Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

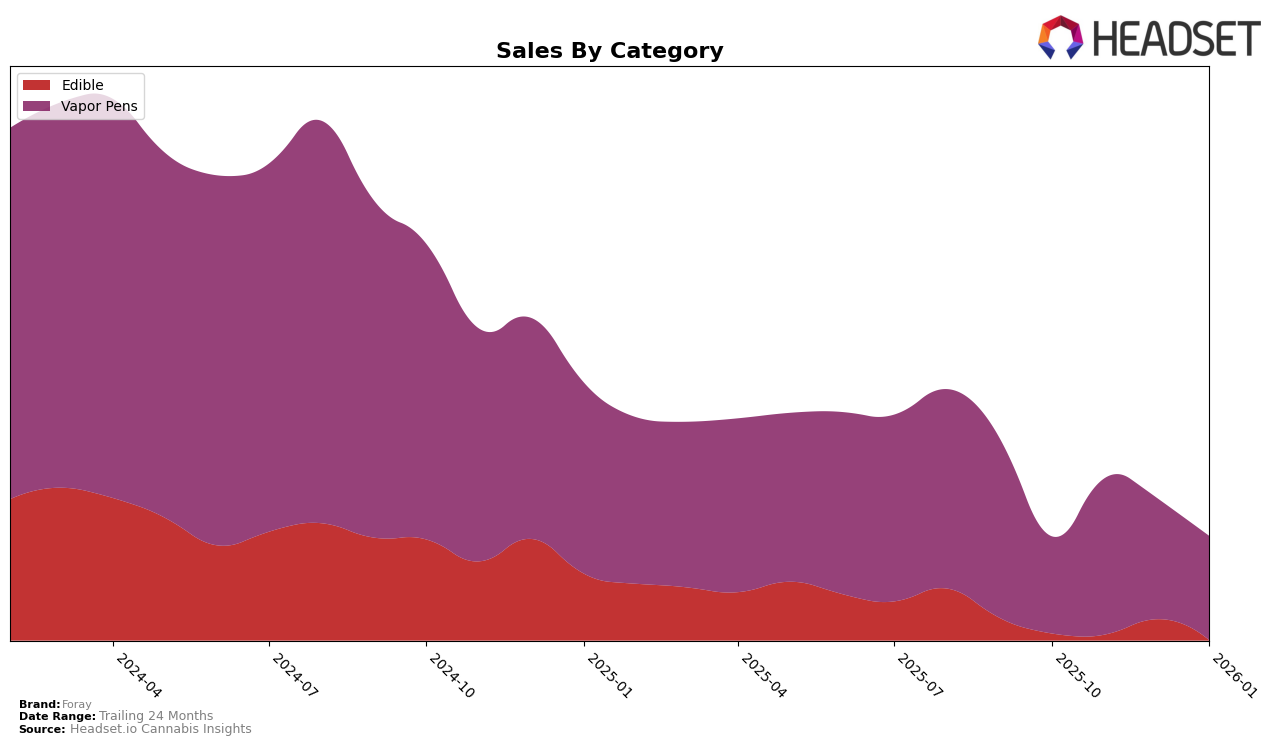

In the edible category, Foray has shown a promising upward trajectory in Alberta, where it climbed from not being in the top 30 to securing the 17th position by January 2026. This indicates a strong market penetration and consumer acceptance in this province. However, in Saskatchewan, Foray's ranking saw a dip as it disappeared from the top 30 in December 2025, only to reappear at the 10th position in January 2026. Meanwhile, in Ontario, Foray maintained a relatively stable performance, consistently ranking around the 10th position, suggesting a steady consumer base in this region.

Foray's performance in the vapor pens category presents a mixed picture across different provinces. In British Columbia, Foray made notable progress, improving its rank from 41st in October 2025 to 19th by January 2026, showcasing significant growth in consumer preference. Conversely, in Ontario, the brand experienced a gradual decline, slipping from the 31st position in October 2025 to 34th by January 2026, indicating potential challenges in maintaining its market share. In Alberta, Foray's position fluctuated outside the top 30, peaking at 39th in October 2025 and dropping to 47th by January 2026, reflecting a competitive landscape in this category.

Competitive Landscape

In the competitive landscape of vapor pens in Ontario, Foray has experienced a slight decline in its rankings from October 2025 to January 2026, moving from 31st to 34th place. This downward trend is mirrored by a decrease in sales over the same period. Notably, Platinum Vape also saw a decline in rank, dropping from 26th to 33rd, suggesting a broader market shift or increased competition. Meanwhile, EastCann demonstrated a significant upward trajectory, climbing from 46th to 31st, surpassing Foray in January 2026, which indicates a potential shift in consumer preferences or successful marketing strategies by EastCann. GREAZY maintained a relatively stable position, closely trailing Foray, which could pose a threat if Foray's downward trend continues. Foray's performance suggests a need for strategic adjustments to regain competitive edge in this dynamic market.

Notable Products

In January 2026, Blackberry Cream Distillate Disposable 0.3g maintained its position as the top-selling product for Foray, with sales figures reaching 9,582 units. Fast Edi's- CBD/CBN/THC Blackberry Lavender Soft Chews 30-Pack climbed to the second spot, demonstrating a consistent upward trend from the fourth position in October 2025. Edi's - CBD Blood Orange Soft Chews 30-Pack held steady in third place, showing resilience in its category. Indica Distillate Disposable 0.3g improved its rank to fourth, up from its consistent fifth-place position in the previous months. The CBD/THC 1:1 Salted Caramel Chocolate Bar saw a notable decline, dropping to fifth place after consistently ranking second in the preceding months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.