Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

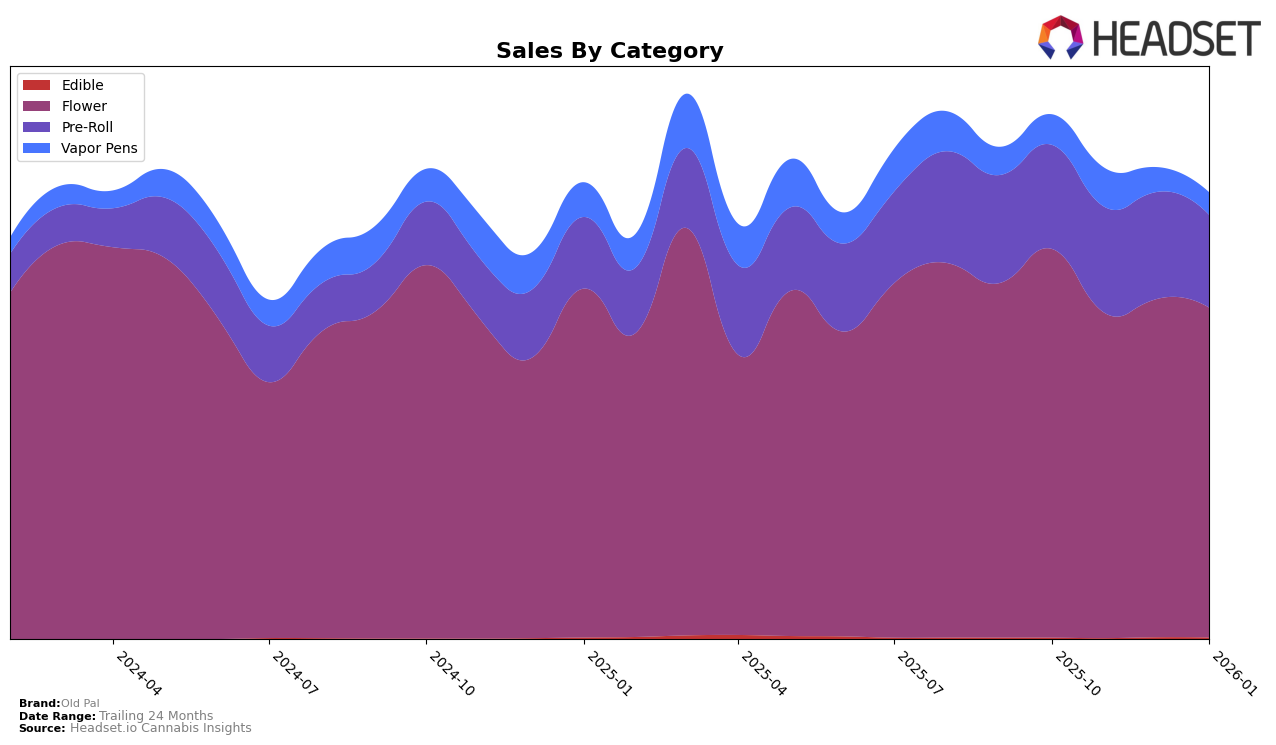

Old Pal has shown varied performance across different categories and states, with notable fluctuations in rankings. In Colorado, the brand experienced a significant drop in the Flower category, moving from 16th place in December 2025 to 36th in January 2026, indicating a need for strategic adjustments in this market. However, their Pre-Roll category maintained a consistent performance, staying within the top 10 across the same period. In Massachusetts, Old Pal's Flower category saw a steady decline in rankings, from 31st in October to 45th in January, highlighting potential challenges in maintaining market share.

In Maryland, Old Pal's Flower category showed some resilience, bouncing back to 23rd place in December after a dip to 30th in November, though it returned to 30th by January 2026. The Pre-Roll category in Maryland remained stable, hovering around the mid-20s. Meanwhile, in New Jersey, the Flower category saw a recovery in January, returning to 20th place after a dip to 28th in December. The brand was not within the top 30 for Vapor Pens in Ohio, hinting at potential growth opportunities or challenges in that category. Overall, Old Pal's performance indicates strengths in certain categories and states, while other areas may require strategic focus to improve rankings.

