Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

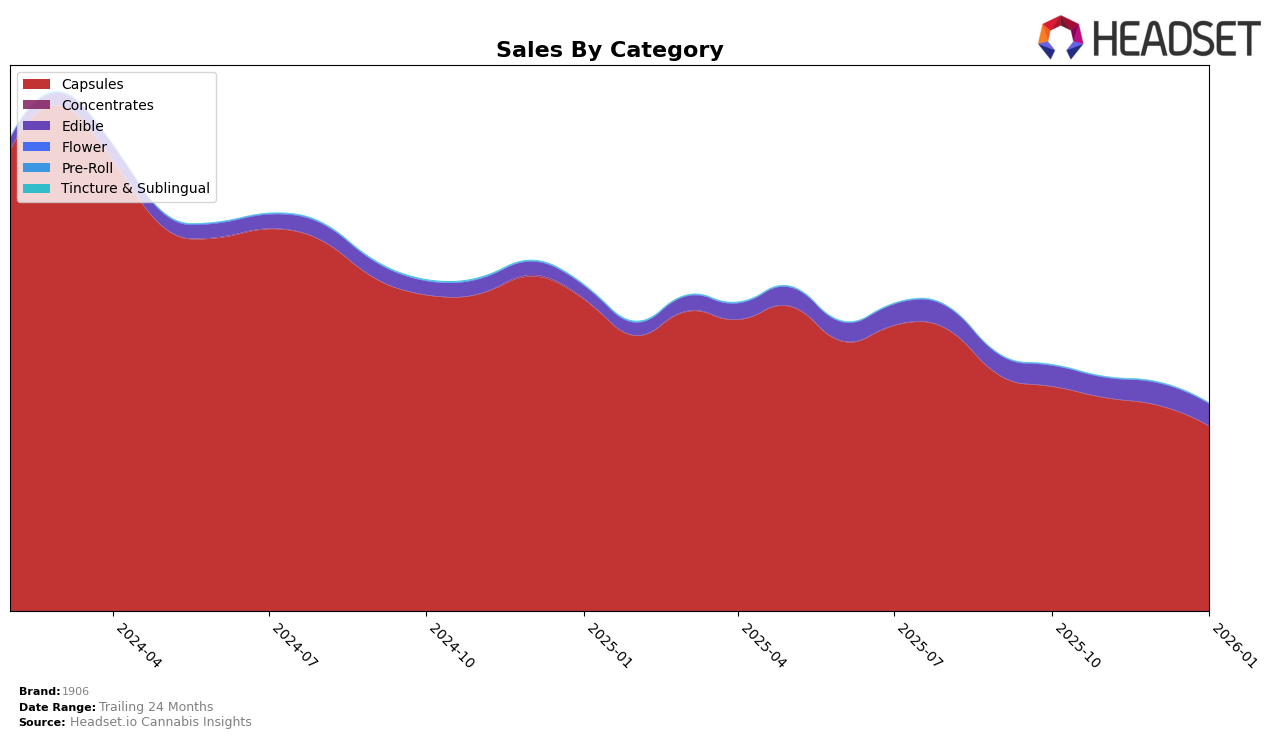

1906 has demonstrated a strong performance in the Capsules category across several states, maintaining the top position in Illinois, Massachusetts, Missouri, New Jersey, and New York from October 2025 to January 2026. This consistent ranking indicates a robust market presence and consumer preference within the Capsules category. Notably, while the sales figures in Illinois and Massachusetts have seen a decline from October to January, the brand has managed to retain its leadership position, suggesting a strong brand loyalty or limited competition in these markets.

In contrast, the performance in the Edible category in New York has shown a different trend, with 1906 holding a position within the top 30 but gradually moving from rank 25 in October 2025 to rank 30 in January 2026. This downward shift could imply increasing competition or changing consumer preferences within the Edible segment. The fact that 1906 is not featured in the top 30 for Edibles in other states might suggest potential areas for growth or challenges in expanding their market share in this category outside of New York.

Competitive Landscape

In the competitive landscape of the New York capsules category, 1906 has consistently maintained its top position from October 2025 through January 2026. Despite a gradual decline in sales over these months, 1906 remains the leader, outperforming its nearest competitor, Level, which has held the second rank throughout the same period. The sales figures for Level show a slight fluctuation, yet they remain significantly lower than those of 1906, indicating a strong market presence for 1906. These insights suggest that while 1906's sales are experiencing a downward trend, its dominance in the market remains unchallenged, highlighting the brand's strong consumer loyalty and market strategy in New York's capsules category.

Notable Products

In January 2026, the top-performing product from 1906 was the CBD/THC 1:1 Bliss Tablets 20-Pack, maintaining its first-place rank from previous months despite a decrease in sales to 9794 units. Boost Drops Pills 20-Pack moved up to second place, with sales increasing to 9512 units, overtaking the CBD/THC 5:1 Chill Tablets, which fell to third. The CBD/THC/CBN 2:2:1 Sleep for ZZZ'S Drops climbed one position to fourth, while CBD/THC 1:1 Go Drop Tablets remained steady at fifth place. This ranking shift highlights the growing consumer preference for products that combine multiple cannabinoids for enhanced effects.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.