Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

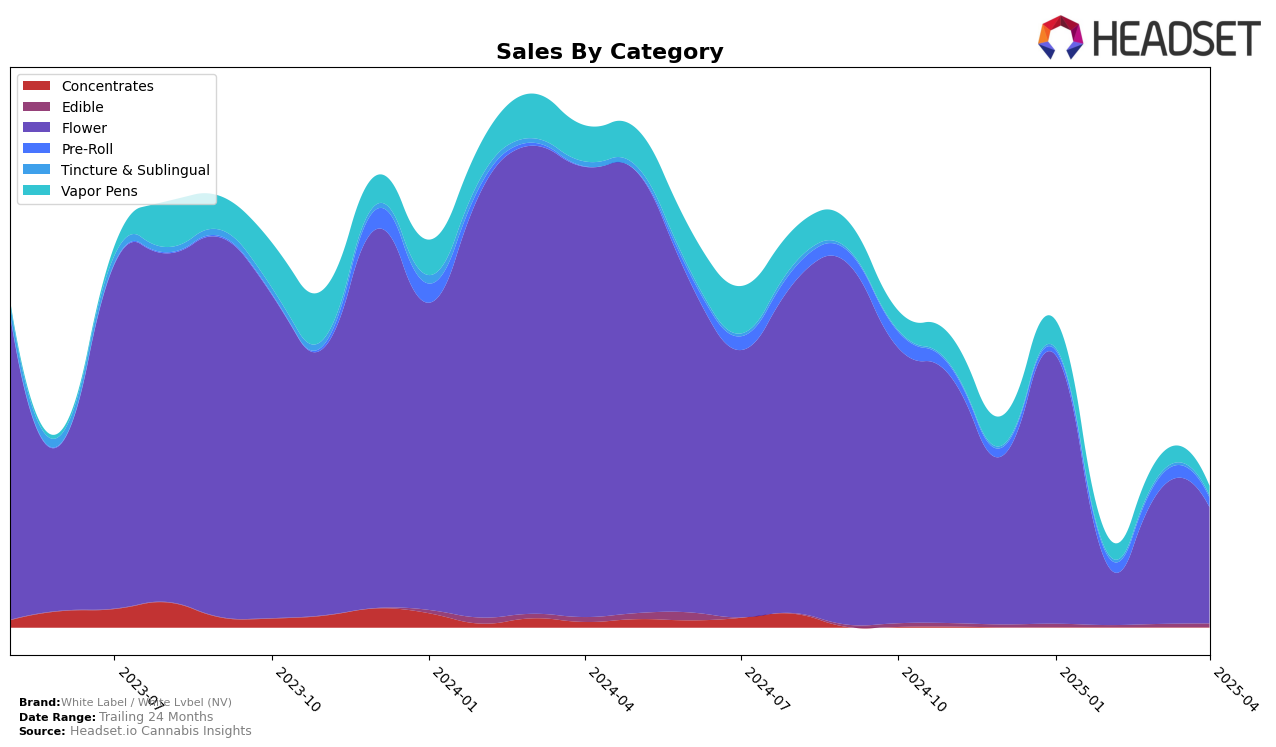

White Label / White Lvbel (NV) has shown a fluctuating performance in the cannabis market, particularly in the California flower category. In January 2025, the brand held a rank of 80, but in the subsequent months, it did not appear in the top 30, indicating a decline in its competitive positioning within this category. This absence from the top ranks in February, March, and April suggests that the brand may be facing challenges in maintaining its market share or is experiencing increased competition from other brands in the California market.

Despite this, the brand's January sales figure of $307,714 in California's flower category demonstrates its potential to be a significant player when conditions are favorable. The lack of consistent top rankings across months could imply either a strategic shift or external market pressures affecting its performance. Without appearing in the top 30 in the following months, it is crucial for White Label / White Lvbel (NV) to reassess its strategies to regain its foothold and capitalize on its previous sales achievements. This performance trend highlights the dynamic and competitive nature of the cannabis industry, particularly in a major market like California.

Competitive Landscape

In the competitive landscape of the California flower category, White Label / White Lvbel (NV) experienced a notable presence in January 2025, securing the 80th rank. However, in subsequent months, the brand did not maintain a position within the top 20, indicating a potential decline in market visibility or sales momentum. In contrast, Old Pal showed a significant upward trajectory, climbing from outside the top 20 to the 75th rank by February, demonstrating a robust sales growth trend. Similarly, MADE held a stronger position at 84th in January, suggesting competitive pressure on White Label / White Lvbel (NV) from brands with increasing market traction. The absence of White Label / White Lvbel (NV) in the top 20 in later months highlights the need for strategic adjustments to regain competitive footing against these rising brands.

Notable Products

In April 2025, White Label / White Lvbel (NV) saw Gelato (28g) from the Flower category rise to the top spot, maintaining its upward trajectory from second place in the previous two months, with sales reaching 1426 units. Indica Pre-Roll (1g) climbed to the second position, up from third in March, indicating strong performance within the Pre-Roll category. Sativa Pre-Roll (1g) experienced a slight drop, moving from fourth to third place, suggesting steady demand despite the shift. Purple Punch (3.5g) made its debut in the rankings at fourth place, highlighting its emerging popularity. Hybrid Pre-Roll (1g) maintained its fifth-place ranking from March, showing consistent sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.