Competitive Landscape

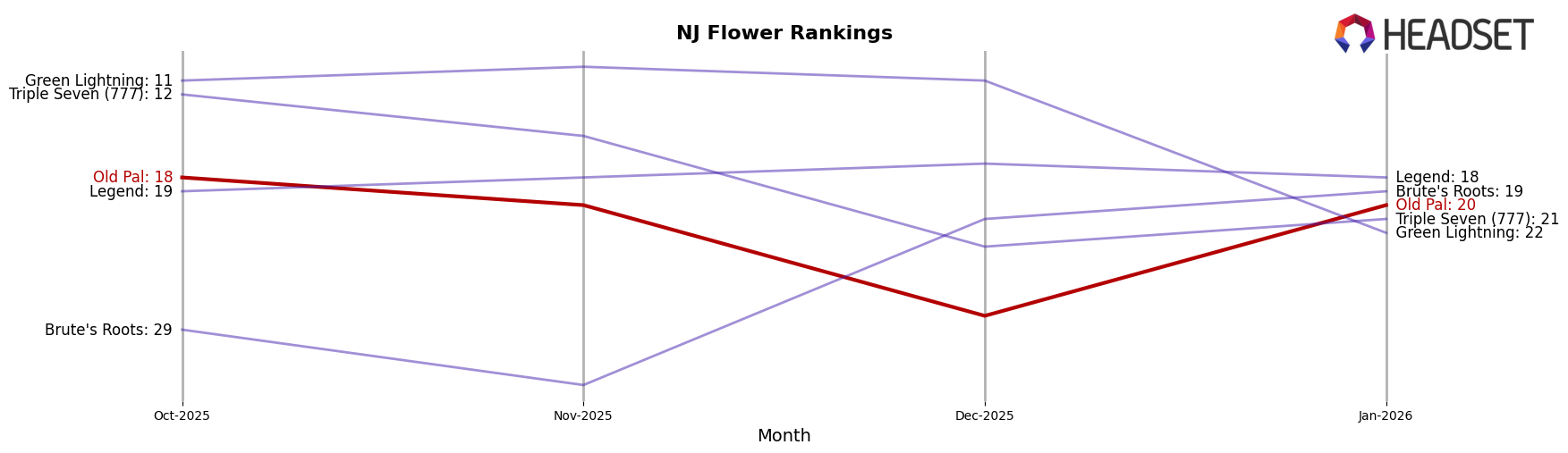

In the competitive landscape of the Flower category in New Jersey, Old Pal has experienced fluctuating rankings over the past few months, indicating a challenging market environment. In October 2025, Old Pal was ranked 18th, but by December, it had fallen out of the top 20, only to recover to 20th place by January 2026. This volatility contrasts with competitors like Green Lightning, which maintained a strong position, ranking consistently in the top 11 until a drop to 22nd in January. Meanwhile, Triple Seven (777) also saw a decline, moving from 12th in October to 21st by January, suggesting a broader market shift. Legend showed more stability, hovering around the 18th position, while Brute's Roots made a notable climb from 29th to 19th. These dynamics highlight the competitive pressures Old Pal faces, as it contends with brands that are either maintaining their market share or showing upward momentum, potentially impacting Old Pal's sales and market strategy.

Notable Products

In January 2026, Berried Alive Pre-Roll 2-Pack (1g) emerged as the top-performing product for Old Pal, climbing to the first rank with sales of $3,840. KY Jealous Pre-Roll 2-Pack (1g) followed in second place, although it experienced a drop from its previous ranking. Red Bullz Pre-Roll (1g) made its debut in the rankings at third place. Black Cherry Jack Ready to Roll (14g) and Velvet Z Pre-Roll 2-Pack (1g) secured the fourth and fifth spots respectively, indicating strong performance in the Flower and Pre-Roll categories. Overall, the rankings show a dynamic shift with new entries and changes in positions compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.