Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

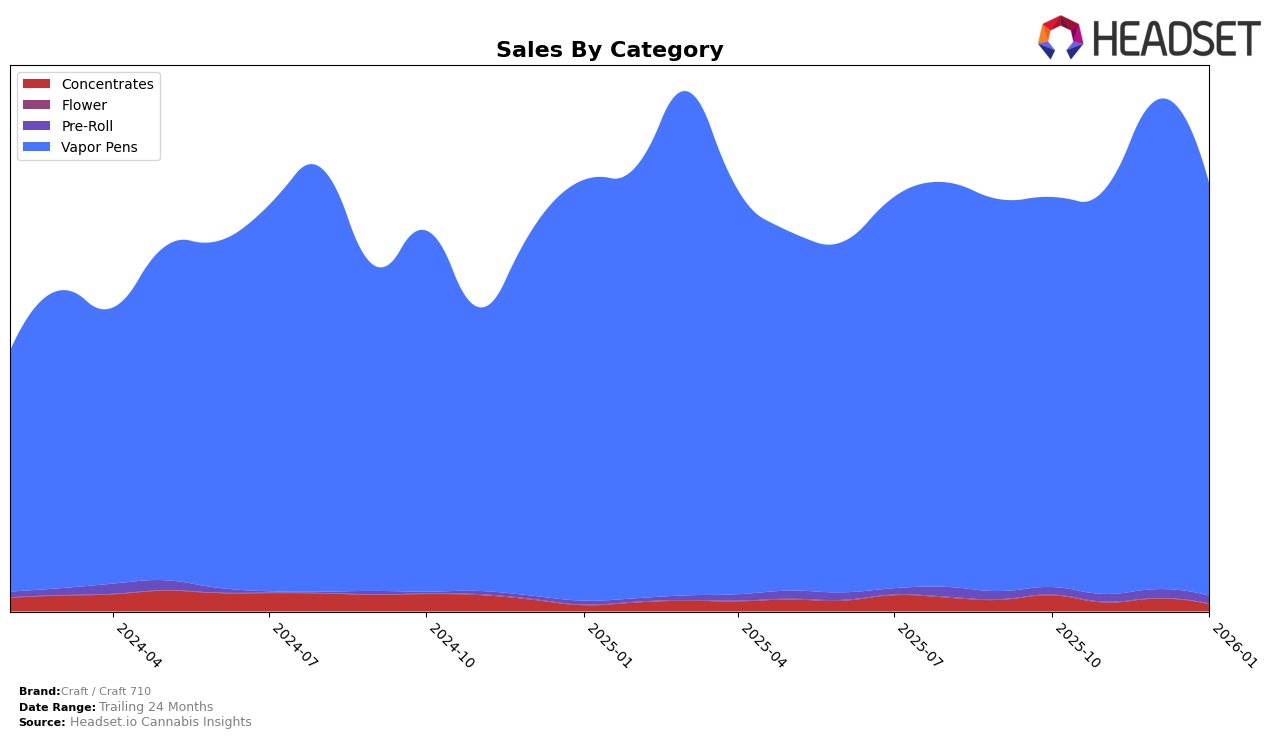

In examining the performance of Craft / Craft 710 across various categories and states, a notable trend emerges in the Colorado market. Within the Concentrates category, the brand's absence from the top 30 rankings in November 2025 and January 2026 indicates a challenge in maintaining a competitive edge. This pattern suggests potential volatility or increased competition in this segment. Conversely, the Vapor Pens category tells a different story, where Craft / Craft 710 consistently held strong, maintaining a solid 5th place ranking from October through December 2025, only slightly dropping to 6th place in January 2026. This indicates a robust presence and consumer preference for their products in this category.

The sales trajectory for Craft / Craft 710 in the Vapor Pens category in Colorado shows a dynamic growth pattern, with a peak in December 2025. This increase reflects a possible seasonal demand or effective marketing strategies during this period. Despite the dip in January 2026, the brand's ability to remain in the top 10 suggests resilience and a strong market position. However, the lack of top 30 rankings in the Concentrates category for two out of the four months analyzed highlights an area that may require strategic attention to regain market share. Overall, Craft / Craft 710's performance in Colorado showcases both strengths and opportunities for growth across different product categories.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Craft / Craft 710 has consistently maintained a strong position, ranking 5th from October to December 2025 before slightly dropping to 6th in January 2026. This slight decline in rank coincides with a robust sales performance, peaking in December 2025, which suggests a strong market presence despite the competitive pressure. Notably, Batch Extracts consistently holds the 4th position, indicating a stable lead over Craft / Craft 710. Meanwhile, Jetty Extracts experienced a notable rise from 9th in October to 5th in January, surpassing Craft / Craft 710, which could indicate a shift in consumer preferences or effective marketing strategies. Green Dot Labs and Spectra also present competitive challenges, with ranks fluctuating between 6th and 8th, suggesting a dynamic market environment. Craft / Craft 710's ability to maintain high sales figures amidst these shifts underscores its competitive resilience and potential for strategic growth in the Colorado vapor pen market.

Notable Products

In January 2026, Craft / Craft 710's top-performing product was Twist - Blueberry Swirl Distillate Disposable (4g) from the Vapor Pens category, climbing to the number one rank with sales of 3330.0. Twist - Tropsicle Distillate Disposable (4g) followed closely, dropping to second place after holding the top spot for the previous two months. Twist - Watermelon Ice Distillate Disposable (4g) improved its position, moving up from fourth to third rank. Mango Squeeze Oil Twists Cartridge (1g) advanced from fifth to fourth, showing a steady increase in sales performance. Twists - Cherry Slush Oil Cartridge (1g) experienced a decline, dropping to fifth place despite previously ranking third in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.