Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

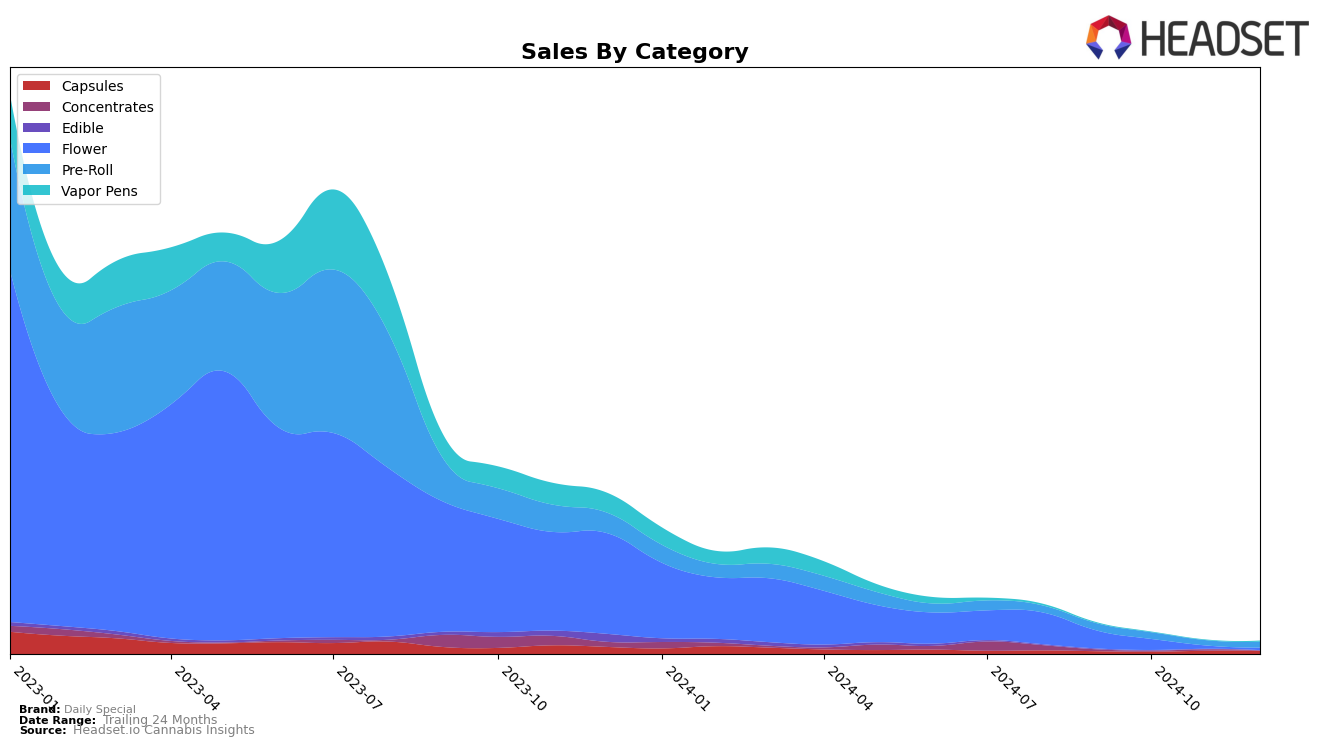

Daily Special, a cannabis brand that has made notable strides in the market, has shown varying performance across different states and categories. In Alberta, the brand has not made it into the top 30 rankings for the Flower category from September to December 2024, indicating a challenging competitive landscape in this region. Despite the absence from the top ranks, the brand's sales figures in September were notable, suggesting a potential for growth if strategic adjustments are made. The lack of ranking in Alberta could be a point of concern, highlighting the need for increased market penetration or differentiation to enhance visibility and competitiveness.

Across other regions, Daily Special's performance could vary significantly, with potential implications for their strategic focus and resource allocation. The fact that the brand did not appear in the top 30 rankings in Alberta may suggest either a highly competitive market or a need for better brand positioning. Understanding the nuances of each market, such as consumer preferences and local competition, can be crucial for Daily Special to improve its standings. While specific sales trends in other states or provinces are not detailed here, the brand's overall trajectory in Alberta provides a glimpse into the challenges and opportunities that lie ahead for Daily Special in the cannabis industry.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, Daily Special has faced significant challenges, as evidenced by its absence from the top 20 brand rankings from September to December 2024. This indicates a struggle to maintain a competitive edge in the market. In contrast, brands like Cookies have shown a positive trajectory, improving their rank from 47th in October to 43rd in November, suggesting a growing consumer preference. Similarly, Kolab and Homestead Cannabis Supply have maintained a presence in the rankings, although they have not shown significant upward movement. The consistent presence of The Loud Plug in the rankings further highlights the competitive pressure Daily Special faces. This competitive environment suggests that Daily Special may need to innovate or adjust its strategies to regain market share and improve its standing in the Alberta Flower category.

Notable Products

In December 2024, Indica Js Pre-Roll 7-Pack (2.1g) maintained its top position as the leading product for Daily Special, despite a decline in sales to 479 units. The Nightmare Fuel Pre-Roll 7-Pack (3.5g) emerged as the second best-selling product, marking its first appearance in the rankings. Sativa J's Pre-Roll 7-Pack (2.1g) slipped slightly to third place, continuing its descent from its peak in October. Sativa THC Softgels 30-Pack (150mg) improved its rank to fourth, showing a positive trend since its introduction in November. Meanwhile, Indica THC Softgels 30-Pack (150mg) rounded out the top five, experiencing a drop in both rank and sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.