Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

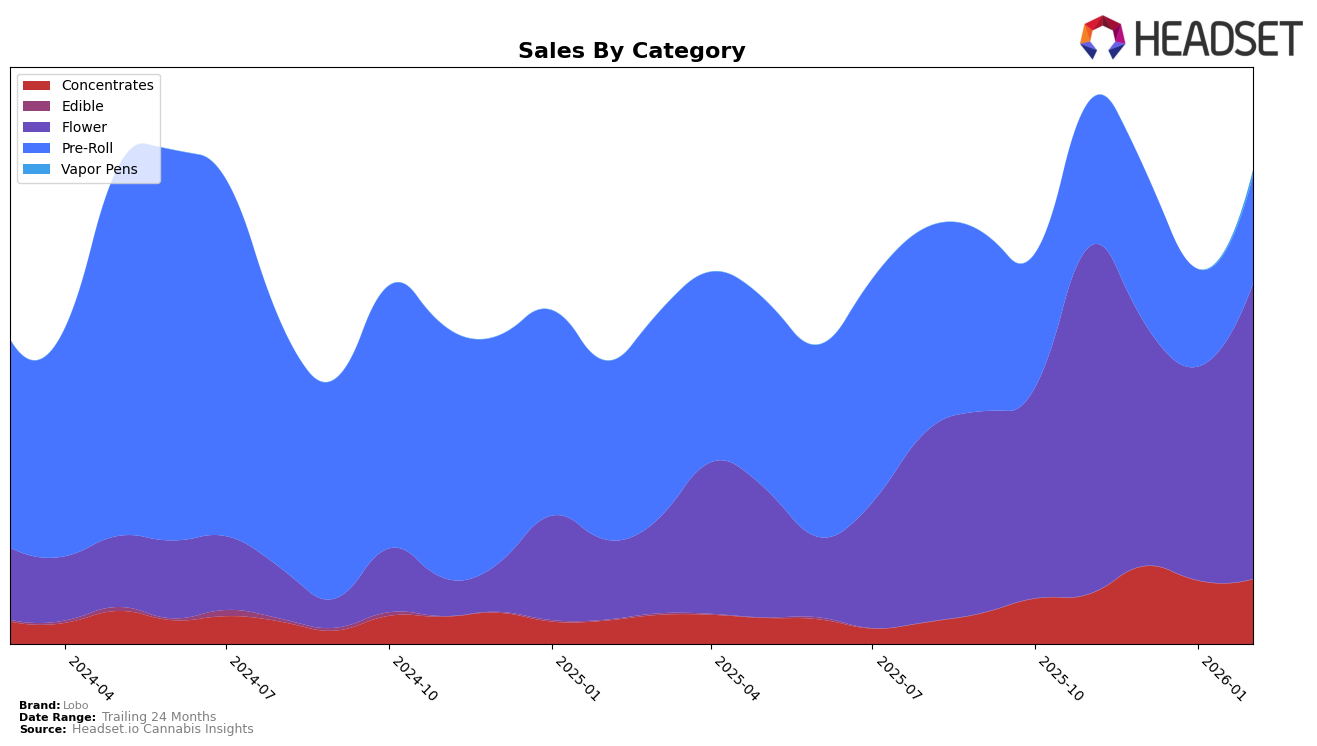

Lobo's performance across various states and categories presents a mixed landscape. In Illinois, Lobo's Pre-Roll category has shown a steady improvement in rankings, moving from 72nd in November 2025 to 63rd by January 2026. However, it is worth noting that by February 2026, Lobo did not make it into the top 30 brands, indicating a potential decline or increased competition in the market. Meanwhile, in New Jersey, Lobo's presence in the Concentrates category saw a slight drop from 28th in December 2025 to 35th in January 2026, which could be a point of concern for the brand's market share in this segment.

In New York, Lobo's Concentrates category has demonstrated a positive upward trend, improving its rank from 25th in November 2025 to 17th by February 2026, reflecting a strengthening position in this competitive market. The Flower category in New York also showed resilience, with a notable leap from 58th in January 2026 to 44th in February 2026, suggesting a potential growth trajectory. However, the Pre-Roll category in New York experienced fluctuations, with a dip to 74th in January 2026, before recovering to 57th in February 2026, indicating volatility in consumer preferences or market dynamics.

