Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

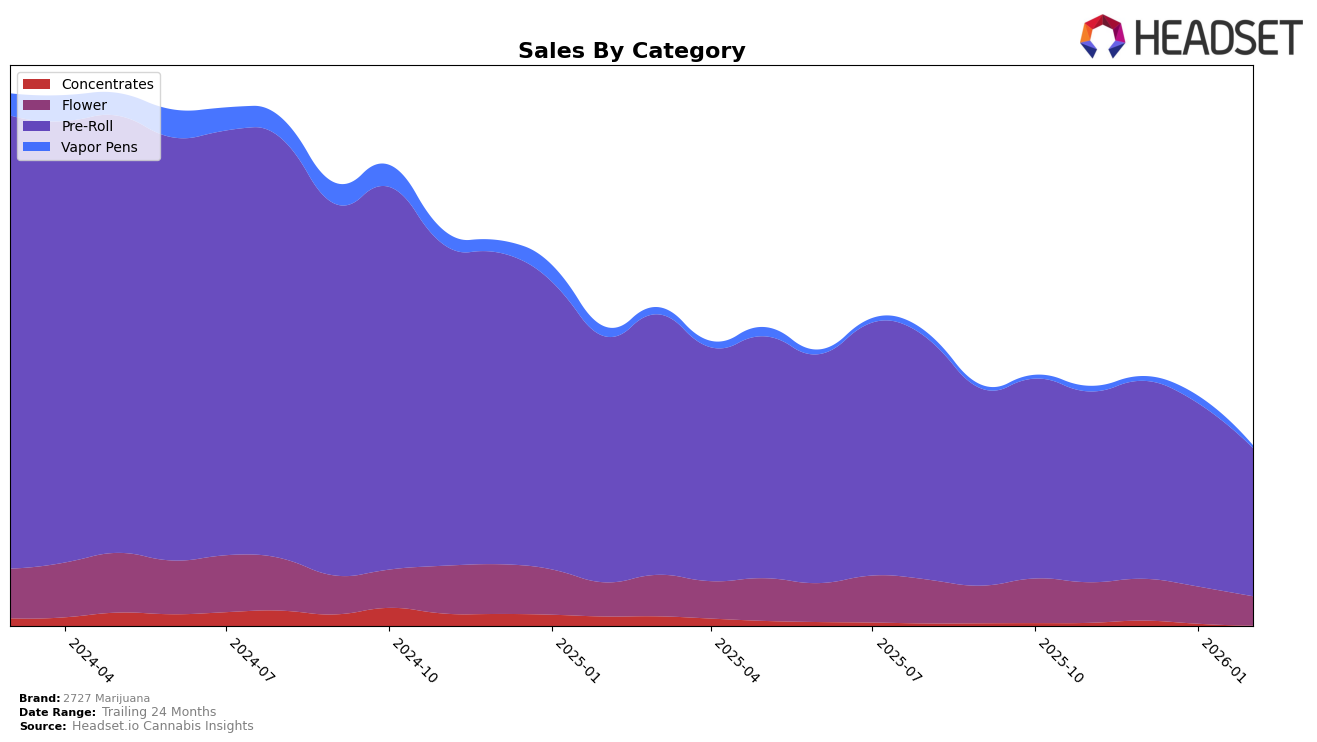

In the state of Washington, 2727 Marijuana has shown a noticeable decline in the Flower category rankings, starting from a position outside the top 30 and continuing to drop from 77th in November 2025 to 82nd by February 2026. This downward trend is concerning as it indicates a consistent struggle to compete within the top tier of brands in this category, despite a moderate sales volume at the onset. The brand's inability to break into the top 30 highlights potential challenges in market penetration or consumer preference shifts that could be impacting their performance.

Conversely, in the Pre-Roll category, 2727 Marijuana has maintained a stronger presence in Washington, with rankings fluctuating between 6th and 10th over the same period. This suggests a more stable consumer base and possibly a stronger brand reputation in this specific category. However, the slight drop from 6th in December 2025 to 10th in February 2026 may indicate emerging competitive pressures or changes in consumer preferences. The brand's ability to remain within the top 10 is a positive sign, yet the downward movement warrants attention to ensure they can maintain or improve their position in the coming months.

Competitive Landscape

In the Washington pre-roll category, 2727 Marijuana experienced notable fluctuations in its market position from November 2025 to February 2026. Initially ranked 7th in November, 2727 Marijuana improved to 6th in December, showcasing a competitive edge. However, by February 2026, the brand slipped to 10th place, indicating a potential challenge in maintaining its earlier momentum. This decline in rank coincides with a decrease in sales, contrasting with competitors such as The Happy Cannabis, which consistently held the 9th position before climbing to 8th, and Fire Bros., which improved from 13th to 11th. Meanwhile, Hellavated maintained a strong presence, only dropping from 8th to 9th, and Torus showed steady improvement, moving from 14th to 12th. These dynamics suggest that while 2727 Marijuana has demonstrated the capacity to compete effectively, it faces pressure from brands that are either stabilizing or improving their market positions, necessitating strategic adjustments to regain its competitive standing.

Notable Products

In February 2026, the top-performing product from 2727 Marijuana was the Cheesewreck Pre-Roll 5-Pack (5g), which ascended to the number one rank from its previous fifth position in November 2025. The product achieved notable sales figures, reaching 847 units sold. Following closely, the Gumbo Pre-Roll 5-Pack (5g) secured the second rank, marking its debut in the top rankings. The Green Crack Pre-Roll 5-Pack (5g) came in third, while the Lemon Cherry Gelato Pre-Roll 5-Pack (5g) also held the third position, moving up from its earlier fifth place in November. Lastly, the Mochi Pre-Roll 5-Pack (5g) rounded out the top five, maintaining a consistent presence in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.