Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

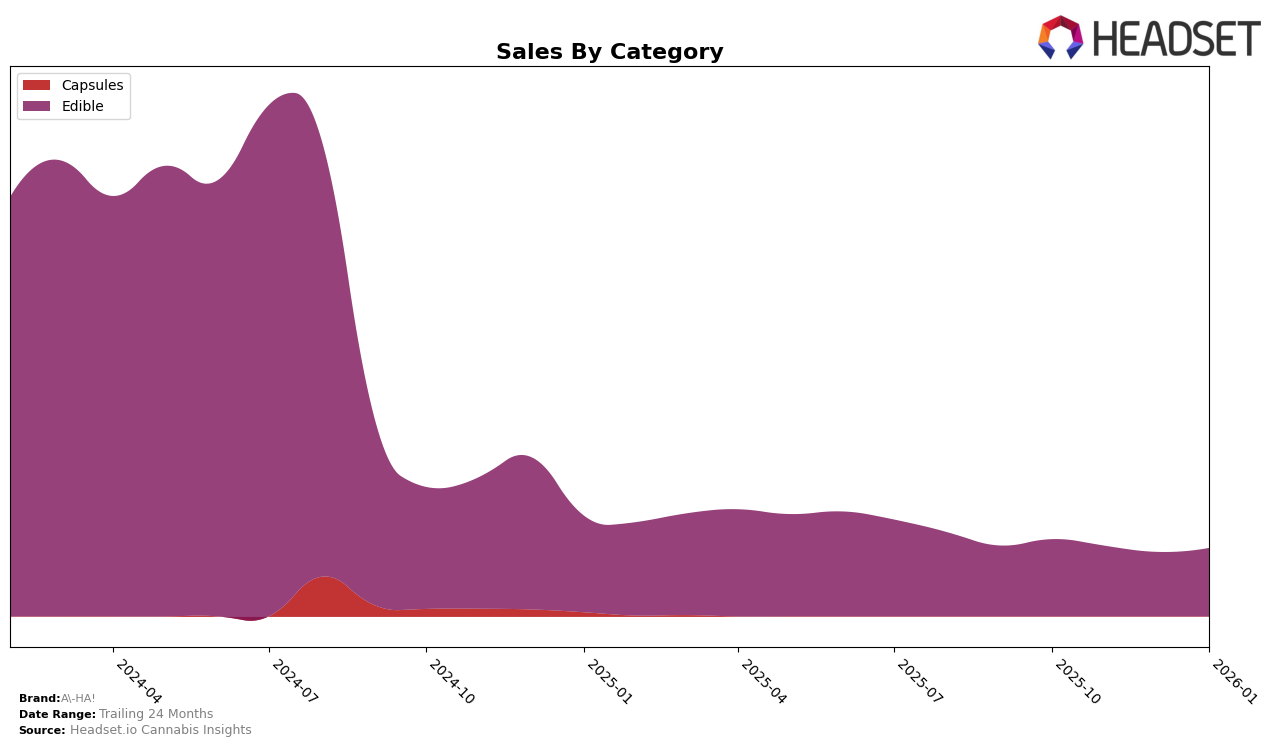

In the province of Alberta, the cannabis brand A-HA! has shown a steady presence in the Edible category. Starting from a rank of 24 in October 2025, A-HA! improved its position slightly to 22 in November, though it was not ranked in the top 30 in December. Interestingly, the brand rebounded to a rank of 21 by January 2026, indicating a positive trend. This upward movement suggests a growing consumer interest or effective marketing strategies that could be contributing to its performance. Despite the dip in December, the brand's ability to climb back into the top 30 demonstrates resilience in a competitive market.

Meanwhile, in Ontario, A-HA! has faced more challenges in maintaining its ranking within the Edible category. The brand hovered around the lower end of the top 30, starting at rank 28 in October 2025 and slipping to 31 by January 2026. This decline suggests potential difficulties in maintaining market share or possibly increasing competition. The sales figures reflect this struggle, with a notable drop from November to January. While the specifics of these challenges are not fully detailed here, the trend indicates that A-HA! might need to reassess its strategy in Ontario to regain a stronger foothold in the market.

