Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

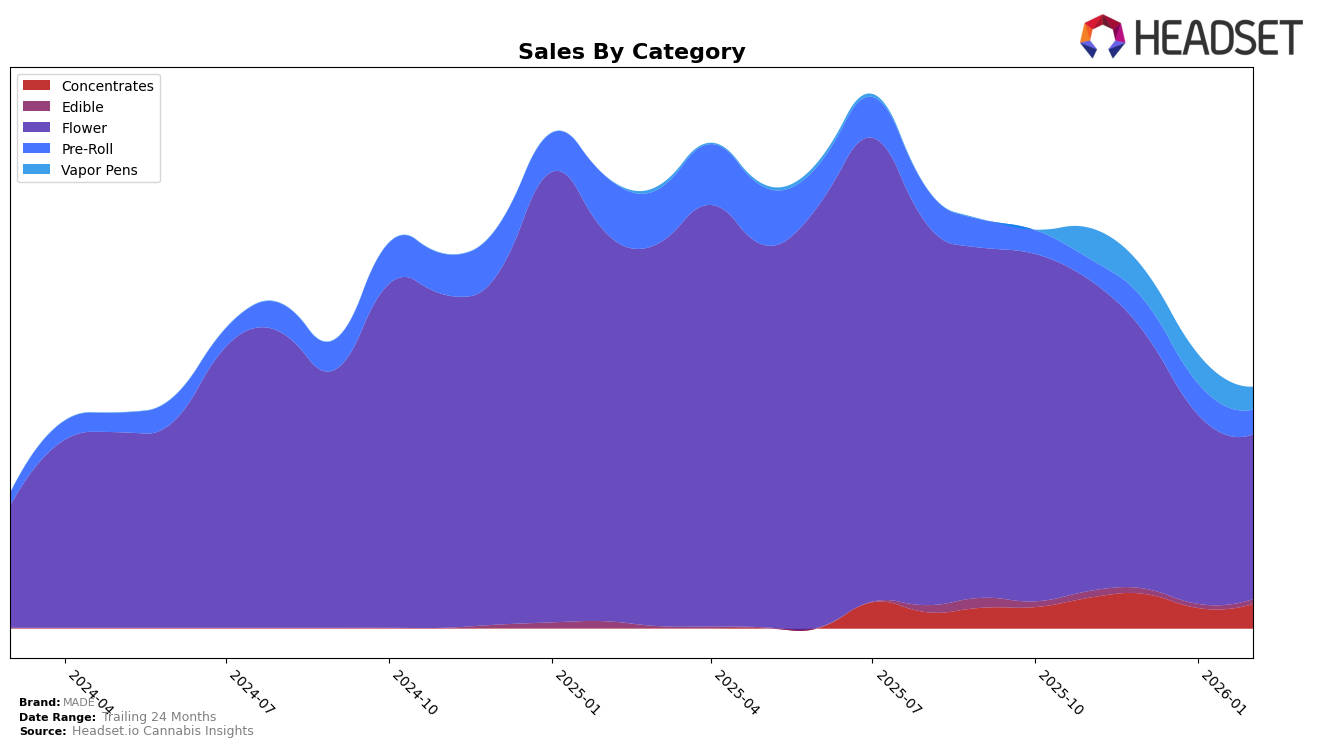

MADE's performance in the Arizona market showcases a dynamic trajectory across various product categories. In the Concentrates category, MADE experienced fluctuations, moving from a rank of 15 in November 2025 to 19 by February 2026. This indicates a moderate decline, albeit with a slight recovery from January's rank of 25. The Flower category, however, saw a more pronounced decline, dropping from rank 19 in November 2025 to 30 by February 2026, suggesting increased competition or shifting consumer preferences. Interestingly, Pre-Roll products showed a steady improvement, climbing from rank 48 in November to 38 by February, hinting at a growing consumer interest or effective marketing strategies in this segment.

In the Vapor Pens category, MADE maintained a relatively stable position, hovering around the low 40s in rank throughout the observed months. This consistency might reflect a stable consumer base or a lack of significant market disruption in this category. Notably, MADE did not break into the top 30 brands for any category in Arizona during this period, which could be seen as an area for potential improvement or strategic realignment. Overall, while MADE has shown some positive movement in specific categories, there remains room for growth and increased market penetration in Arizona.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, MADE has experienced a notable shift in its market position over recent months. Starting from a rank of 19 in November 2025, MADE has seen a decline, dropping to 30 by February 2026. This downward trend in rank is accompanied by a decrease in sales, suggesting potential challenges in maintaining its market share. In contrast, Roll One / R.O. has shown a positive trajectory, improving its rank from 42 to 29 over the same period, indicating a significant increase in consumer preference or strategic market maneuvers. Similarly, Seed Junky Genetics has climbed from 48 to 33, showcasing a strong upward trend in sales and rank. Meanwhile, Vortex Cannabis Inc. and DTF - Downtown Flower have displayed fluctuating ranks, with Vortex maintaining a relatively stable position and DTF experiencing a decline. These dynamics highlight the competitive pressures faced by MADE, underscoring the need for strategic adjustments to regain its standing in the Arizona Flower market.

Notable Products

In February 2026, Blue Dream 3.5g emerged as the top-performing product for MADE, securing the number one rank with impressive sales figures of 1502 units. Super Silver Haze 3.5g followed closely, advancing to the second position from third in January, with 877 units sold. The Super Silver Haze Pre-Roll 2-Pack (2g) maintained a strong presence at the third rank, while the Blue Dream Pre-Roll 2-Pack (2g) entered the top five, securing the fourth position. Coco Chanelle 3.5g rounded out the top five, debuting with noteworthy sales. The rankings indicate a strong preference for flower products, with Blue Dream showing significant popularity and growth over the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.