Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

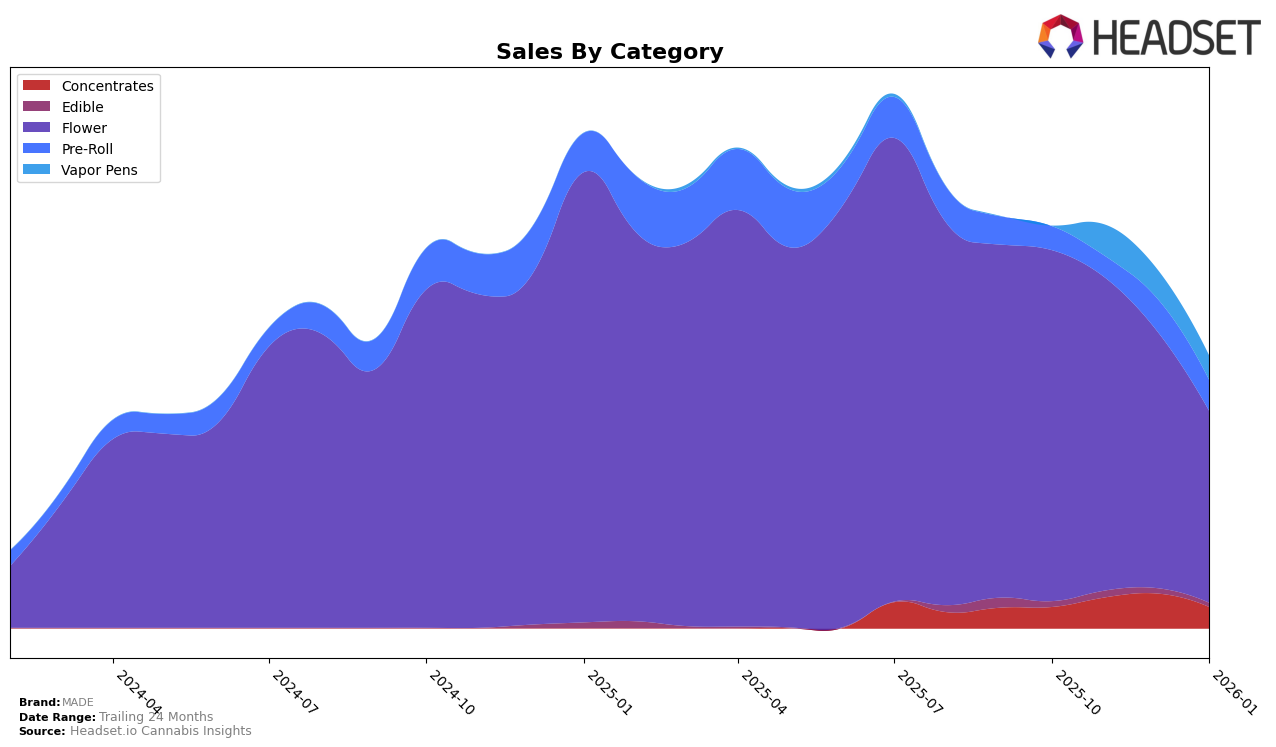

In the state of Arizona, MADE has shown notable fluctuations across various cannabis product categories. Concentrates have seen an interesting trajectory with MADE's ranking improving from 24th in October 2025 to 15th in November, before slightly declining to 18th and then 23rd by January 2026. This suggests a potential volatility in consumer preferences or competitive dynamics in this category. In the Flower category, MADE experienced a drop out of the top 30 by January 2026, after being as high as 19th in November 2025. This decline might indicate challenges in maintaining market share or changes in consumer demand. Meanwhile, the Pre-Roll category has maintained a consistent presence, holding steady at 39th place from December 2025 to January 2026, indicating a stable niche market for MADE's products.

In California, MADE's performance in the Flower category was less prominent, with a ranking of 84th in October 2025 and no presence in the top 30 in subsequent months. This absence suggests significant competition or a strategic focus elsewhere, which could be a point of concern or an opportunity for MADE to reassess its market strategy. Additionally, MADE's performance in the Vapor Pens category in Arizona, where they entered the rankings at 41st in November 2025 and remained in the top 42 by January 2026, indicates a relatively stable foothold in this segment despite not being in the top 30 initially. These insights reflect the brand's varying success across different states and categories, hinting at areas for potential growth and reevaluation of market strategies.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, MADE has experienced notable fluctuations in its ranking and sales over the past few months. Starting from a strong position at rank 23 in October 2025, MADE improved to rank 19 in November, indicating a positive momentum. However, this was followed by a decline back to rank 23 in December and further down to rank 29 in January 2026. This downward trend in rank coincides with a decrease in sales from November to January, suggesting potential challenges in maintaining market share. Competitors such as TRIP and Halo Cannabis (formerly The Green Halo) have shown resilience, with TRIP improving its rank to 27 in January and Halo Cannabis climbing to 28, both surpassing MADE. Meanwhile, Sunday Goods and Sonoran Roots have also demonstrated competitive sales figures, with Sunday Goods maintaining a consistent upward trajectory in sales, which could pose further challenges for MADE in the upcoming months.

Notable Products

In January 2026, Red Dragon (3.5g) from MADE reclaimed the top spot in the Flower category with sales of 1001 units, having previously ranked first in October 2025 before dropping to third in December 2025. Sugar Shack (3.5g) maintained its strong performance, holding steady at second place in the Flower category, following its second-place ranking in November 2025. Super Silver Haze (3.5g) emerged as a new contender, securing the third position in the Flower category. In the Pre-Roll category, Grape Gas Pre-Roll 2-Pack (2g) entered the rankings at fourth place, while Prezidential Pre-Roll 2-Pack (2g) followed closely in fifth place. This shift in rankings highlights a dynamic change in consumer preference towards these new entries in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.