Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

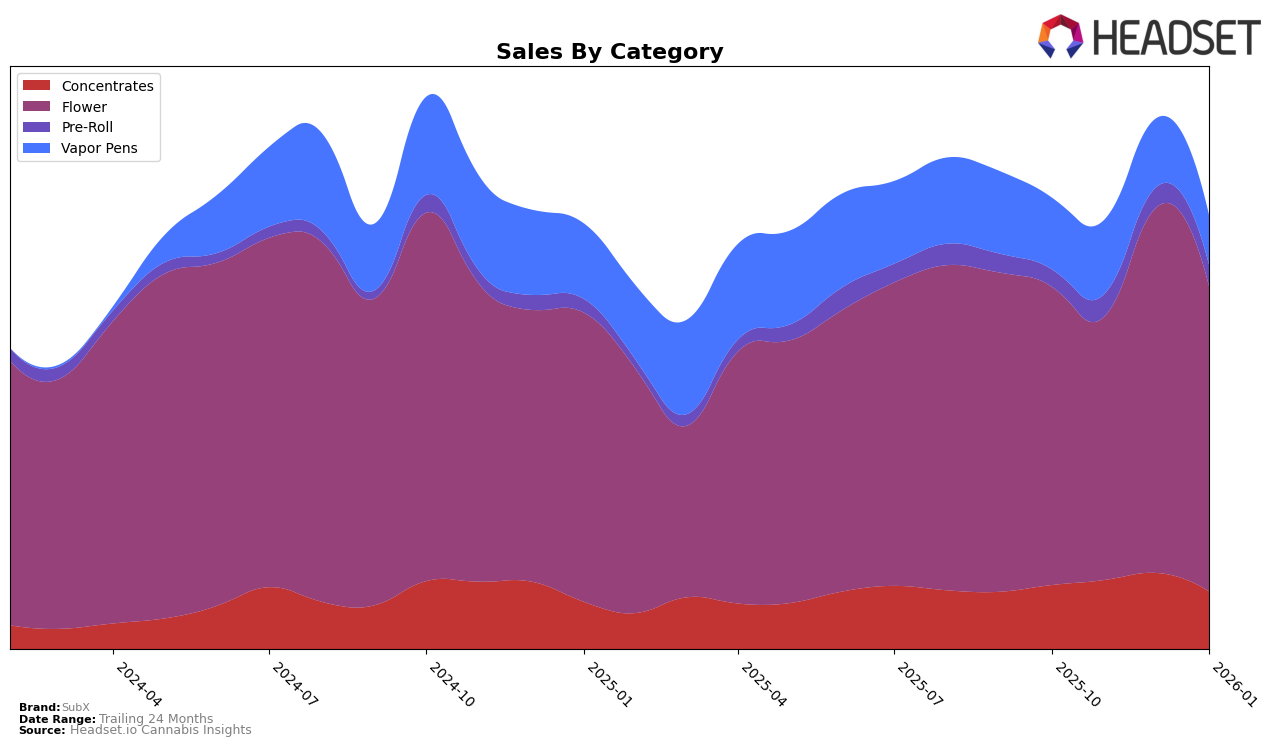

SubX has shown varied performance across different product categories in Washington. In the Flower category, SubX demonstrated a notable rebound from November 2025 to December 2025, jumping from the 25th to the 18th position. This upward movement suggests a strong consumer preference for their flower products during that period. However, the Concentrates category tells a different story, with SubX not making it into the top 30 in January 2026 after a steady climb from October to December 2025. This drop indicates potential challenges or increased competition that may have impacted their standing in this category.

In the Vapor Pens category, SubX has consistently struggled to break into the top 30, with rankings hovering around the 60s. This consistently lower performance might suggest that SubX's offerings in this category are not resonating as strongly with consumers compared to their competitors. Despite these challenges, it's important to note the brand's overall presence in the Washington market, especially in the Flower category, where they have maintained a relatively strong position. The fluctuations in rankings across categories highlight the dynamic nature of the cannabis market and the need for brands like SubX to adapt and innovate to maintain and improve their standing.

Competitive Landscape

In the competitive landscape of the flower category in Washington, SubX has experienced fluctuations in its market position, reflecting both challenges and opportunities. From October 2025 to January 2026, SubX's rank varied notably, starting at 19th, dropping out of the top 20 in November, and then recovering to 18th in December before slipping to 20th in January. This volatility contrasts with competitors like Royal Tree Gardens, which maintained a relatively stable presence, peaking at 13th in December. Meanwhile, Mt Baker Homegrown showed a positive trend, improving from 25th to 19th over the same period, suggesting a potential threat to SubX's market share. Additionally, Ooowee demonstrated a significant leap from 30th to 21st, indicating a growing competitive pressure. Despite these challenges, SubX's sales rebounded in December, suggesting resilience and potential for growth if strategic adjustments are made to capitalize on market dynamics.

Notable Products

In January 2026, SubX's top-performing product was Orange Poison (3.5g) in the Flower category, climbing to the first position with notable sales of 1,275 units. Swampwater Fumez (3.5g) dropped to second place, showing a decrease in sales compared to previous months. Island Octane (3.5g) maintained its third-place ranking from December 2025, despite a decline in sales figures. Crunch Berries (3.5g) entered the top five in January, securing the fourth position. Super Boof (3.5g) rounded out the top five, marking its debut in the rankings for January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.