Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

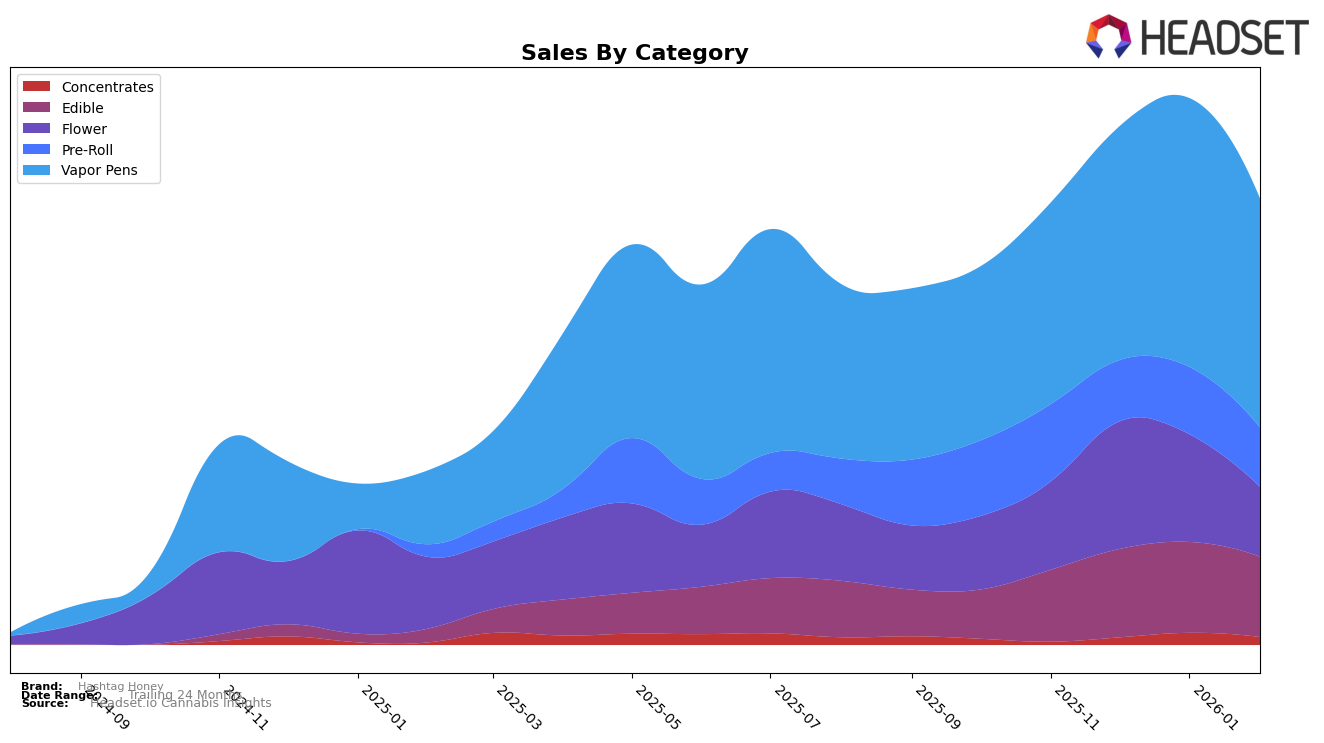

Hashtag Honey has shown varied performance across different product categories in New York. In the Vapor Pens category, they achieved a commendable top 10 ranking in January 2026, highlighting their strength in this segment. This was a significant improvement from December 2025, where they were ranked 13th. However, the Flower category tells a different story, with Hashtag Honey dropping from 24th in December 2025 to 46th in February 2026, indicating potential challenges in maintaining their position in this competitive market. Notably, Hashtag Honey's entry into the top 20 for Concentrates in January 2026 marks a new achievement, showcasing their expanding footprint across categories.

In the Edible category, Hashtag Honey maintained a steady performance, holding the 15th rank from December 2025 through February 2026, suggesting consistent consumer interest and demand. On the other hand, the Pre-Roll category witnessed fluctuations, with the brand moving from 22nd in November 2025 to 29th by February 2026, reflecting some instability in their market presence. It's worth noting that in some months, Hashtag Honey did not appear in the top 30 rankings for certain categories, such as Concentrates before January 2026, which could be interpreted as either a strategic focus on other categories or an area ripe for growth and improvement.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Hashtag Honey has demonstrated a dynamic performance over the past few months. Starting from November 2025, Hashtag Honey was ranked 11th, but experienced a slight dip to 13th in December before climbing to an impressive 8th position in January 2026, only to settle at 10th in February. This fluctuation indicates a competitive market environment where Hashtag Honey is contending closely with brands like Untitled, which consistently maintained a high rank, peaking at 8th in February. Meanwhile, STIIIZY showed a stable presence, consistently staying in the top 10, which suggests a strong brand loyalty or market strategy. Notably, Jetty Extracts and Heavy Hitters have also been significant players, with Jetty Extracts improving its rank from 17th to 11th by February. Despite these challenges, Hashtag Honey's sales trajectory has been upward, particularly in January 2026, where it reached its peak sales, indicating effective marketing or product appeal during that period. This competitive analysis highlights the need for Hashtag Honey to continue innovating and strategically positioning itself to maintain and improve its market share in the New York vapor pen category.

Notable Products

In February 2026, Blue Dream Pre-Roll (1g) emerged as the top-selling product for Hashtag Honey, marking its first appearance in the rankings with an impressive sales figure of 6001. Grand Daddy Purp Pre-Roll (1g) secured the second spot, climbing one position from January 2026, despite a slight dip in sales. Green Crack Pre-Roll (1g) maintained its third-place ranking from December 2025, showing consistent performance. Blue Dream Distillate Disposable (1g) improved its position to fourth place, up from fifth in the previous two months. Notably, Strawberry Diesel Live Resin Disposable (1g) entered the rankings for the first time, capturing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.