Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

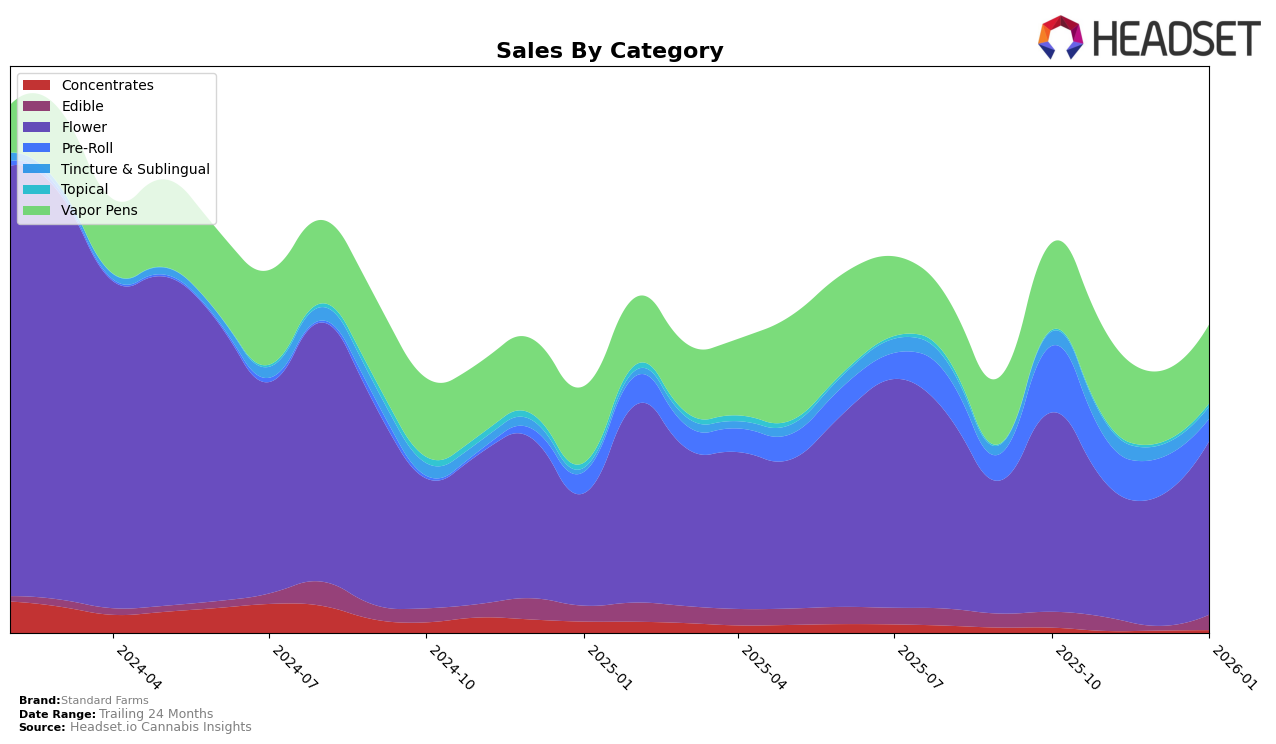

Standard Farms has shown varied performance across different categories and states. In Massachusetts, the brand's presence in the Flower and Pre-Roll categories has seen a decline over the months, with rankings dropping from 54th and 43rd in October 2025 to 82nd and 86th by January 2026, respectively. This downward trend in rankings is mirrored by a decrease in sales figures, indicating a potential challenge in maintaining market share in these categories. Notably, Standard Farms did not make it into the top 30 for Vapor Pens in Massachusetts, highlighting a competitive market landscape or possible strategic shifts away from this category.

In contrast, Ohio presents a more promising picture for Standard Farms. The brand has maintained a strong position in the Tincture & Sublingual category, consistently ranking within the top 5 throughout the observed months. Furthermore, in the Flower category, Standard Farms improved its ranking to 28th in January 2026, showing a positive trajectory from its lowest point in December 2025. However, the Edible category saw fluctuations, with the brand not appearing in the top 30 in December 2025, but regaining its position by January 2026. This suggests a dynamic market presence in Ohio, with opportunities for growth and stabilization in certain product lines.

Competitive Landscape

In the Ohio flower category, Standard Farms experienced notable fluctuations in its market position from October 2025 to January 2026. Initially ranked 34th in October, the brand saw a decline in rank to 41st in both November and December, before making a significant leap to 28th in January. This improvement in January suggests a positive shift in consumer preference or effective marketing strategies. In contrast, Galenas maintained a more stable presence, consistently ranking higher than Standard Farms, peaking at 26th in both November and January. Meanwhile, The Botanist showed a steady performance, with ranks fluctuating slightly but remaining close to Standard Farms. The Standard and Ohio Clean Leaf both outperformed Standard Farms in terms of rank and sales, with Ohio Clean Leaf starting strong at 18th in October before dropping to 29th in January. These dynamics highlight the competitive pressure Standard Farms faces and underscore the importance of strategic adjustments to improve its market standing in the Ohio flower sector.

Notable Products

In January 2026, Standard Farms' top-performing product was NF1 Pre-Roll (1g), maintaining its rank as number one from the previous month with sales of 2,032 units. Raspberry Parfait Pre-Roll (1g) climbed to the second position despite a slight drop in sales from December, indicating strong consumer preference. LA Kush Cake Pre-Roll (1g) held steady in third place, although its sales figures decreased compared to the prior months. White Truffle (14.15g) made a notable entry into the rankings at fourth place, highlighting its growing popularity. Cicada's Buzz Pre-Roll (1g) reappeared in the rankings at fifth place, showcasing a resurgence in interest despite previous months' absence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.