Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

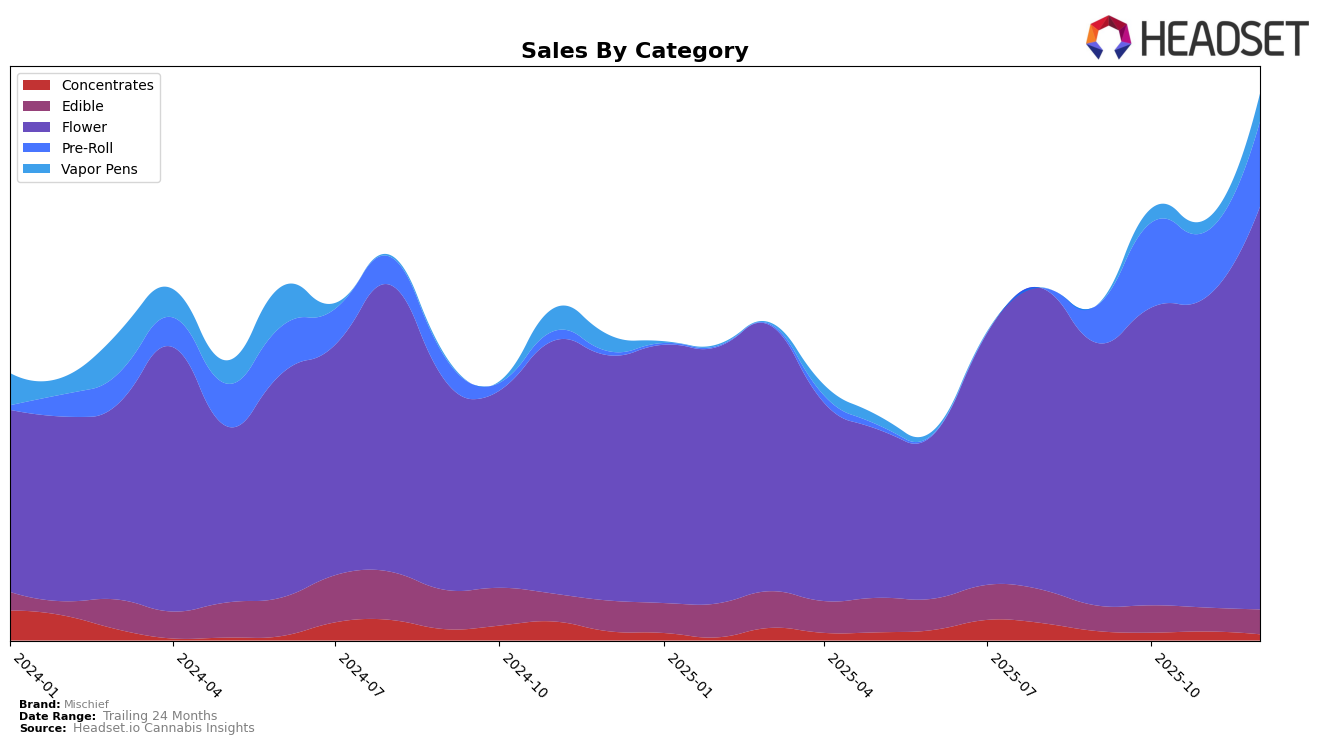

Mischief has shown varied performance across different product categories in Michigan. In the Flower category, Mischief has demonstrated a strong upward trajectory, climbing from the 7th position in September 2025 to the 5th position by December 2025, with a noticeable increase in sales. This indicates a growing preference for Mischief's flower products among consumers. In contrast, Mischief's performance in the Concentrates category has been less impressive, as it has not appeared in the top 30 rankings for October and December 2025, implying that it may be struggling to capture market share in this segment. Meanwhile, the Edible category has seen a slight decline in rankings from 27th in October to 32nd in December, suggesting potential challenges in maintaining a competitive edge or consumer interest.

In the Pre-Roll category, Mischief has made significant strides, moving from the 30th position in September to a more competitive 13th position by December 2025, which could reflect successful product innovation or marketing strategies. The Vapor Pens category presents an interesting case; although Mischief did not rank in the top 30 in September, it entered the rankings at 64th in October and made a remarkable jump to 34th by December. This indicates a positive trend and growing consumer acceptance of their vapor pen products, despite the initial lack of presence in the rankings. Overall, Mischief's performance across these categories and its dynamic movement in rankings highlight the brand's varied success and potential areas for growth in the Michigan market.

Competitive Landscape

In the competitive landscape of Michigan's Flower category, Mischief has shown a promising upward trajectory in recent months. From September to December 2025, Mischief improved its rank from 7th to 5th, indicating a positive shift in its market position. This advancement is particularly noteworthy when compared to competitors such as Redemption, which maintained a relatively stable rank around 6th, and Pro Gro, which consistently held a higher rank at 4th. Mischief's sales growth is a key factor in its rising rank, with a significant increase in sales from November to December 2025, surpassing the sales of Redemption and closing the gap with Pro Gro. Meanwhile, Society C experienced a slight decline in rank from 2nd to 3rd, which may present further opportunities for Mischief to climb higher in the rankings. As Mischief continues to strengthen its market presence, it is poised to capture a larger share of the Michigan Flower market.

Notable Products

In December 2025, the top-performing product for Mischief was Strawberry Guava (28g) in the Flower category, securing the number one rank with sales reaching 20,826 units. Purple Drank Gummies 10-Pack (200mg), consistently ranked first from September to November, dropped to second place, despite a notable increase in sales to 16,507 units. Apple Fritter (3.5g) made a strong showing in third place, followed by Ztan Lee (3.5g) and Sherb Tang (3.5g) in fourth and fifth places, respectively. This marks the first month that Strawberry Guava (28g) has appeared in the rankings, overtaking previous leaders. The shift in rankings highlights a growing consumer preference for flower products from Mischief in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.