Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

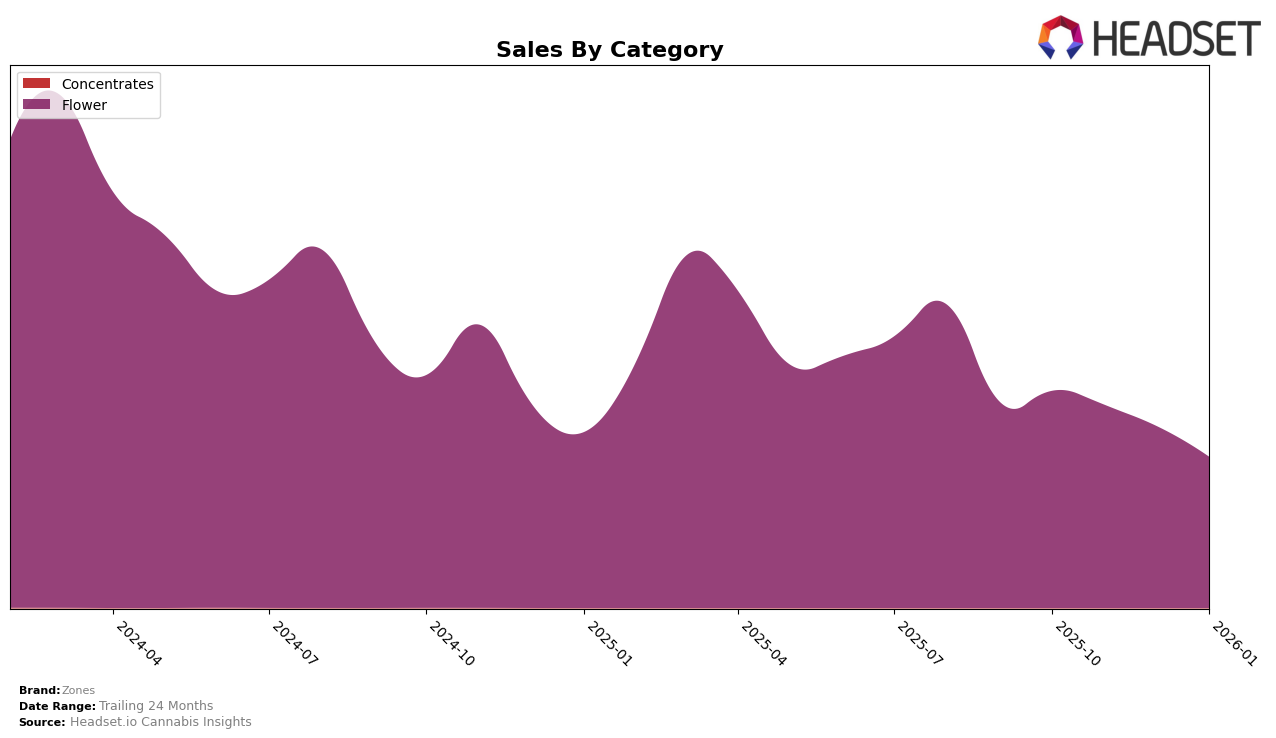

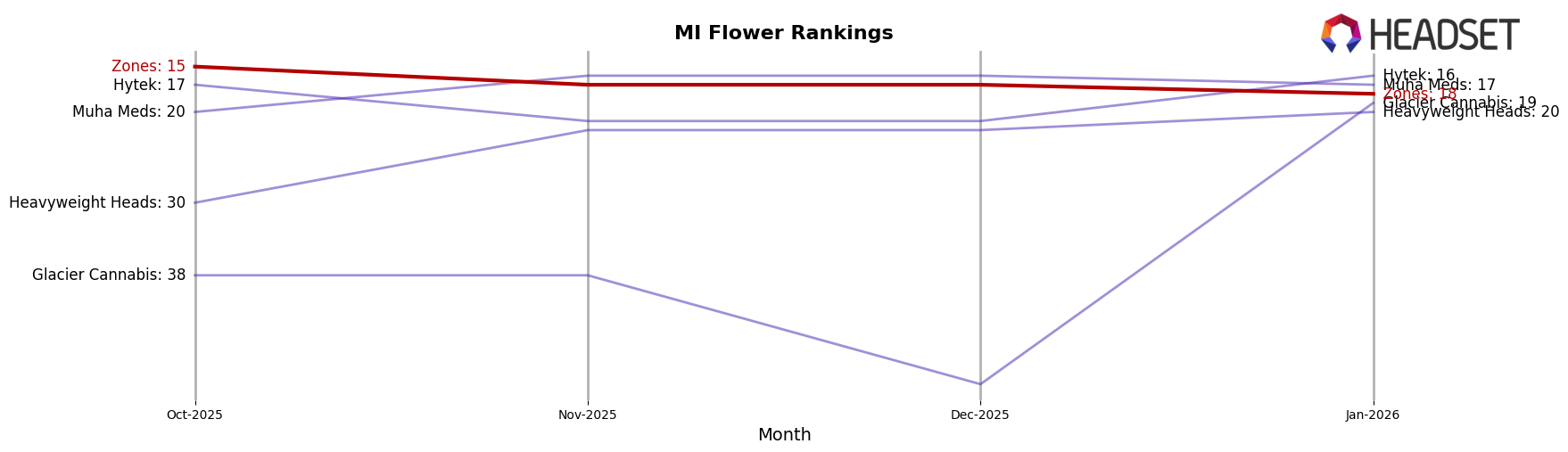

In the state of Michigan, Zones has shown a slight decline in its performance within the Flower category over the last few months. Starting at the 15th position in October 2025, the brand slipped to the 18th position by January 2026. This downward trend is coupled with a consistent decrease in sales, indicating potential challenges in maintaining market share amidst competition. The drop in rankings suggests that Zones might need to reassess its strategy in Michigan to regain momentum in the Flower category.

Interestingly, the data reveals that Zones did not make it into the top 30 brands in any other state or province for the categories tracked, which could be seen as a limitation in their market presence outside of Michigan. The absence from these rankings highlights a potential area for growth or a need for strategic expansion to tap into other markets. This lack of presence in other states can be either a strategic choice or a missed opportunity, depending on the brand's broader goals and market strategies.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Zones has seen a notable decline in its ranking, moving from 15th in October 2025 to 18th by January 2026. This downward trend in rank is accompanied by a decrease in sales, which may be attributed to the rising competition from brands like Hytek and Muha Meds, both of which maintained higher sales figures during the same period. While Hytek improved its rank from 17th to 16th, Muha Meds remained relatively stable, indicating strong consumer loyalty or effective marketing strategies. Meanwhile, Glacier Cannabis made a significant leap from 50th to 19th, suggesting a potential threat to Zones if this trend continues. The competitive pressure from these brands highlights the need for Zones to reassess its market strategies to regain its footing and boost sales in the Michigan flower market.

Notable Products

In January 2026, Gastro Pop (28g) emerged as the top-performing product for Zones, climbing from a fifth place in December 2025 to secure the first rank with sales reaching 1503 units. Sticky Ricky (28g) followed closely behind, debuting directly at the second position with impressive sales figures. Sticky Swiss (28g) also made a significant leap from not being ranked in December 2025 to achieving the third spot in January 2026. Gelatina (28g) entered the rankings at fourth place, while Lemon Marker (28g) tied with Gastro Pop in December but settled at the fifth position in January. This reshuffling highlights a dynamic shift in consumer preferences within Zones' product lineup, particularly in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.