Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

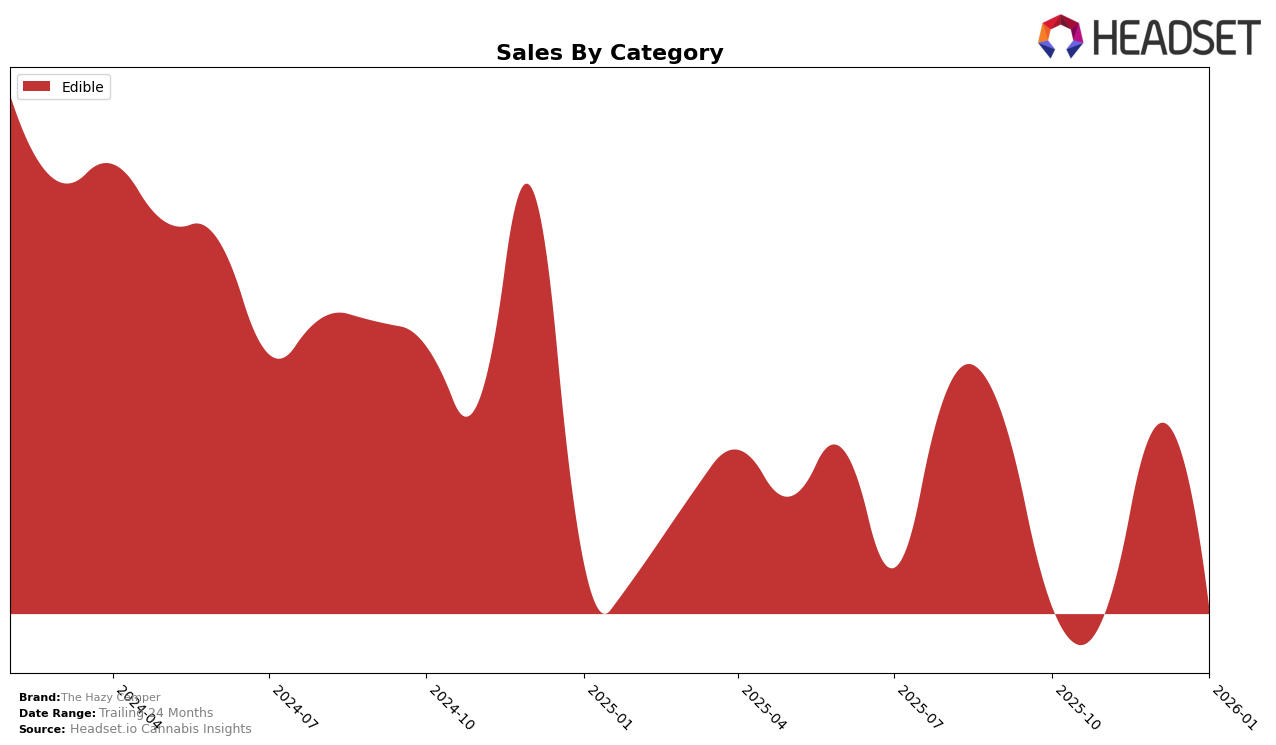

The Hazy Camper, a cannabis brand specializing in edibles, has shown significant movement in the British Columbia market. Notably, the brand broke into the top 30 rankings in January 2026, securing the 20th position after not being listed in the top 30 in the previous months. This advancement indicates a positive trend and suggests that The Hazy Camper is gaining traction in the British Columbia edible category. While specific sales figures for January 2026 are not disclosed, the brand's ability to enter the rankings after months of absence is a promising sign of growing consumer interest and market penetration.

Despite the lack of specific sales data for November and December 2025, the available information suggests that The Hazy Camper has been strategically positioning itself to capture a larger share of the edible market in British Columbia. The absence from the rankings in October, November, and December of 2025 could be viewed as a challenge, but the subsequent entry into the rankings by January 2026 highlights a successful turnaround. This movement could be attributed to various factors, such as changes in marketing strategies, product offerings, or consumer preferences. The brand's journey in British Columbia serves as an interesting case study for understanding market dynamics and consumer behavior in the cannabis industry.

