Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

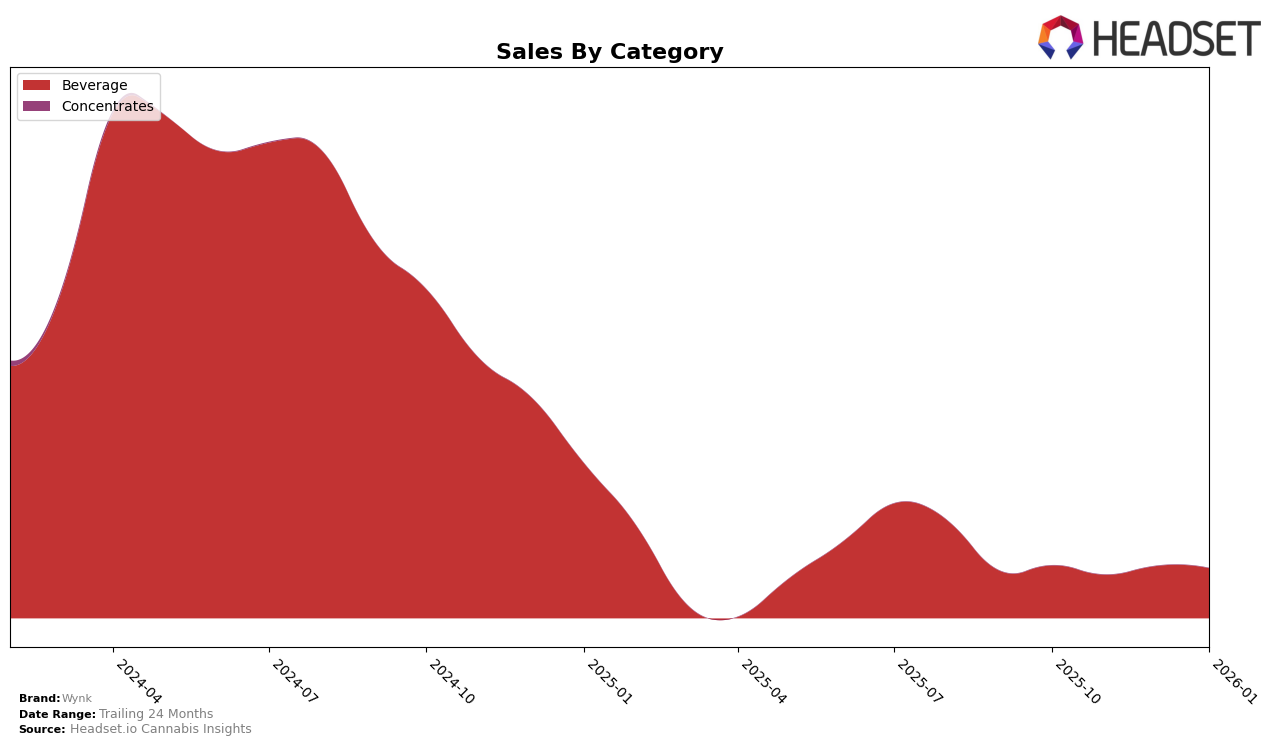

Wynk has shown a consistent performance in the Beverage category within Connecticut. The brand maintained its position at rank 5 in October, December, and January, despite missing a rank in November. This consistency suggests a stable consumer base and effective market presence in the state. The sales figures indicate a slight decline from October to January, which could be attributed to seasonal variations or shifts in consumer preferences. However, the ability to remain in the top 5 throughout these months highlights Wynk's strong foothold in the Connecticut beverage market.

While Wynk's presence in Connecticut is notable, the absence of a rank in November raises questions about the competitive landscape during that time. It is possible that other brands temporarily surged in popularity, pushing Wynk out of the top 30. This scenario underscores the dynamic nature of the cannabis beverage market, where consumer trends and brand strategies can swiftly alter rankings. Despite this anomaly, Wynk's return to the top 5 in December and January demonstrates resilience and the potential for sustained success in the Connecticut market.

Competitive Landscape

In the Connecticut beverage category, Wynk has maintained a consistent presence, ranking 5th in October, December, and January, with a notable absence from the top 20 in November. This stability in ranking is despite the competitive pressure from brands like CANN Social Tonics, which consistently ranks in the top three, and Muze (CT), which holds the 4th position in January. Wynk's sales figures show a slight decline from October to January, contrasting with the fluctuating sales of CANN Social Tonics, which saw a peak in December. The absence of Wynk in November's rankings suggests a temporary dip in market visibility, potentially impacting its sales momentum. Meanwhile, Zero Proof experienced a drop in rank after November, indicating a shift in consumer preferences or competitive dynamics that Wynk could capitalize on to improve its market position.

Notable Products

In January 2026, Wynk's top-performing product was the CBD/THC 1:1 Black Cherry Fizz Infused Seltzer, maintaining its leading position from previous months with a sales figure of 816 units. The CBD/THC 1:1 Juicy Mango Infused Seltzer secured the second spot, showing a consistent rise from fourth place in October and November to second in December and January. The CBD/THC 1:1 Lime Twist Infused Seltzer held steady in third place throughout the observed months, indicating a stable demand. The CBD/THC 1:1 Lemonade Infused Seltzer, however, slipped from second place in October and November to fourth in January. The CBD/THC 1:1 Tangerine Infused Seltzer, introduced later, maintained its fifth position since its debut in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.