Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

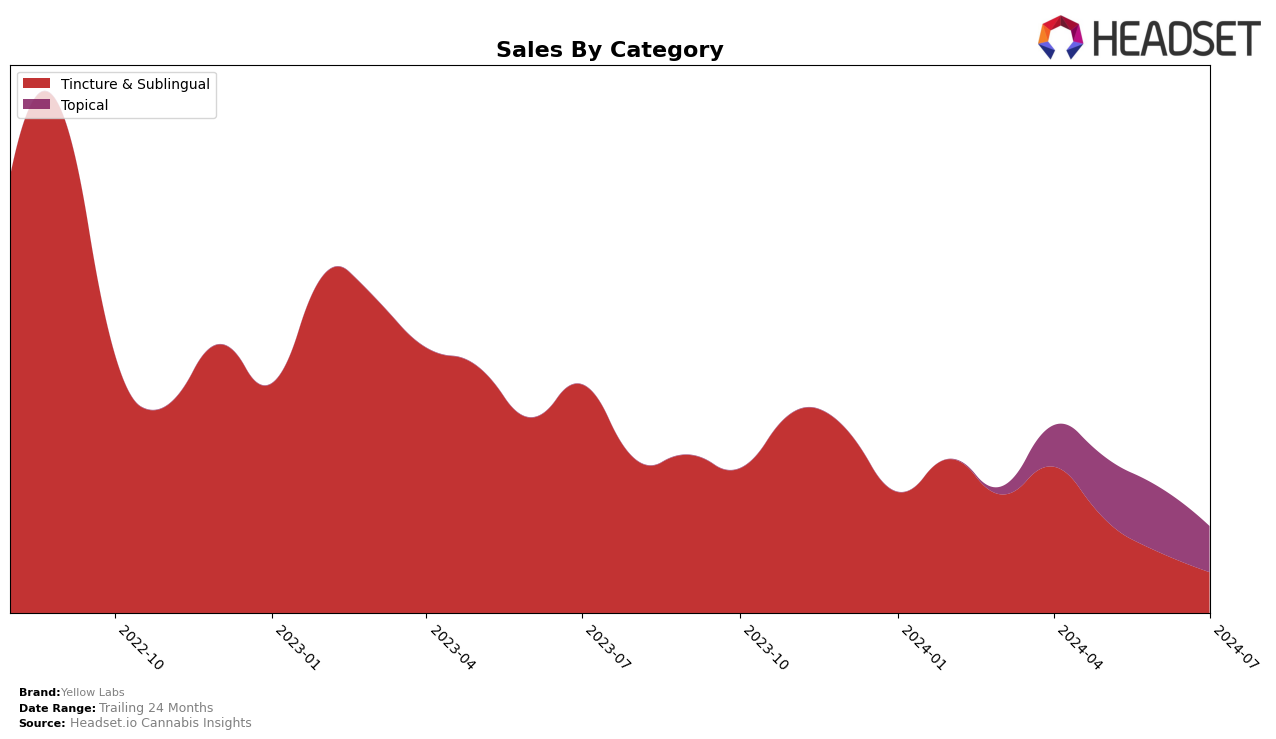

Yellow Labs has shown a notable performance in the Tincture & Sublingual category in Massachusetts. In April 2024, the brand secured the 5th position, an impressive ranking that underscores its strong market presence. However, it is important to note that Yellow Labs did not maintain this momentum in subsequent months, as they were not listed in the top 30 rankings for May, June, and July 2024. This decline indicates a significant drop in market visibility and possibly sales, suggesting that the brand may need to reassess its strategies to regain its foothold in the Massachusetts market.

The absence of Yellow Labs from the top 30 rankings in the Tincture & Sublingual category across the other states or provinces during the same period highlights a critical area for improvement. This lack of presence in multiple markets could either indicate a highly competitive landscape or potential gaps in Yellow Labs' distribution and marketing efforts. The brand's performance in April 2024, with sales amounting to $11,508, demonstrates their potential when they are able to capture consumer interest. Moving forward, it will be crucial for Yellow Labs to analyze the factors contributing to their initial success in Massachusetts and apply these insights to bolster their performance across different regions.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Yellow Labs has experienced notable fluctuations in its market rank and sales performance. Initially, in April 2024, Yellow Labs secured a commendable 5th rank, indicating strong market presence. However, the brand did not appear in the top 20 for the subsequent months of May, June, and July 2024, suggesting a significant drop in both rank and visibility. In contrast, Doctor Solomon's maintained a consistent 5th rank from April to June 2024, showcasing stable performance and possibly capturing a loyal customer base. Meanwhile, Sip showed a slight decline from 6th to 8th rank but rebounded to 6th in July 2024, indicating some volatility but overall resilience. Additionally, HALO by Rebelle emerged in June 2024 at the 7th rank, suggesting a new competitive entrant that could be impacting Yellow Labs' market share. These dynamics highlight the competitive pressures Yellow Labs faces and underscore the importance of strategic adjustments to regain and sustain its market position.

Notable Products

In July 2024, the top-performing product from Yellow Labs was Lib Mouth Spray Tincture (130mg THC, 2.5ml) in the Tincture & Sublingual category, which climbed to the first rank with sales of $85. Recover Mist (220mg), also in the Tincture & Sublingual category, secured the second position with notable sales figures. Calm THC Cream (295mg THC) in the Topical category was ranked third, showing a decline from its second position in June. The 2 Day NRG Mango THC Mist (131.25mg THC, 2.5ml) entered the rankings at fourth place in July. Rose Oil Massage Cream (295mg THC) maintained its fifth position from June, indicating stable performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.