Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

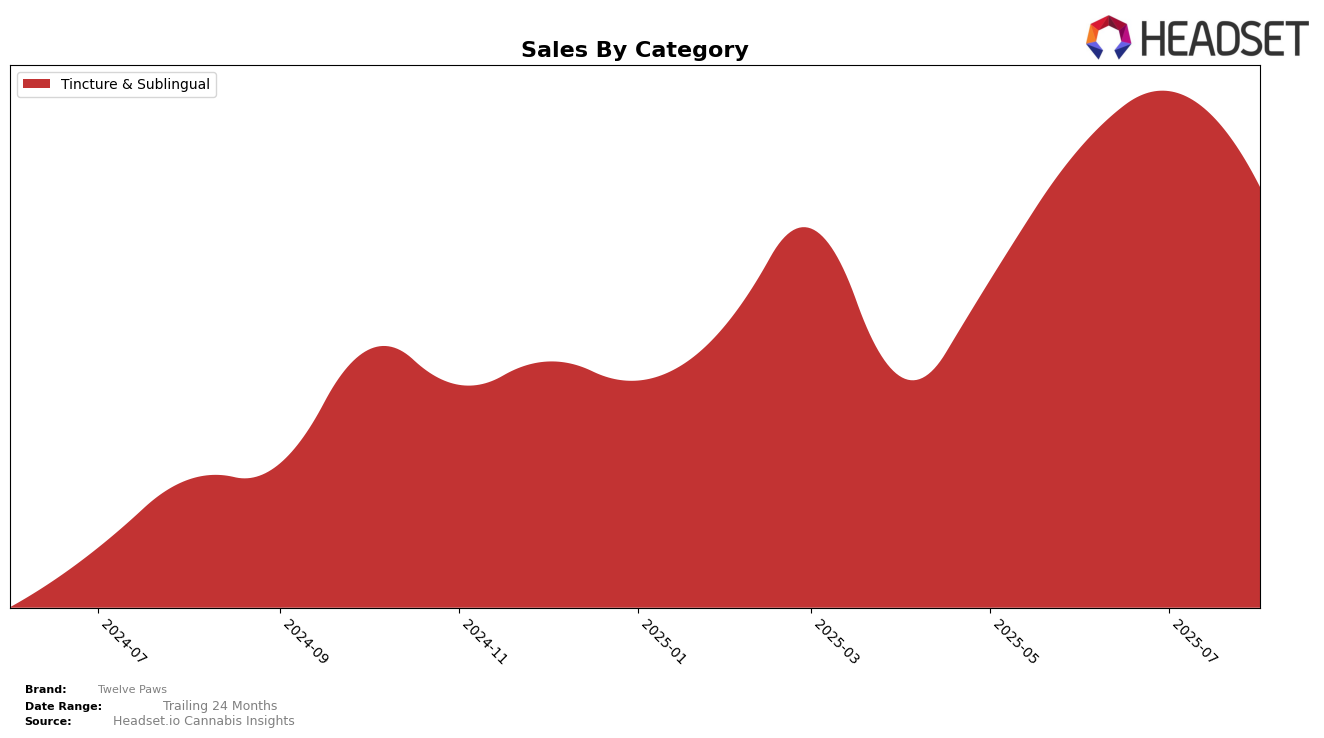

Twelve Paws has shown notable performance in the Colorado market, particularly in the Tincture & Sublingual category. In June 2025, the brand achieved a commendable rank of 7th, followed by a slight dip to 8th in July. However, it's worth noting that Twelve Paws did not appear in the top 30 rankings in May and August, which could indicate challenges in maintaining a consistent presence among top competitors. This fluctuation suggests that while the brand has potential, there might be underlying factors affecting its stability in the market.

Despite the absence from the top 30 in May and August, Twelve Paws saw an increase in sales from May to June, jumping from $10,177 to $11,089. This upward trend in sales during the months they were ranked indicates that when Twelve Paws does secure a spot in the rankings, it performs well in terms of revenue generation. The absence in the top 30 for certain months suggests a need for strategic adjustments to sustain their market position throughout the year. This could involve exploring new marketing strategies or product innovations to capture and maintain consumer interest.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in Colorado, Twelve Paws has experienced notable fluctuations in its market position over recent months. As of June 2025, Twelve Paws entered the top 20 rankings at the 7th position but subsequently slipped to 8th by July. This shift indicates a competitive pressure from brands like Care Division, which consistently maintained a higher rank, moving from 6th to 5th and back to 6th, suggesting stable demand and possibly a loyal customer base. Meanwhile, marQaha emerged in the rankings in July at 7th place, directly competing with Twelve Paws. The absence of Twelve Paws in the top 20 in May and August suggests a volatile market presence, highlighting the need for strategic marketing efforts to stabilize and improve its rank and sales performance amidst strong competition.

Notable Products

In August 2025, Twelve Paws maintained its stronghold in the Tincture & Sublingual category with the CBD/THC 50:1 Savory Bacon Pet Tincture (50mg CBD, 1mg THC) continuing to rank as the top-performing product for the fourth consecutive month. This product achieved sales of 522 units, reflecting a slight dip from its peak in July 2025 but still securing the number one position. Notably, this tincture has consistently been the leader since May 2025, showcasing its sustained popularity and customer loyalty. The product's steady performance highlights its dominance in the market, with no other products surpassing its rank in any of the previous months. This consistent ranking underscores the effectiveness of Twelve Paws' offerings in meeting consumer demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.