Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

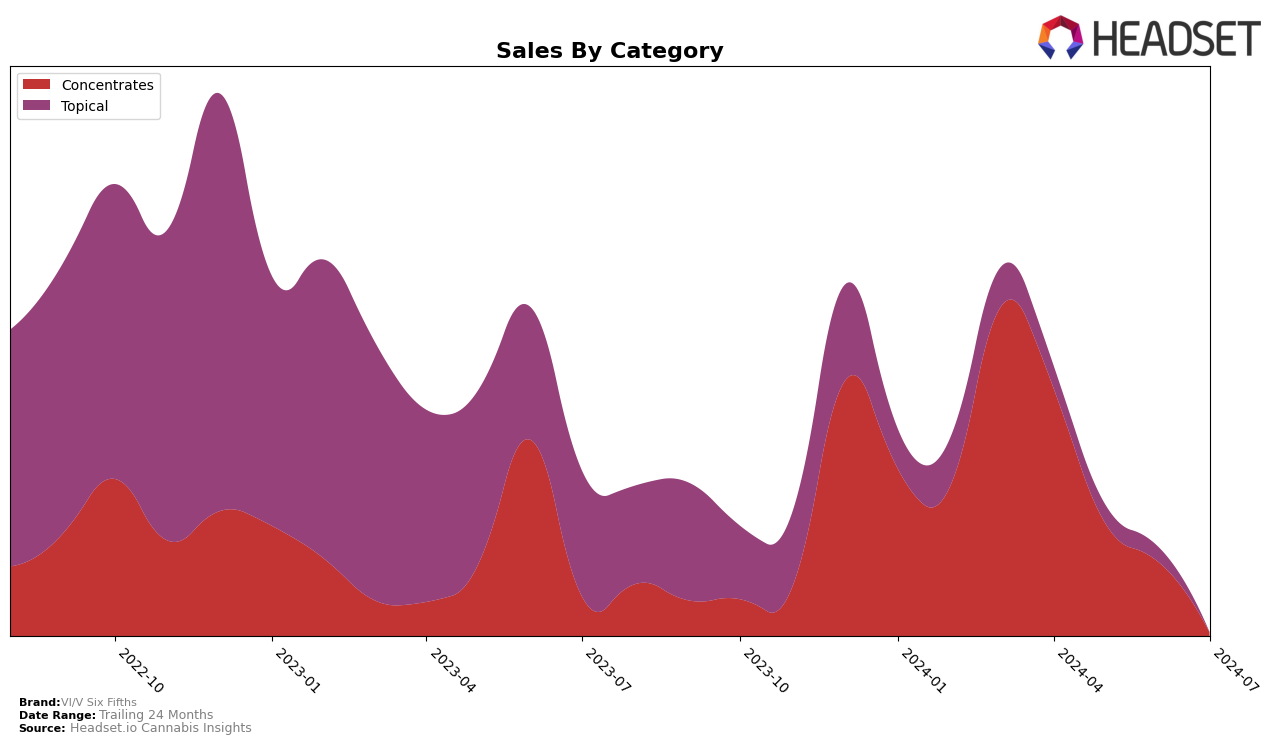

VI/V Six Fifths has shown a fluctuating performance across various categories and states. In Washington, the brand's presence in the Concentrates category is notable. However, in April 2024, they were ranked at 90th place, and they did not appear in the top 30 for the subsequent months. This downward trend indicates a significant drop in their market position. Despite the initial sales of $18,477 in April, the absence of ranking in the following months highlights potential challenges in maintaining market presence and consumer interest in the state.

When examining the broader market, the absence of VI/V Six Fifths in the top 30 brands across other states and categories suggests that the brand may need to reassess its strategies. The lack of rankings in multiple states could be indicative of either a highly competitive market or a need for enhanced marketing and product differentiation. These insights are crucial for understanding the brand's current standing and areas where improvements are necessary for better market penetration and consumer engagement.

Competitive Landscape

In the highly competitive Washington state concentrates market, VI/V Six Fifths has experienced fluctuating rankings that highlight both opportunities and challenges. Notably, VI/V Six Fifths ranked 90th in April 2024 but did not appear in the top 20 in subsequent months, indicating a need for strategic adjustments to regain market presence. In contrast, SubX showed a downward trend, slipping from 77th in April to 95th in July, which could suggest potential market share VI/V Six Fifths could capture with the right initiatives. Meanwhile, 2727 Marijuana demonstrated a more stable performance, ranking 92nd in May and improving to 83rd in June, underscoring the importance of consistent product quality and marketing efforts. These insights suggest that while VI/V Six Fifths faces stiff competition, there are clear opportunities to enhance its market position through targeted strategies and improved product offerings.

Notable Products

In July 2024, the top-performing product for VI/V Six Fifths was CBD/THC 1:1 Unicorn Body Butter (100mg CBD, 100mg THC) in the Topical category, maintaining its first-place ranking for four consecutive months with notable sales of 219 units. P91 Cold Cure Rosin (1g) emerged as the second-best product in the Concentrates category, improving from fourth place in June to second place in July. CBD/THC 1:1 Coconut Vanilla Bath Soak (100mg CBD, 100mg THC) ranked third in the Topical category, entering the rankings for the first time. CBD/THC 1:1 Chamomile Bath Soak (100mg CBD, 100mg THC) dropped from fifth place in June to fourth place in July within the Topical category. Star Pebbles Cold Cure Rosin (1g) made its debut in the rankings, securing the fifth position in the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.