Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

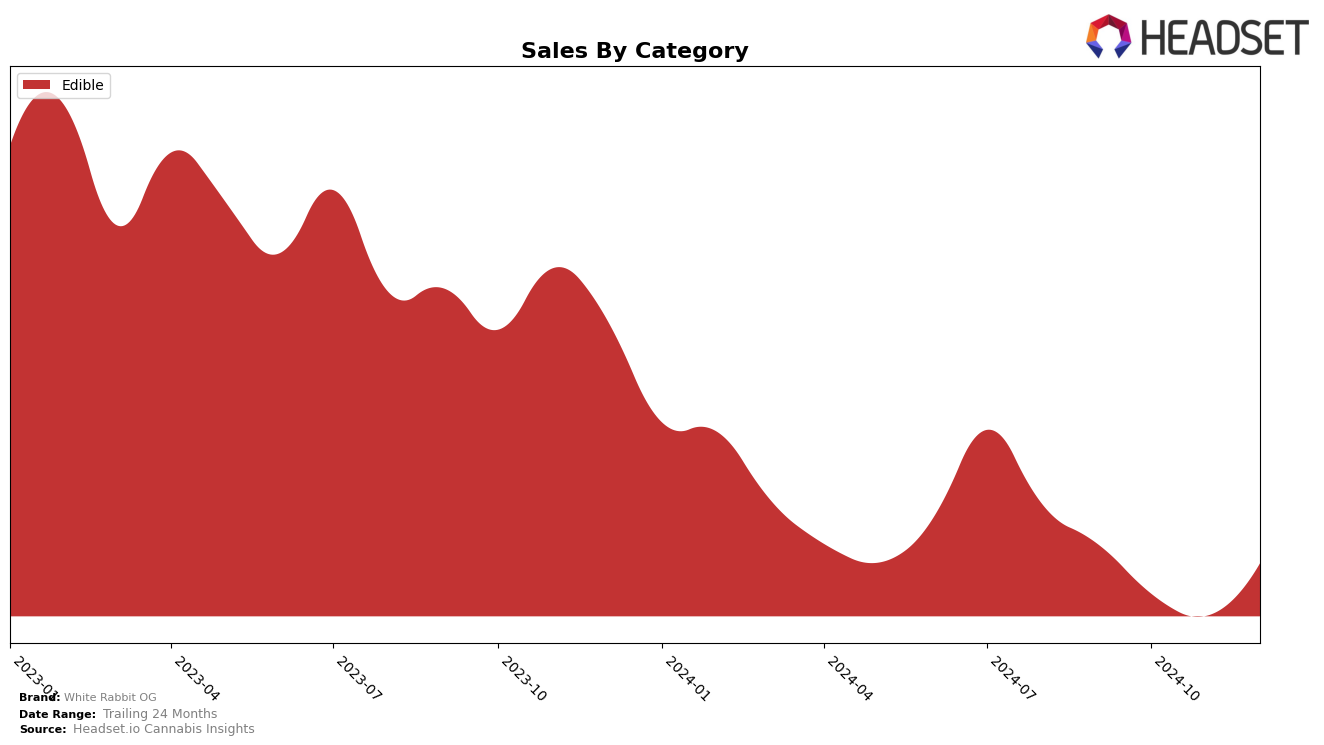

White Rabbit OG has demonstrated a notable presence in the Edible category within the province of British Columbia. In September 2024, the brand was ranked 23rd, indicating a solid foothold in this market segment. However, the absence of rankings for the subsequent months suggests that the brand did not maintain a position within the top 30, which could be a point of concern for stakeholders looking for consistent performance. This drop out of the top rankings could signal increased competition or a shift in consumer preferences that the brand might need to address.

Despite the lack of top 30 rankings beyond September, White Rabbit OG's initial presence indicates potential that could be leveraged with strategic adjustments. The sales figure for September, which was over 11,000, shows that there is a demand for their products, even if it wasn't sustained in the following months. This data point could serve as a benchmark for future performance and strategy development. Observing trends and shifts in consumer behavior in British Columbia could provide insights into how White Rabbit OG might regain or enhance its market position in the Edible category.

Competitive Landscape

In the competitive landscape of the Edible category in British Columbia, White Rabbit OG has faced significant challenges in maintaining its rank and sales momentum. As of December 2024, White Rabbit OG did not appear in the top 20 brands, indicating a struggle to capture market share. In contrast, Foray consistently held its position within the top 20, despite a slight dip from 15th to 17th rank in November 2024, before falling out of the top 20 in December. This suggests that Foray's sales, while declining, were still robust enough to maintain visibility. Meanwhile, Indiva hovered just outside the top 20, showing a slight improvement in November before returning to its previous rank. The consistent presence of these competitors highlights the competitive pressure on White Rabbit OG, which may need to innovate or adjust its strategies to regain traction and improve its standings in the market.

Notable Products

In December 2024, the top-performing product for White Rabbit OG was the CBG:THC 2:1 Rapid Matcha Banana Smoothie Chews 4-Pack, which secured the number one rank with an impressive sales figure of 1000 units. This product showed a significant rise from its fourth position in October and maintained its top spot from November. The Craft Sour Peach Pate De Fruits Chews 4-Pack consistently held the second position for three consecutive months, from October to December. The CBD:THC 2:1 Blackberry Lemonade Soft Chews, which was the top product in September and October, fell to the third position in December. Notably, the CBD:THC 1:1 Raspberry White Chocolate Soft Chews re-entered the rankings, reaching fourth place in December after not being ranked in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.