Competitive Landscape

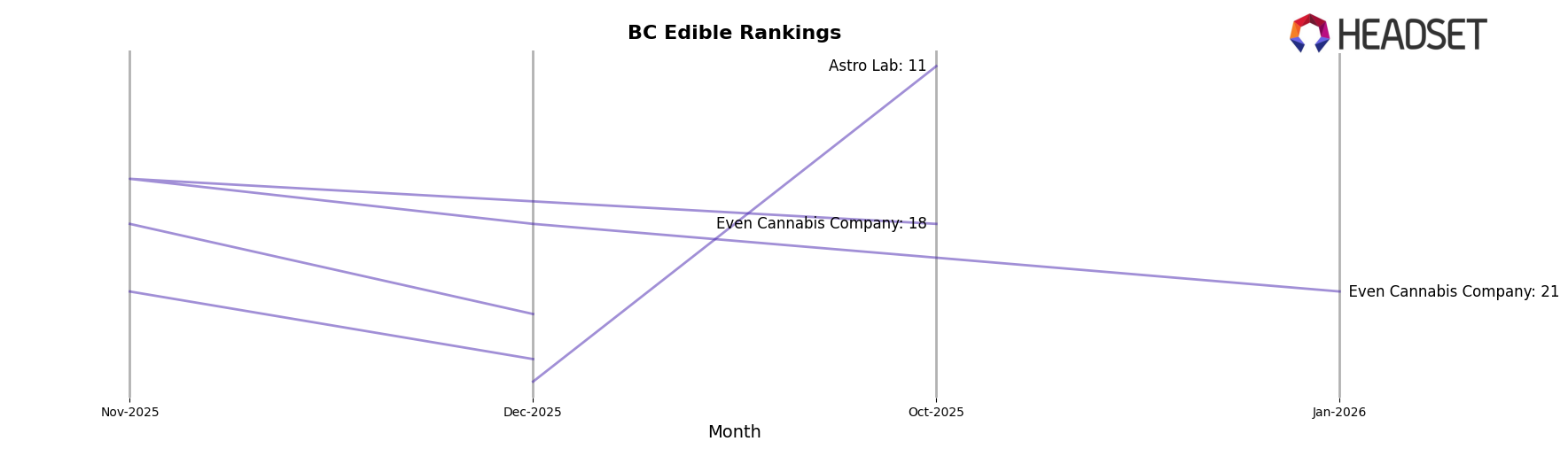

In the competitive landscape of the Edible category in British Columbia, The Hazy Camper has shown a notable entry into the top 20 brands by securing the 20th rank in January 2026. This marks a significant milestone, as The Hazy Camper was absent from the top 20 in the preceding months, indicating a positive trend in market penetration and consumer acceptance. In contrast, Even Cannabis Company experienced fluctuations, peaking at 16th in November 2025 but dropping to 21st by January 2026, suggesting potential volatility in their sales strategy or market conditions. Meanwhile, Dabble Cannabis Co. also saw a decline from 18th in November 2025 to 22nd in January 2026, which could indicate challenges in maintaining their consumer base. Astro Lab showed a dramatic drop from 11th in October 2025 to falling out of the top 20 by December, highlighting potential issues in sustaining their earlier momentum. These shifts suggest that The Hazy Camper's strategies might be effectively capturing market share from competitors, positioning them as a rising contender in the British Columbia edibles market.

Notable Products

In January 2026, The Hazy Camper's Black Forest Organic Dark Chocolate (10mg) emerged as the top-performing product, regaining its number one rank after slipping to second place in November and December 2025, with sales reaching 1400 units. Hazy Mint Organic Dark Chocolate Bite (10mg) dropped to second place despite previously holding the top spot for two consecutive months. Cherry Bomb Milk Chocolate Bite (10mg) maintained a steady position, ranking third in January, consistent with its performance in December 2025. Meanwhile, Mary's Chocolate Orange Milk Chocolate Bite (10mg) ranked fourth, a slight decline from its third-place ranking in December. A new entry, Wild Raspberry Dark Chocolate (10mg), debuted in fifth place, indicating a positive reception.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.