Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

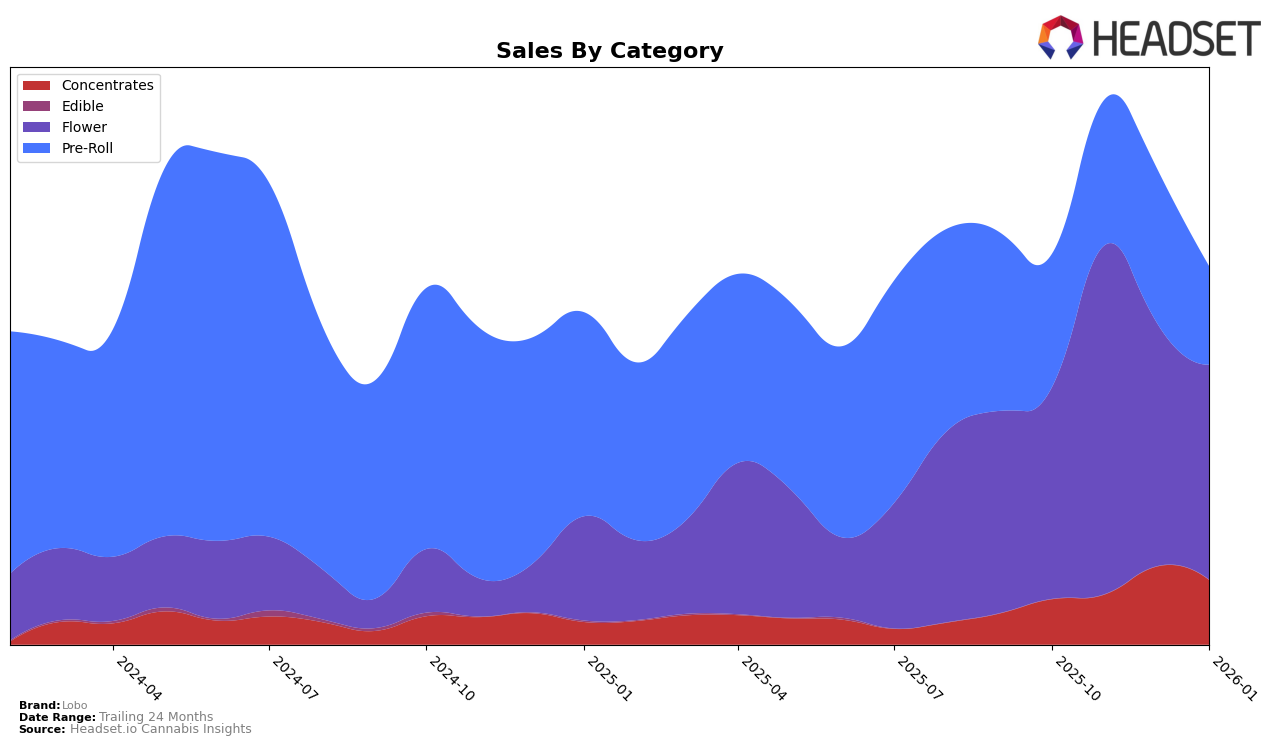

Lobo's performance across various states and categories shows intriguing trends. In Illinois, the brand has shown a consistent upward trajectory in the Pre-Roll category. From October 2025 to January 2026, Lobo improved its ranking from 73rd to 62nd, reflecting a steady increase in sales over the months. This positive momentum in Illinois suggests an increasing consumer preference or effective market strategies in this state. Conversely, in New Jersey, Lobo's performance in the Concentrates category saw a slight dip in January 2026, falling to 31st position from 27th in December 2025, indicating potential challenges or increased competition in this category.

In New York, Lobo has maintained a strong presence in the Concentrates category, improving its ranking from 24th in October 2025 to 18th by January 2026. This indicates robust growth and possibly a strong consumer base for concentrates in New York. However, in the Flower category in New Jersey, Lobo's ranking dropped significantly from 47th in November 2025 to 85th by January 2026, having not even ranked in the top 30 in October, which could be a cause for concern. This suggests that while Lobo has areas of strength, there are also markets where they face significant challenges. The fluctuating rankings across categories and states highlight the dynamic nature of the cannabis market and the importance for brands like Lobo to adapt and strategize accordingly.

Competitive Landscape

In the competitive landscape of the New York flower category, Lobo has experienced fluctuations in its rankings over the past few months, indicating a dynamic market presence. From October 2025 to January 2026, Lobo's rank shifted from 45th to 56th, reflecting a downward trend despite a peak in sales in November 2025. In comparison, House of Sacci maintained a relatively stable position, ending January 2026 just one rank above Lobo, despite a dip in sales in November. Meanwhile, urbanXtracts demonstrated a notable upward trajectory, climbing from 76th to 59th, driven by consistent sales growth, particularly in January. High Peaks and UMAMII also showed resilience, with UMAMII making a significant leap to 54th place in January. These shifts highlight the competitive pressure on Lobo to innovate and capture market share in a rapidly evolving environment.

Notable Products

In January 2026, Lobo's top-performing product was Gelonade Moonrocks (3.5g), maintaining its number one rank from December 2025 with sales of 1306 units. Sour Diesel Hashish (1g) held steady at the second position, showing consistent demand over the past few months. Bold - Blue Dream Infused Pre-Roll (1g) remained in third place, despite a notable drop in sales compared to previous months. The Blue Dream Diamond Infused Pre-Roll 5-Pack (2.5g) improved its ranking to fourth place from fifth in December 2025, indicating a positive reception among consumers. New to the top five in January, OG Chem Moonrocks (3.5g) entered the ranking at fifth place, showcasing its growing popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.