Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

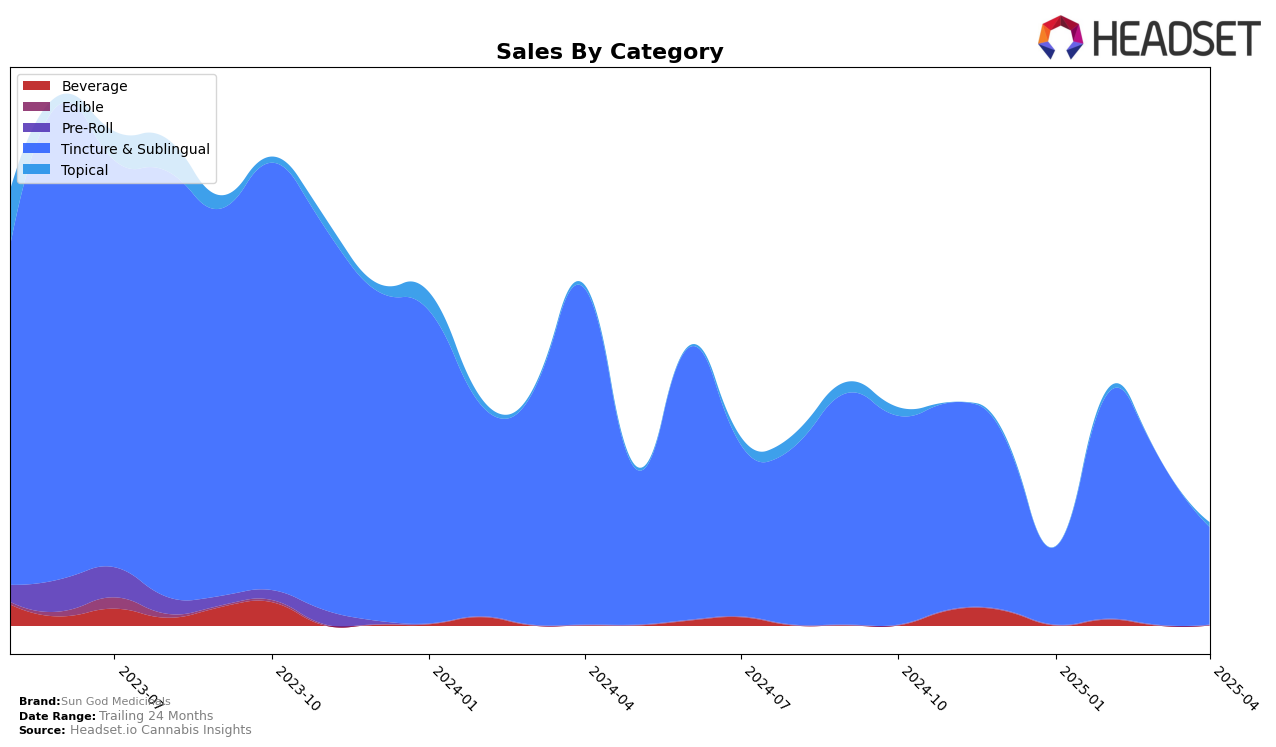

Sun God Medicinals has shown notable performance in the Tincture & Sublingual category in the state of Oregon. By February 2025, the brand achieved an 11th place ranking, marking a significant entry into the top 30 brands in this category. This indicates a positive reception and growing consumer interest, as they were not ranked in the top 30 in January. The absence of a ranking in March and April suggests that while the brand made an initial impact, maintaining a consistent position among the top competitors proved challenging. This fluctuation could be attributed to various market dynamics or consumer preferences within the state.

While the brand's performance in Oregon is noteworthy, the lack of data for other states or provinces implies that Sun God Medicinals may not yet have a significant presence outside of Oregon in this category. The specific sales figure of $12,197 in January indicates the starting point of their trajectory, but further sales data is not available for subsequent months, which could provide more insight into their growth or decline. Monitoring future rankings and sales will be crucial to understanding whether Sun God Medicinals can leverage their initial success in Oregon to expand their footprint in other regions or categories.

Competitive Landscape

In the Oregon Tincture & Sublingual category, Sun God Medicinals experienced notable fluctuations in its competitive positioning from January to April 2025. In January, Sun God Medicinals was absent from the top 20 rankings, but by February, it had climbed to the 11th position, indicating a significant improvement in market presence. This upward trend, however, was not sustained in subsequent months as Sun God Medicinals did not appear in the top 20 rankings for March and April. In contrast, Medicine Farm maintained a consistent presence, ranking 13th in February and improving to 12th in March and April. Meanwhile, Dr. Jolly's showed a similar pattern to Sun God Medicinals, appearing in the 13th position in January and April but missing from the top 20 in February and March. These dynamics suggest that while Sun God Medicinals had a brief surge in visibility, sustaining competitive momentum remains a challenge amidst consistent performers like Medicine Farm.

Notable Products

In April 2025, the top-performing product from Sun God Medicinals was the Ra cannabis - CBD/THC 1:1 Indica Tincture, which climbed to the first position from its previous second place in March. The Ra Hemp - CBD Green Dragon Tincture, consistently a strong performer, slipped from its long-held top spot to second place. The CBD Hercules Massage Oil made a notable entry into the rankings, securing the third position. Meanwhile, the CBG:CBD 1:1 Loki Tincture maintained its fourth-place ranking from March. The Ra Hemp - CBD/THC/CBG 1:1:1 Green Dragon Tincture remained steady in fourth place, matching its performance from March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.