweet Dreams Softgels moved up one rank to fourth place this month, indicating an increase in popularity. Meanwhile, the CBD:THC 1:1 Relief Stick dropped to fifth place, reflecting a decline in sales compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.