Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

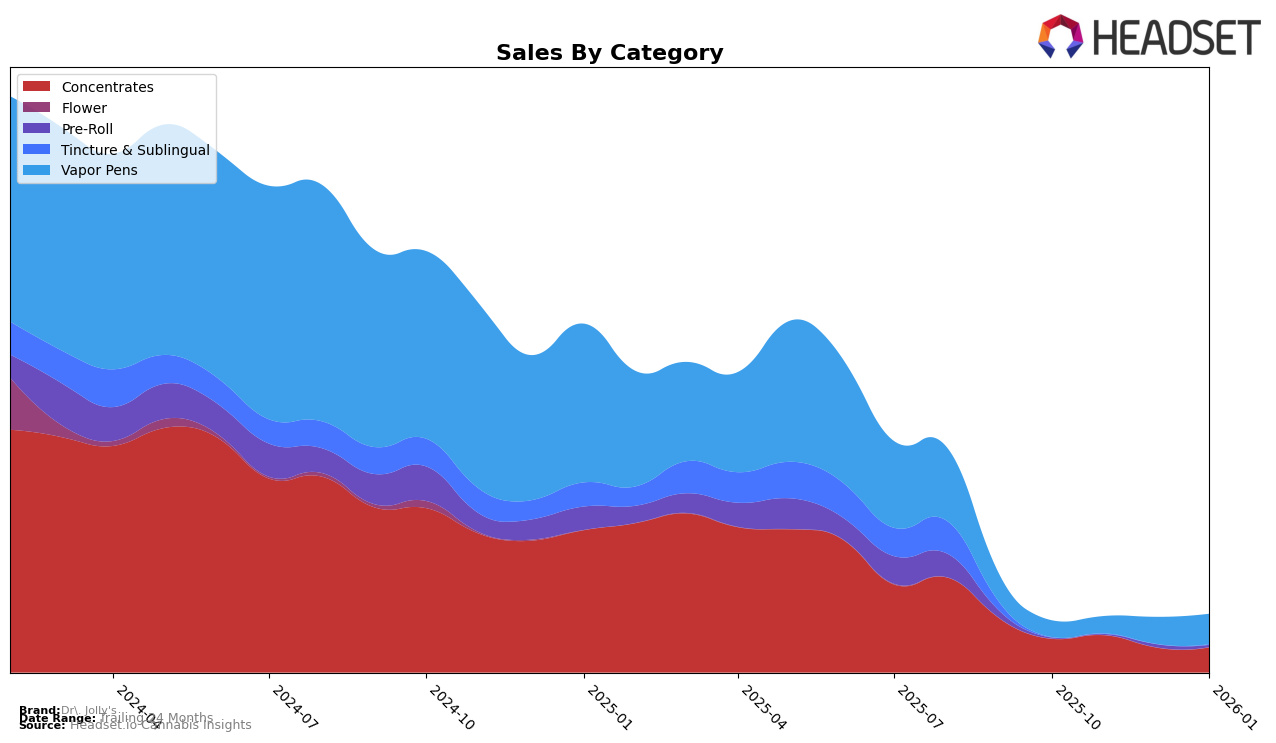

Dr. Jolly's has shown varied performance across different product categories in Oregon. In the Concentrates category, the brand has experienced a downward trend, with rankings slipping from 34th position in November 2025 to 48th by January 2026. This decline is accompanied by a notable decrease in sales from November to December 2025, which might indicate challenges in maintaining its market share in this category. The absence of Dr. Jolly's from the top 30 brands in this category highlights a potential area for improvement.

Conversely, the Vapor Pens category presents a more optimistic scenario for Dr. Jolly's in Oregon. The brand has shown a steady upward movement, improving its rank from 70th in October 2025 to 60th by January 2026. This positive trajectory is supported by a significant increase in sales, particularly noticeable between November 2025 and January 2026. This suggests that Dr. Jolly's is gaining traction in the Vapor Pens market, potentially due to effective product offerings or marketing strategies that resonate well with consumers. However, the brand still remains outside the top 30, indicating room for growth in this competitive category.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Dr. Jolly's has shown a steady improvement in rank from October 2025 to January 2026, climbing from 70th to 60th position. This upward trend in rank is mirrored by a consistent increase in sales, indicating a positive reception in the market. However, Happy Cabbage Farms and Mama Lou's have also demonstrated strong performances, with Happy Cabbage Farms notably surpassing Dr. Jolly's in sales and achieving a higher rank in December 2025 before dropping slightly in January 2026. Meanwhile, High Tech consistently outperformed Dr. Jolly's in both rank and sales, maintaining a position within the top 54. Newcomer Stay Lifted entered the rankings in December 2025 and quickly rose to 63rd by January 2026, suggesting a potential emerging competitor. These dynamics highlight the competitive pressure Dr. Jolly's faces, emphasizing the need for strategic marketing and product differentiation to continue its positive trajectory in the Oregon vapor pen market.

Notable Products

In January 2026, the top-performing product from Dr. Jolly's was Cake Biscuits FECO (1g) in the Concentrates category, which climbed to the number one rank with impressive sales of 242 units. Following closely was Jolly Stick -Mac Dragon Live Resin Distillate Cartridge (1g) in the Vapor Pens category, securing the second position after leading in December 2025. Glue Live Resin (1g) made its debut at rank three, indicating strong market entry. Tangie Cake Fusion Live Resin Cartridge (1g) improved its standing from fifth in December to fourth in January, showing consistent growth. Meanwhile, Magic Headband Live Resin Cartridge (1g) entered the rankings at fifth place, marking its first appearance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.