Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

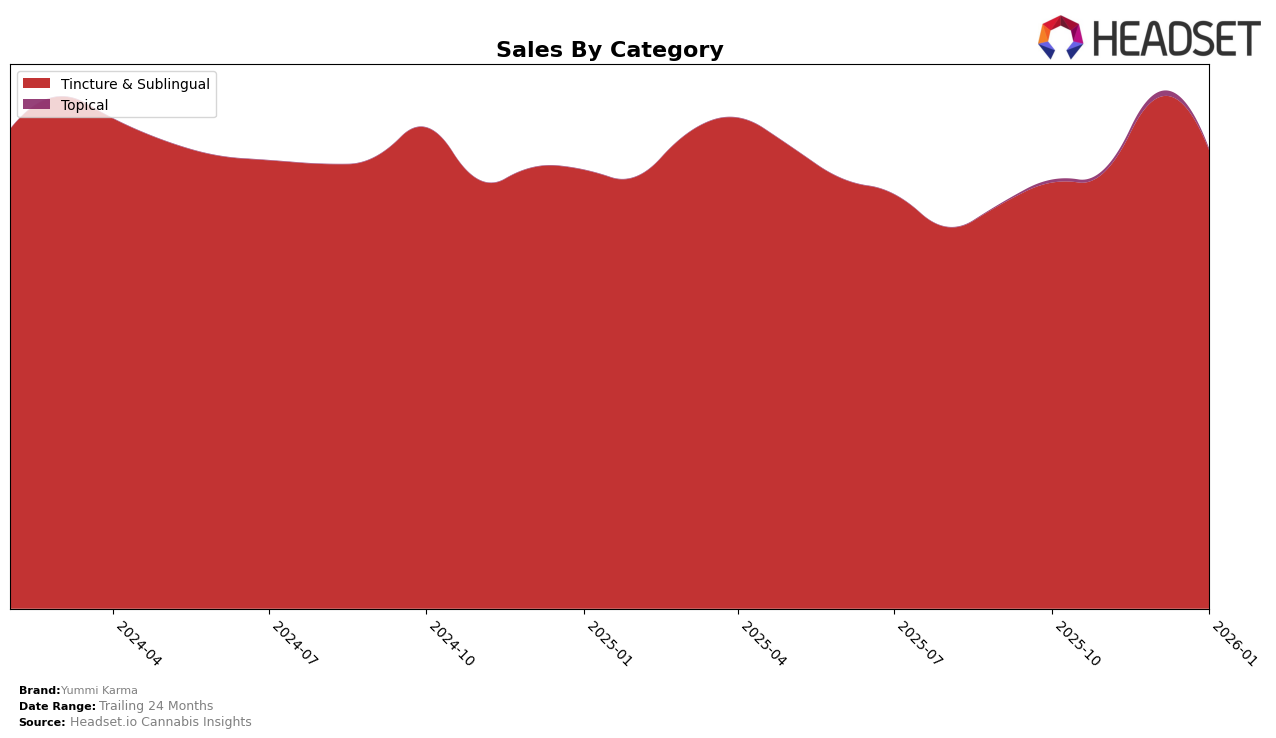

Yummi Karma has displayed a consistent performance in the Tincture & Sublingual category in California. The brand maintained a steady rank of 2nd place from October 2025 through January 2026. This stability in ranking indicates a strong foothold in the Californian market. Notably, Yummi Karma's sales saw a marked increase in December 2025, peaking at $435,134, before experiencing a slight decline in January 2026. This trend suggests that while the brand is well-established, there are fluctuations in consumer purchasing behavior that could be seasonal or promotional in nature.

Across other states and categories, Yummi Karma's presence is notably absent from the top 30 rankings, which could be seen as a limitation in their market penetration outside of California. This lack of visibility in other regions might indicate either a strategic focus on the Californian market or potential challenges in expanding their brand footprint. The absence from the rankings could be an area for growth, as capturing a broader audience across different states could enhance their overall brand strength and sales performance.

Competitive Landscape

In the California Tincture & Sublingual category, Yummi Karma consistently held the second rank from October 2025 to January 2026, indicating a stable market position amidst strong competition. Despite maintaining its rank, Yummi Karma's sales showed a positive trend, peaking in December 2025, which suggests effective marketing strategies or seasonal demand influences. In contrast, Papa & Barkley consistently led the category, maintaining the top rank with higher sales figures throughout the period. Meanwhile, Care By Design and VET CBD held steady at third and fourth ranks, respectively, with Care By Design experiencing a slight sales dip in January 2026. Yummi Karma's consistent second-place ranking amidst these competitors highlights its strong brand presence and potential for growth in the California market.

Notable Products

In January 2026, the top-performing product from Yummi Karma was the Lights Out Marshmallow Natural Sleep Tincture in the Tincture & Sublingual category, maintaining its first-place ranking with sales of 3059 units. The Drift Away Bedtime Tincture held steady in second place, showing consistent growth with sales increasing to 1744 units. The Wicked Apple Broad Spectrum Tincture remained in third place, although its sales decreased to 913 units from previous months. Notably, the Birthday Cake Tincture reappeared in the rankings at fourth, matching its previous position from October and November 2025. The CBD/CBN/THC 8:10:2 Tasty Taro Tincture slipped to fifth place from its December rank, reflecting a slight decline in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.