Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

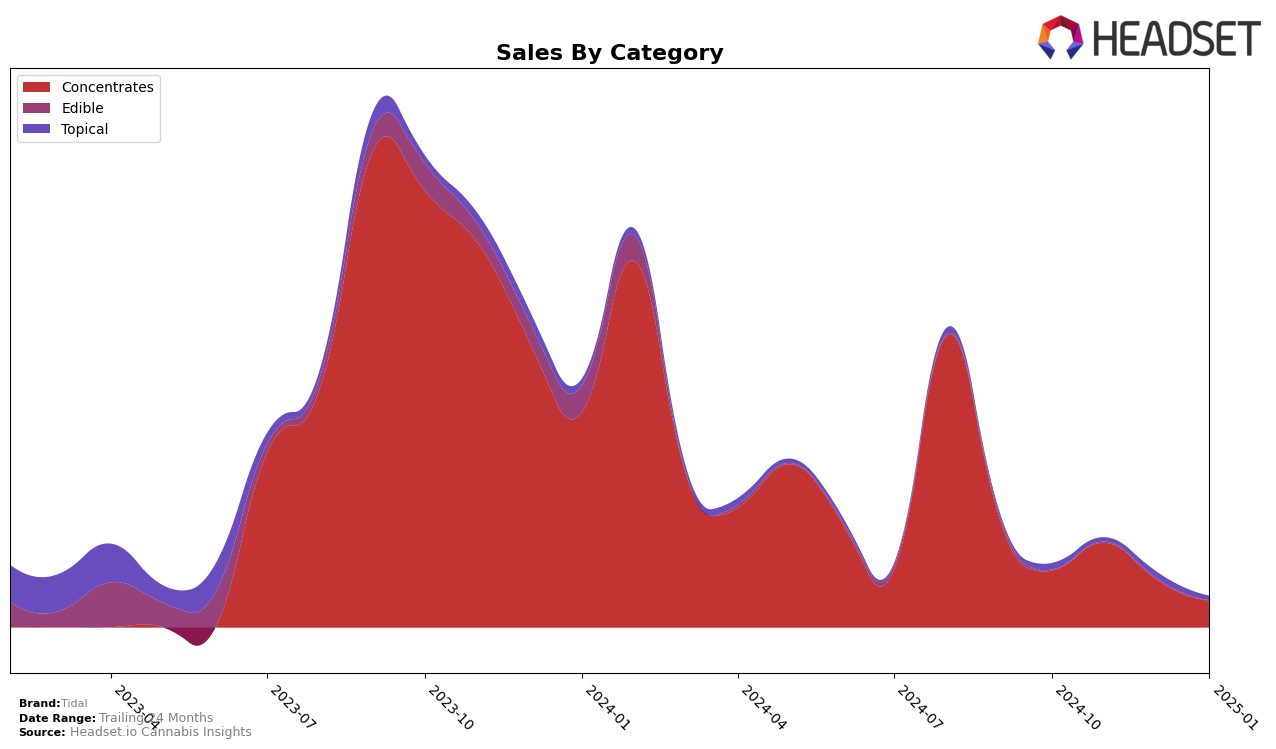

Tidal's performance in the cannabis market shows interesting dynamics, particularly in the state of Nevada. In the Concentrates category, Tidal made its way into the top 30 brands in November 2024, securing the 28th position. This entry into the rankings marks a significant achievement, as the brand was not listed among the top 30 in October 2024. The sales figures for October 2024 were $12,885, indicating a growth trend that likely contributed to their November ranking. However, Tidal's absence from the December 2024 and January 2025 rankings suggests that sustaining a position in the top 30 may be challenging, pointing to potential volatility or competitive pressures in the Nevada market.

Examining Tidal's performance across categories reveals a focused presence in the Concentrates segment, with no rankings reported in other categories or states. This concentration could suggest a strategic emphasis on a specific product line or a need to diversify to capture a broader market share. The absence from the top 30 in other categories and states may indicate areas for growth or highlight the competitive nature of the cannabis market outside of Nevada's Concentrates category. As Tidal navigates these market dynamics, monitoring their strategic adjustments and potential category expansions could provide further insights into their long-term positioning and performance.

Competitive Landscape

In the Nevada concentrates market, Tidal has faced challenges in maintaining a strong competitive position, as evidenced by its absence from the top 20 rankings in October 2024 and its re-entry at 28th place in November 2024. This suggests a struggle to capture market share compared to competitors such as Panna Extracts, which, despite a drop from 16th to 26th place, still maintained a presence in the rankings. Meanwhile, Doctor Solomon's showed a consistent upward trajectory, climbing from 17th to 15th place by December 2024, indicating strong consumer preference and potentially better sales strategies. LP Exotics also demonstrated resilience, fluctuating but remaining within the top 25. The data suggests that Tidal may need to reassess its market strategies to improve its rank and sales performance in this competitive landscape.

Notable Products

In January 2025, Tidal's top-performing product was Breakfast Cereal Live Resin Sugar (1g) in the Concentrates category, which rose to the number one rank with sales reaching 79 units. This product improved from third place in December 2024, demonstrating a significant increase in popularity. CBD All Natural Lip Balm (50mg CBD, 5g) climbed to second place in the Topical category, despite not being ranked in the previous two months, with sales of 42 units. CBD Coconut Lip Balm (50mg CBD) entered the ranking at third place, indicating a strong market entry. Grape Cream Cake Live Resin Sugar (1g) saw a decline, dropping from first place in December to fifth place in January, reflecting a decrease in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.