Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

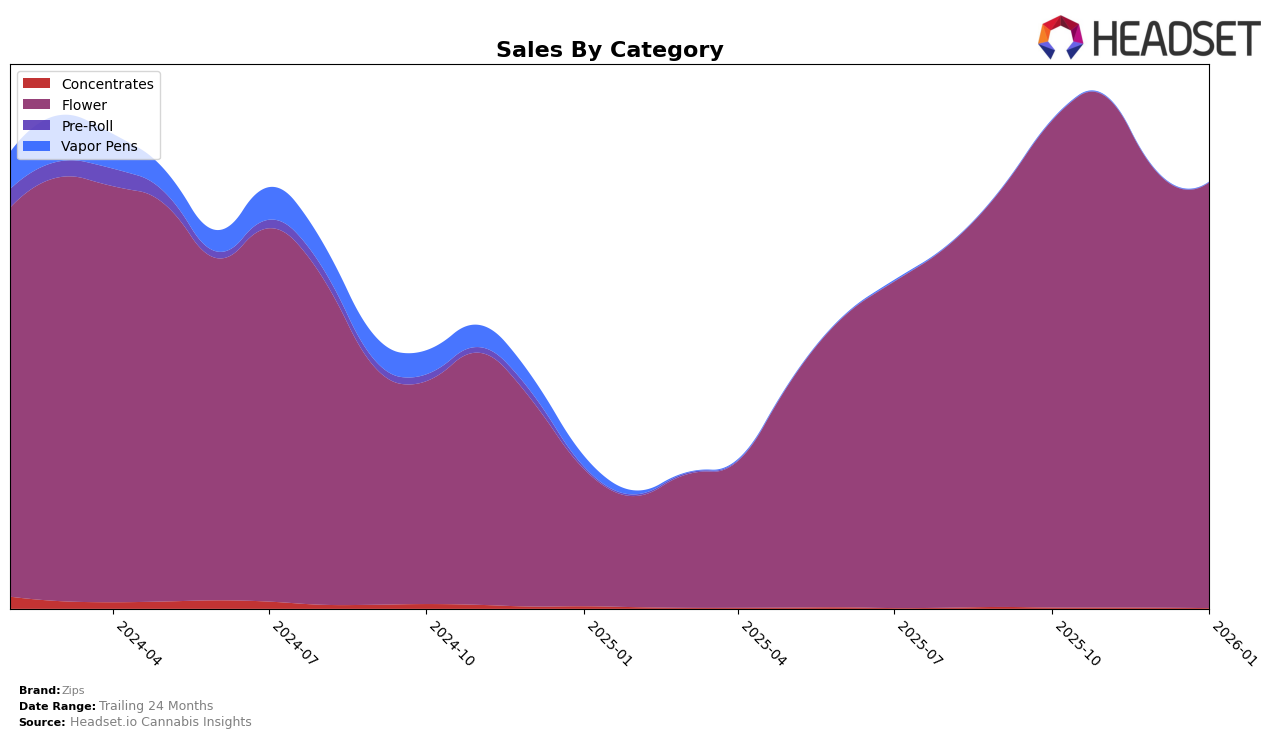

In the realm of cannabis brands, Zips has experienced varied performance across different states and provinces, reflecting a dynamic market presence. In Michigan, Zips has not managed to break into the top 30 rankings in the Flower category from October 2025 to January 2026, hovering around the 55 to 62 range. This consistent absence from the top tier suggests a challenging competitive landscape in Michigan's flower market. Meanwhile, in New Jersey, Zips has consistently maintained a strong position, ranking between 6th and 8th place over the same period. This indicates a robust foothold in New Jersey's flower market, with a slight dip in December 2025 that was quickly corrected by January 2026.

In Ontario, Zips' performance in the Flower category tells a different story. The brand has struggled to secure a significant position, consistently ranking outside the top 80, with a drop to 92nd place in January 2026. This suggests potential challenges in gaining traction or possibly facing fierce competition from other brands in Ontario. Despite these fluctuations, Zips' overall sales trends reveal interesting patterns worth exploring further, particularly in markets where they have shown resilience or growth. Understanding these dynamics can provide insights into the brand's strategic positioning and future opportunities for expansion or consolidation.

Competitive Landscape

In the competitive landscape of the Flower category in New Jersey, Zips has demonstrated resilience and consistency, maintaining a steady presence within the top 10 brands from October 2025 to January 2026. Despite a slight dip in December 2025, where Zips fell to 8th place, they quickly rebounded to 7th place in January 2026, showcasing their ability to recover and sustain consumer interest. In contrast, The Lid experienced significant volatility, dropping to 20th place in December 2025 before climbing back to 9th in January 2026, indicating potential instability in their market strategy. Meanwhile, Simply Herb showed impressive growth, moving from 14th place in October 2025 to 5th place by January 2026, suggesting a strong upward trajectory that could pose a competitive threat to Zips. Pete's Farmstand remained a consistent competitor, closely trailing Zips with a rank of 8th in January 2026. However, Garden Greens, despite a drop from 1st to 6th place over the period, still maintains a significant lead in sales, highlighting the competitive pressure Zips faces in maintaining and improving its market position.

Notable Products

In January 2026, the top-performing product for Zips was Monkey Spunk (28g) in the Flower category, claiming the first rank with notable sales of 1652 units. Island Pink (14g), which had consistently held the top spot from October to December 2025, slipped to second place with sales decreasing to 1148 units. Wonka Bars (28g) re-emerged in the rankings, taking third place after being absent in the previous months. Newportz (28g) and Purplato Daddy (28g) secured the fourth and fifth positions, respectively, marking their debut in the rankings. This shift indicates a dynamic change in consumer preferences from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.