Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

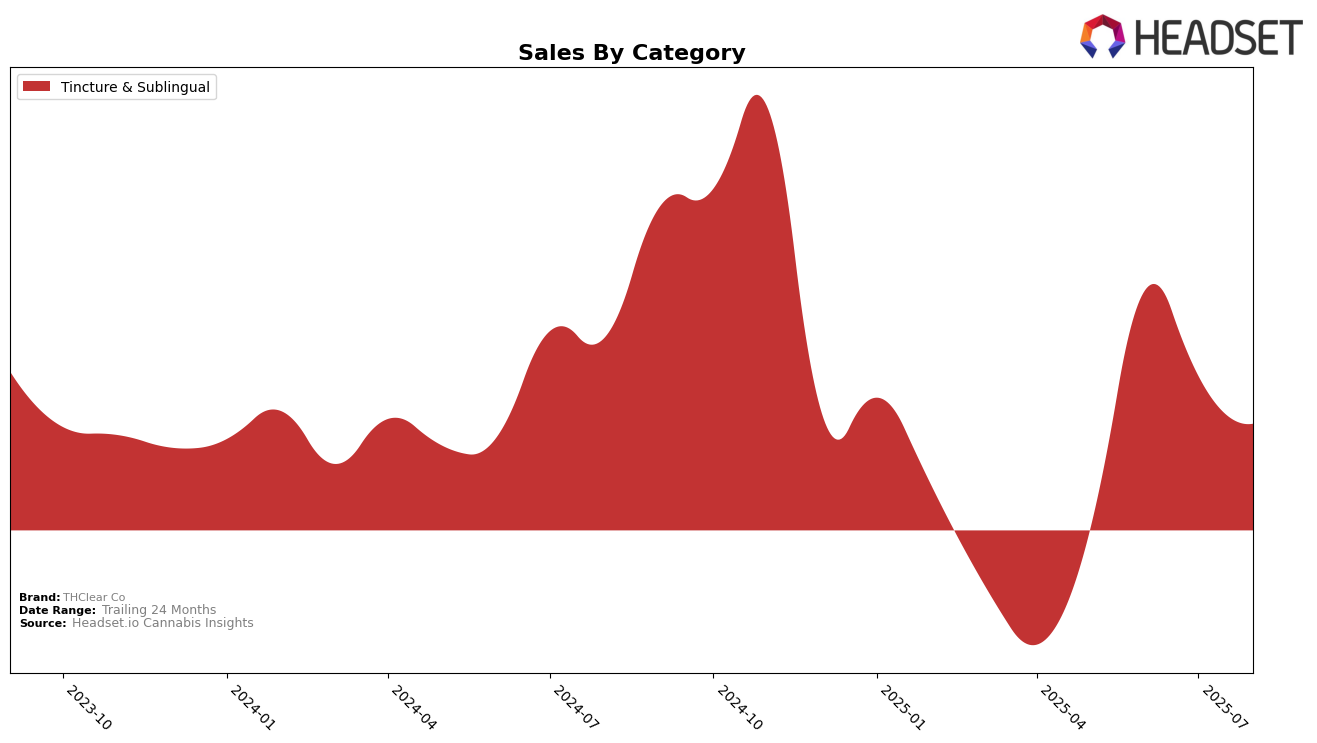

THClear Co's performance in the Tincture & Sublingual category in Oregon saw a notable development in June 2025, where the brand secured the 13th rank. This was a significant achievement given that they did not rank in the top 30 in May 2025. However, the absence of rankings for July and August indicates that THClear Co could not maintain its position within the top 30 in the following months. This suggests a potential challenge in sustaining their market presence in Oregon's competitive tincture and sublingual category.

The lack of data for other states or categories implies that THClear Co's market penetration might be limited geographically or within specific product categories. The absence of rankings in other states or categories could be interpreted as either a strategic focus on Oregon or a need for expansion and diversification. The sales figure for May 2025 in Oregon was $14,560, which provides a baseline for evaluating their growth or decline in subsequent months. Observing these trends could offer insights into the brand's market strategies and consumer reception.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Oregon, THClear Co has shown fluctuating performance, with a notable rank of 13 in June 2025. This places it ahead of Magic Number, which re-entered the rankings at 14 in August 2025, and behind Luminous Botanicals, which held a rank of 12 in May 2025 but did not appear in subsequent months. Bobsled Extracts consistently outperformed THClear Co, maintaining a top 10 position throughout the summer, while Elysium Fields showed a strong recovery to rank 11 in August 2025. These dynamics suggest that while THClear Co has potential, it faces stiff competition from brands that are either maintaining or improving their market positions, indicating a need for strategic adjustments to enhance its competitive edge and sales trajectory.

Notable Products

In August 2025, the top-performing product for THClear Co was CBD Pineapple Syrup Tincture (100mg CBD) in the Tincture & Sublingual category, maintaining its first-place rank consistently since May 2025. This product achieved notable sales of 167 units in August, although this represents a decline from prior months. The product has held its top position due to its consistent demand, despite fluctuating sales figures. Over the months, no other product has surpassed this tincture in its category, indicating a strong consumer preference. The unwavering rank highlights its dominance in the market, even as sales figures adjusted over the summer months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.