Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

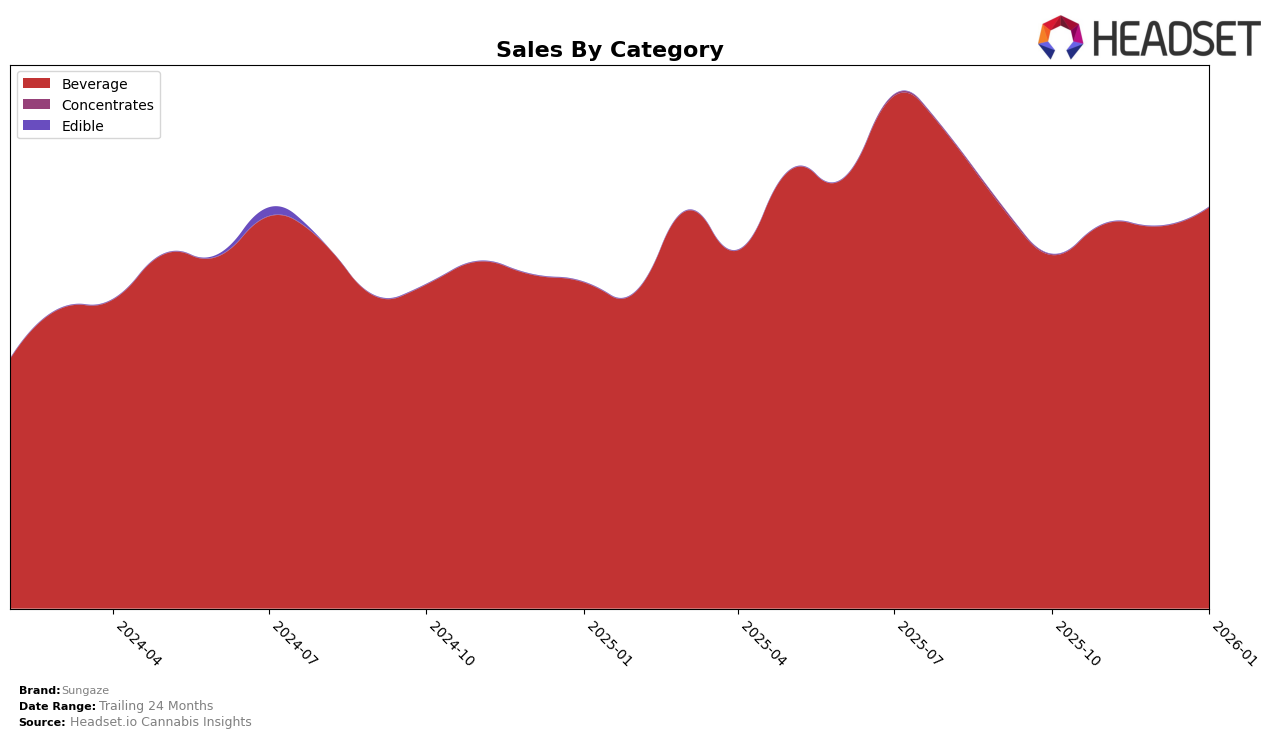

Sungaze has shown a consistent performance in the Beverage category across the state of Washington. The brand maintained a steady presence within the top 15 rankings from October 2025 to January 2026, with minor fluctuations. Starting at the 13th position in October, Sungaze experienced a slight dip to 15th in November before climbing back to 14th in December and maintaining that rank in January. This indicates a stable demand for their products, with a gradual increase in sales, as evidenced by the January sales figure of $36,030, reflecting a positive growth trend from October's sales.

While Sungaze's performance in Washington's Beverage category is commendable, their absence from the top 30 in other states or categories suggests potential areas for growth and expansion. The brand's consistent ranking within the top 15 in Washington highlights a strong foothold in that market, yet the lack of presence in other regions or categories could be seen as a missed opportunity. Expanding their reach beyond Washington and exploring other categories could be beneficial for Sungaze, enabling them to capture a larger market share and diversify their consumer base.

Competitive Landscape

In the Washington beverage category, Sungaze has shown a consistent presence, maintaining a rank between 13th and 15th from October 2025 to January 2026. Despite a slight fluctuation, Sungaze's sales have demonstrated a positive trend, increasing from October to January. In comparison, CQ (Cannabis Quencher) experienced a decline in sales, dropping from 10th to 12th place by January, which may indicate a potential opportunity for Sungaze to capture more market share. Meanwhile, Doja Trees has shown some volatility, with a dip in sales in January, although maintaining a slightly higher rank than Sungaze. Canna Cantina and Vice Soda remain close competitors, with Canna Cantina's rank fluctuating similarly to Sungaze's, while Vice Soda consistently trails behind. This competitive landscape suggests that while Sungaze is holding steady, there is potential for growth if they can capitalize on the weaknesses of higher-ranked competitors.

Notable Products

In January 2026, Sungaze's top-performing product was the CBD/THC 2:1 Strawberry Citrus Seltzer 2-Pack, maintaining its number one rank for four consecutive months with sales reaching 1997 units. Following closely, the CBD/THC 2:1 Lemon Ginger Seltzer 2-Pack held steady at the second position, showing a consistent performance since October 2025. The CBD/THC 2:1 Lime Agave Seltzer 2-Pack also retained its third-place position, reflecting stable sales growth across the months. The CBD/THC 2:1 Strawberry Citrus Seltzer 6-Pack saw a notable increase in sales, reaching the fourth rank, while the newly introduced CBD/THC 2:1 Lemon Ginger Seltzer 6-Pack debuted at the fifth position. These rankings indicate a strong and consistent demand for Sungaze's beverage offerings, with minimal shifts in product popularity over the past months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.