Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

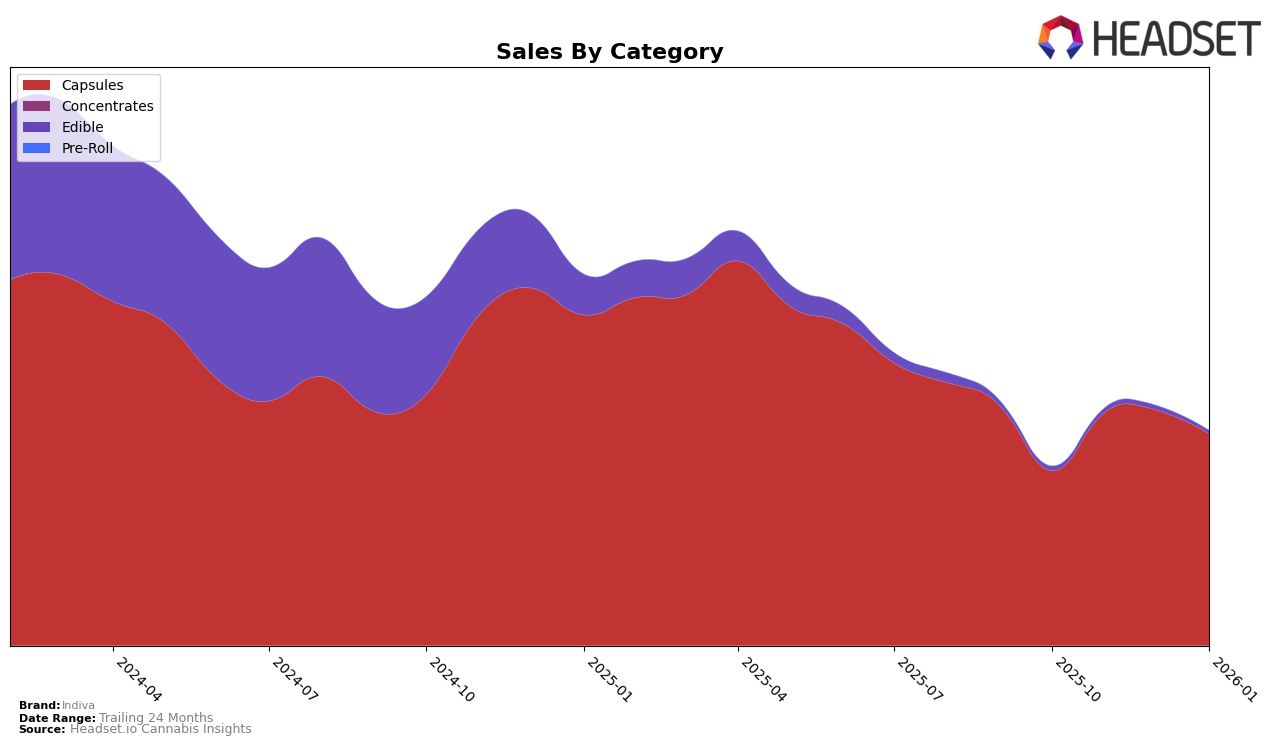

Indiva's performance across Canadian provinces in the capsules category shows varying degrees of success. In Alberta, Indiva consistently maintained a position within the top 10, although it experienced a slight decline in sales from October 2025 to January 2026. This consistent ranking indicates a stable presence in the market, albeit with room for growth. In contrast, British Columbia saw Indiva holding a strong position at rank 2 from November 2025 through January 2026, demonstrating a solid foothold and possibly reflecting a favorable reception among consumers. The sales figures in British Columbia also highlight a peak in November before stabilizing, which could suggest successful promotional activities or seasonal demand shifts.

Meanwhile, in Ontario, Indiva maintained a consistent rank of 6 throughout the observed months, indicating a steady performance in a competitive market. The sales trend in Ontario shows a peak in December 2025, which could be attributed to increased holiday season purchases. However, the absence of Indiva from the top 30 in any additional states or provinces suggests that while the brand has a strong presence in its existing markets, there is significant potential for expansion. This absence might be viewed as a missed opportunity to capture market share in other regions, but also highlights the potential for growth if strategic initiatives are implemented.

Competitive Landscape

In the competitive landscape of the Ontario cannabis capsules market, Indiva has maintained a consistent rank of 6th place from October 2025 to January 2026. Despite its steady position, Indiva faces stiff competition from brands like Emprise Canada, which consistently holds the 5th rank with significantly higher sales figures. Tweed also remains a formidable competitor, ranking 3rd and showing a slight dip in January 2026, which could present an opportunity for Indiva to close the gap. Meanwhile, Simply Bare and Decimal trail behind Indiva, with Simply Bare showing a notable upward sales trend, suggesting potential future competition. Indiva's stable rank amidst these dynamics underscores its resilience but also highlights the need for strategic initiatives to boost sales and improve its competitive standing.

Notable Products

In January 2026, Indiva's top-performing product was Big Blips THC Tablets 55-Pack (550mg) in the Capsules category, maintaining its first-place rank from the previous two months with sales of 3051 units. Blips THC Tablets 25-Pack (250mg), also in the Capsules category, held steady in second place, closely trailing the top product. The Dark Chocolate Bar (10mg) remained consistent in third place within the Edible category, although its sales decreased to 377 units. Notably, the Vanilla Double Stuffed Chocolate Cookie (10mg) improved its ranking, moving up to fourth place from its previous fifth-place position. The CBG/THC 1:2 Blips Tablets 20-Pack (100mg CBG, 200mg THC) rounded out the top five, experiencing a drop from fourth place in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.