Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

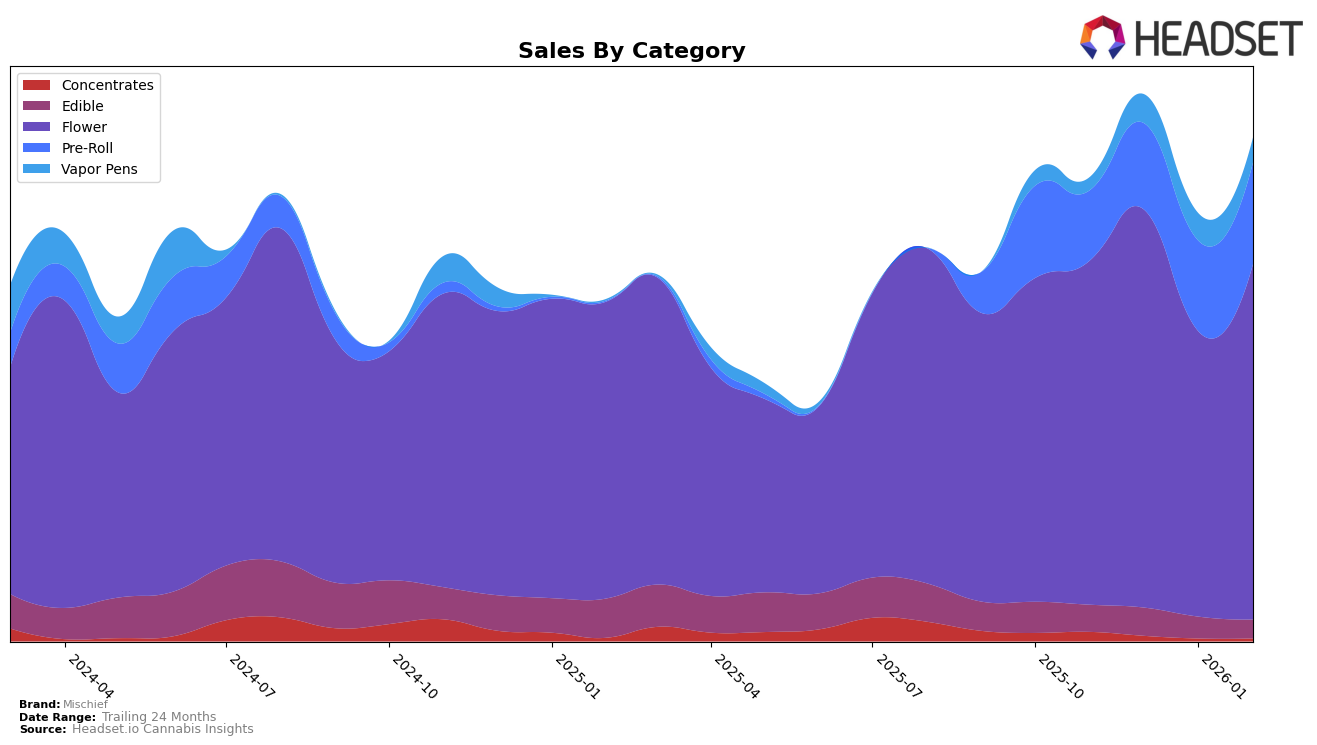

Mischief's performance in the Colorado flower category has shown some fluctuations over recent months. Notably, they have experienced a significant drop in rankings from November 2025 to December 2025, moving from 44th to 61st, before climbing back into the top 40 by January 2026. This movement indicates a volatile presence in the market, possibly suggesting a response to seasonal demand or competitive pressures. The sales figures also reflect this trend, with a notable increase in January 2026, highlighting a potential rebound in consumer interest or strategic adjustments by the brand.

In Michigan, Mischief's performance across different categories presents a varied picture. The brand has maintained a strong presence in the flower category, consistently ranking within the top 10, peaking at 5th place in both December 2025 and February 2026. This suggests a solid foothold and consumer loyalty within this segment. Conversely, Mischief's edible category ranking has slipped slightly, moving from 31st in November 2025 to 35th in February 2026, indicating potential challenges or increased competition. Their vapor pen category performance showed improvement in December 2025, moving from 73rd to 37th, but this ranking did not sustain, hinting at ongoing challenges in maintaining a stable market position.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Mischief has demonstrated a dynamic performance over the months from November 2025 to February 2026. While Mischief's rank fluctuated, moving from 6th in November to 5th in December, then dropping to 8th in January before climbing back to 5th in February, its sales figures reflect a similar volatility. Notably, Pro Gro consistently maintained a higher rank than Mischief, starting at 4th and only dropping to 6th by February, indicating a more stable presence in the market. Meanwhile, Goodlyfe Farms experienced a significant drop to 21st in December before recovering to 4th in February, showcasing a more erratic pattern compared to Mischief. Society C remained a strong competitor, consistently ranking in the top 3, which suggests a robust brand loyalty or market strategy that Mischief could analyze for insights. These shifts highlight the competitive pressures Mischief faces, as well as opportunities for strategic adjustments to enhance its market position and sales performance.

Notable Products

In February 2026, Mad Honey 3.5g emerged as the top-performing product for Mischief, leading the sales with a notable $16,452. Bowser's Breath 28g closely followed, securing the second position. Sherb Cream Pie 3.5g maintained its consistency, holding the third rank for consecutive months since January 2026. The Watermelon Sour Infused Pre-Roll 1g entered the top ranks, achieving the fourth position in February. Apples and Bananas Pre-Roll 1g remained steady in the fifth spot, mirroring its January 2026 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.