Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

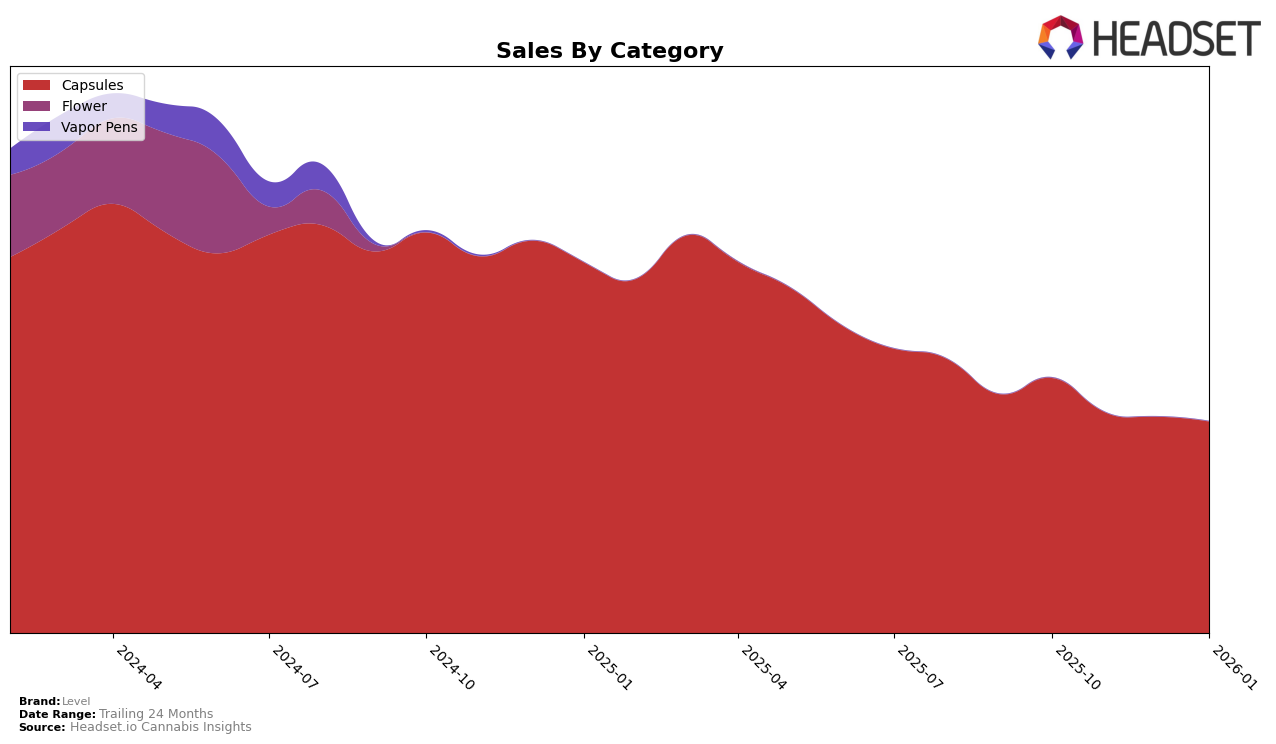

In the California market, Level has consistently maintained a strong presence in the Capsules category. The brand held the top rank in October and November 2025, briefly dropped to second place in December, and reclaimed the first position in January 2026. This suggests a robust demand and consumer loyalty in the state, despite the noticeable decline in sales figures over these months. Meanwhile, in Nevada, Level demonstrated resilience by quickly recovering its top position after a brief dip to second place in November 2025. The sales trend in Nevada shows a fluctuating pattern, with a dip in November followed by a recovery in the subsequent months, indicating potential market volatility or seasonal influences.

In New York, Level maintained a consistent second-place ranking in the Capsules category from October 2025 through January 2026. This steady performance suggests a stable market presence, though it hints at strong competition preventing Level from capturing the top spot. Meanwhile, in Ohio, Level appeared in the rankings only in October and November 2025, securing the fifth position both months. The absence from the top 30 in December and January could indicate a significant drop in market share or strategic shifts away from this state. This variability across states highlights the differing market dynamics and competitive landscapes that Level navigates within the Capsules category.

Competitive Landscape

In the competitive landscape of the California capsules category, Level has demonstrated a strong presence, consistently maintaining a top-tier rank. Despite a slight dip in December 2025, where Level moved from the first to the second position, the brand quickly regained its leading status by January 2026. This fluctuation highlights Level's resilience and ability to recover swiftly in a competitive market. Notably, Breez emerged as a formidable competitor, briefly overtaking Level in December 2025, which underscores the dynamic nature of consumer preferences in this category. Meanwhile, ABX / AbsoluteXtracts remained steady in the third position throughout the observed period, indicating a stable but less aggressive competitive stance. These insights suggest that while Level is a dominant player, continuous innovation and customer engagement are crucial to maintaining its leadership amidst strong competition.

Notable Products

In January 2026, the top-performing product for Level was Protab+ - Lights Out Tablets 10-Pack, maintaining its position as the number one ranked product from December 2025, with sales reaching 3041 units. Protab - Indica Extra Strength Tablets 10-Pack held steady at the second rank, showing consistent performance over the past two months. Protab - Indica Tablet climbed to the third position, improving from its fourth-place ranking in December 2025. Hashtab - Indica Tablets 10-Pack moved up to fourth place, recovering from a dip to fifth place in the previous two months. Protab - Sativa Extra Strength Tablets 10-Pack experienced a drop in performance, falling from third in December 2025 to fifth in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.