Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

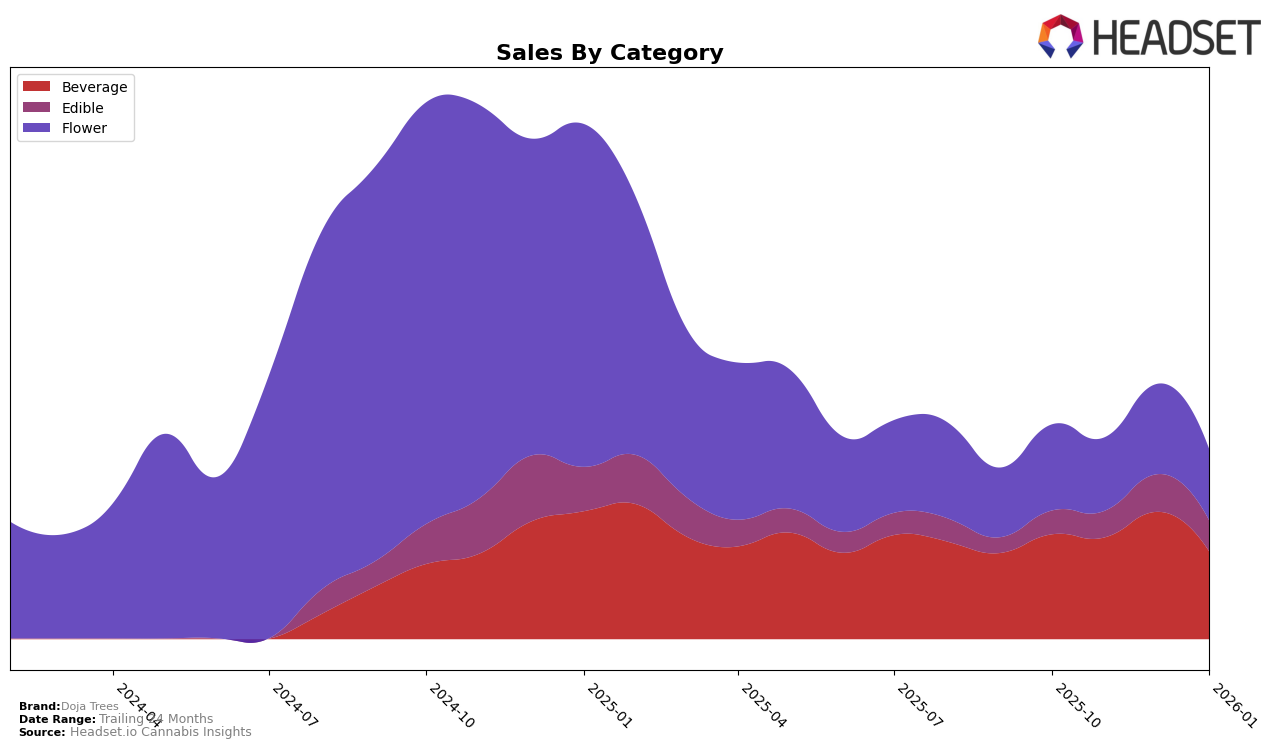

Doja Trees has shown a consistent presence in the Washington market, particularly in the Beverage category. Their ranking fluctuated slightly between 12th and 13th place from October 2025 to January 2026, indicating a stable yet competitive positioning. This stability is noteworthy given that many brands often experience more significant shifts in their rankings. Despite a dip in sales from November to January, the brand managed to maintain its position within the top 15, suggesting a loyal customer base or strong brand recognition in this category.

In contrast, Doja Trees has struggled to break into the top 30 in the Edible category in Washington. Their rankings hovered just outside the top 40, suggesting a need for strategic improvements or increased marketing efforts to enhance their visibility and competitiveness in this segment. Despite this, the brand did see a notable increase in sales from October to December, which could indicate a growing interest or seasonal demand. However, sustaining this momentum will be crucial if they aim to improve their ranking and capture a larger market share in the future.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Doja Trees has shown a relatively stable performance from October 2025 to January 2026. While Doja Trees maintained a rank between 12th and 13th, it faces significant competition from brands like Ratio (WA), which consistently ranks higher, dropping only to 11th in January 2026, indicating stronger sales figures. Meanwhile, CQ (Cannabis Quencher) also poses a challenge, with a fluctuating rank but still maintaining a competitive edge over Doja Trees. Despite these challenges, Doja Trees outperformed Sungaze and Canna Cantina, which consistently ranked lower. The sales trends suggest that while Doja Trees saw a peak in December 2025, it experienced a decline in January 2026, indicating potential areas for strategic improvement to climb the ranks further.

Notable Products

In January 2026, Blue Raspberry Shot (100mg) maintained its position as the top-performing product for Doja Trees, despite a decrease in sales to 1932 units. Kush Berry Shot (100mg) also held steady at the second rank, following a similar trend in sales figures. Grape God Shot (100mg) climbed to the third position, improving from its previous fourth-place ranking in December 2025. Watermelon Punch Shot (100mg) dropped to fourth place, swapping positions with Grape God Shot. Lemon Haze Shot (100mg) remained consistent in fifth place, showing stability in its category over the months despite a lack of data for November 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.