Competitive Landscape

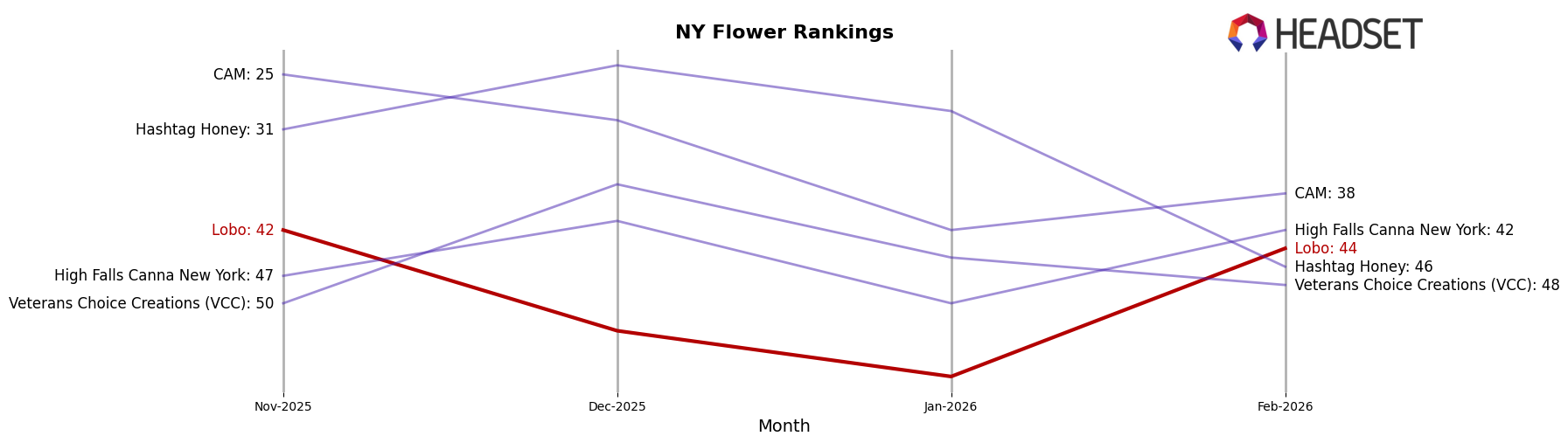

In the competitive landscape of the Flower category in New York, Lobo has experienced notable fluctuations in its market position from November 2025 to February 2026. While Lobo's rank dipped from 42nd in November 2025 to 58th in January 2026, it rebounded to 44th by February 2026, indicating a potential recovery in sales momentum. This period saw Lobo's sales peak in February 2026, suggesting a strategic adjustment or market response that positively impacted their performance. In contrast, CAM maintained a relatively stable position, ranking between 25th and 42nd, with consistently higher sales than Lobo, highlighting a strong market presence. Veterans Choice Creations (VCC) and High Falls Canna New York also demonstrated competitive resilience, with VCC peaking at 37th in December 2025 and High Falls Canna New York achieving a 42nd rank in February 2026, both outperforming Lobo in certain months. Meanwhile, Hashtag Honey experienced a significant drop from 24th in December 2025 to 46th in February 2026, reflecting a volatile market dynamic. These insights suggest that while Lobo faces stiff competition, its recent sales increase could signal a strategic opportunity to strengthen its market position.

Notable Products

In February 2026, Gelonade Moonrocks (3.5g) maintained its position as the top-performing product from Lobo, with a significant sales figure of 2334 units. Sour Diesel Hashish (1g) held steady at the second rank, continuing its consistent performance from the previous months. OG Chem Moonrocks (3.5g) retained its third position, indicating stable demand since its introduction. Bold - Blue Dream Infused Pre-Roll (1g) remained fourth, showing a slight improvement in sales compared to January 2026. The Blue Dream Diamond Infused Pre-Roll 5-Pack (2.5g) stayed in fifth place, demonstrating a rebound in sales from December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.