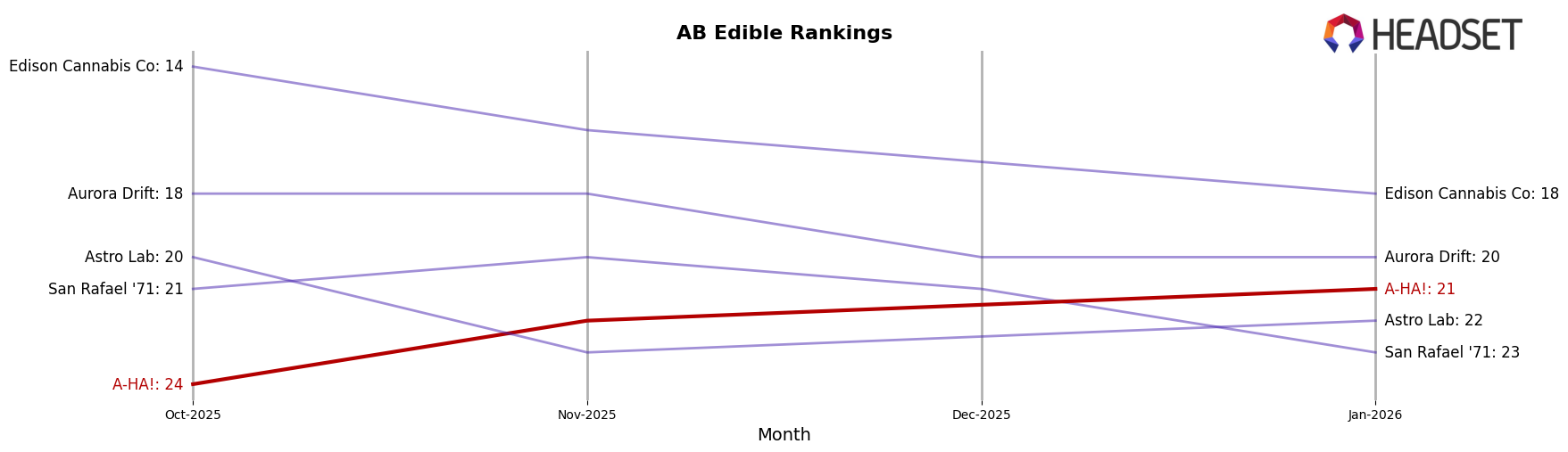

Competitive Landscape

In the Alberta edible cannabis market, A-HA! has shown a fluctuating performance in recent months, with its rank improving from 24th in October 2025 to 21st by January 2026. This upward trend suggests a positive reception of their products, potentially driven by strategic marketing or product innovation. In contrast, Edison Cannabis Co has experienced a decline, dropping from 14th to 18th place over the same period, indicating a significant reduction in sales. Meanwhile, San Rafael '71 and Aurora Drift have maintained relatively stable positions, although their sales figures suggest a downward trend. Notably, Astro Lab has also seen a decline, moving from 20th to 22nd place. These shifts in rankings and sales highlight A-HA!'s potential to capitalize on the market dynamics, especially as some competitors face challenges in maintaining their standings.

Notable Products

In January 2026, A-HA!'s top-performing product was the Milk Chocolate Live Rosin Waffle Cones 2-Pack (10mg) in the Edible category, maintaining its first-place ranking for four consecutive months with sales of 2419 units. The Wild Berries Soft Chew 2-Pack (10mg) also held steady in the second position, despite a slight decline in sales compared to December 2025. New entries in the rankings include the Double Chocolate Cookie 10-Pack (300mg), which debuted at third place, followed by the Chocolate Chip Cookie 10-Pack (250mg) and the Chocolate Chip Cookie (10mg) in fourth and fifth positions, respectively. These new entries highlight a shift in consumer preference towards variety in the Edible category. Overall, the rankings reflect consistent top performance by established products and emerging demand for new offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.