Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

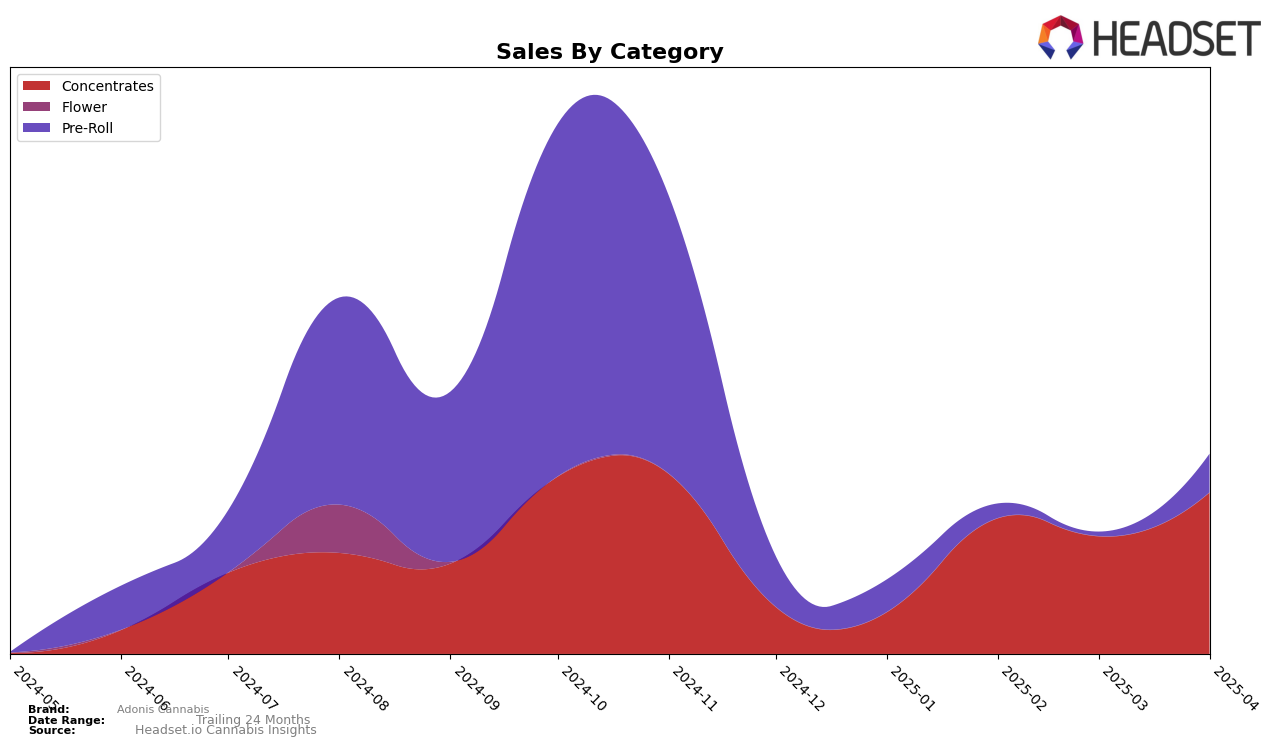

Adonis Cannabis has shown a notable presence in the New York market, particularly in the concentrates category. In January 2025, the brand did not make it into the top 30, but by February, it climbed to 21st place, slightly dropping to 24th in March, and then regaining its 21st position in April. This fluctuation indicates a dynamic performance, with a clear capability to recover quickly after minor setbacks. Such movements suggest that while the brand is competitive, it faces significant challenges within the New York concentrates market, yet it demonstrates resilience and potential for growth.

Interestingly, the sales figures for Adonis Cannabis in New York show a positive trend from March to April, highlighting a growth trajectory that could be promising for future rankings. While January's lack of ranking could be viewed as a setback, the subsequent months show that Adonis Cannabis is gaining traction. This upward sales momentum, particularly the notable increase from March to April, suggests that the brand is effectively capturing more market share or improving its product offerings to appeal to consumers. However, the brand's journey in the concentrates category is still evolving, and it will be interesting to see how it continues to navigate the competitive landscape in New York.

Competitive Landscape

In the competitive landscape of the New York concentrates category, Adonis Cannabis has shown significant fluctuations in its market position from February to April 2025. Initially absent from the top 20 in January, Adonis Cannabis entered the ranks at 21st in February, dropped to 24th in March, and then climbed back to 21st in April. This volatility contrasts with competitors like Lobo, which maintained a steady presence in the top 20, consistently improving its rank from 19th in January to 18th by April, indicating a stable upward trajectory. Meanwhile, Pura experienced a decline, dropping from 11th in January to 23rd in April, suggesting potential challenges in maintaining its earlier momentum. Hashtag Honey entered the rankings in March at 15th and slightly declined to 17th in April, showcasing a relatively strong market entry. These dynamics highlight the competitive pressures Adonis Cannabis faces, as it strives to solidify its position amidst brands with varying trajectories in the New York concentrates market.

Notable Products

In April 2025, Purple Oreoz Classic Hash (1g) emerged as the top-performing product for Adonis Cannabis, reclaiming its number one rank from January after a brief dip to the second position in February and March. Its sales soared to 356 units, demonstrating significant growth. Tangerine Dream Classic Hash (1g) followed closely, slipping to the second position after leading in March, with notable sales figures maintaining its strong market presence. Hash Burger Infused Pre-Roll (1g) secured the third spot, showing a recovery from its absence in March. Banana Split XL Rosin Infused Pre-Roll (2.5g) rose to fourth, marking its return to the top rankings since January, while Blueberry AK Limeade Infused Pre-Roll (1g) consistently held the fifth position throughout the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.