Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

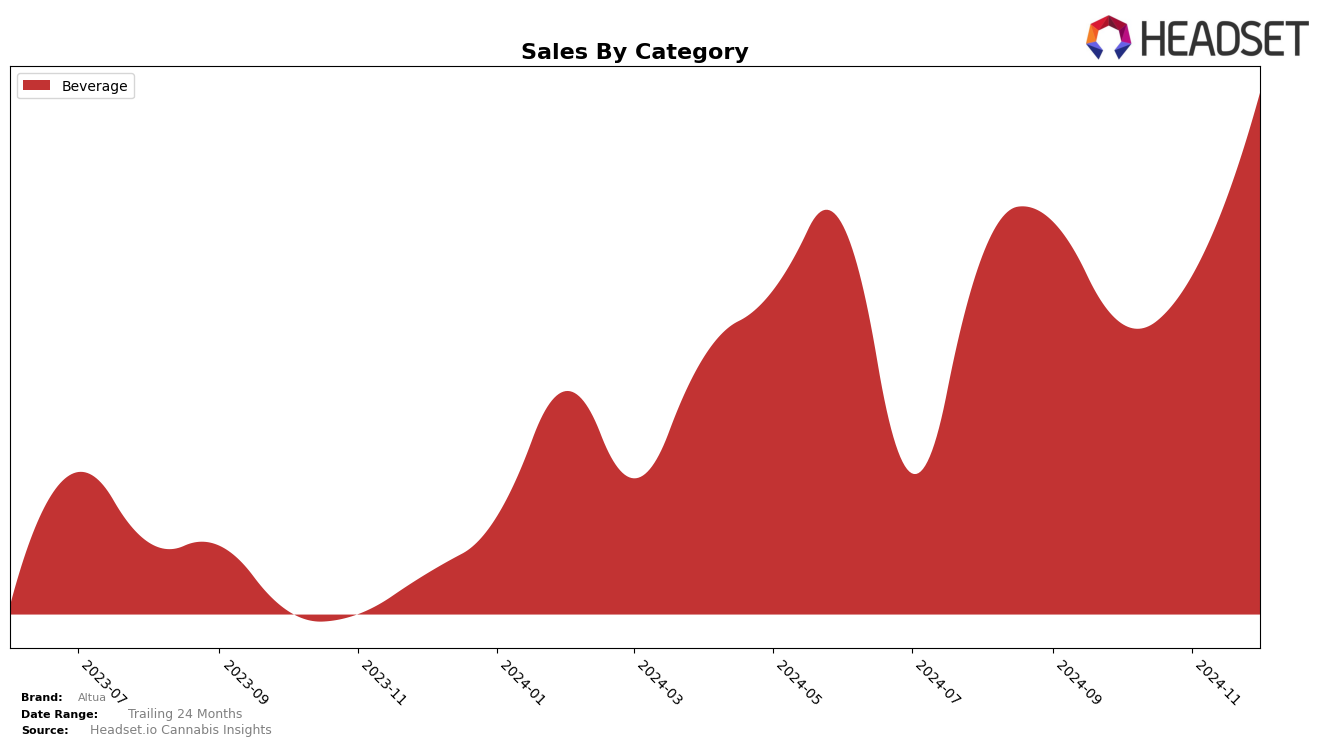

Altua has shown an intriguing performance across different categories and states, with a notable entry in the New York market. In the Beverage category, Altua made a significant leap by securing the 9th position in December 2024. This is particularly impressive considering that they were not ranked in the top 30 for the previous months of September, October, and November 2024. Such a movement suggests a strategic push or successful campaign that resonated well with consumers, allowing them to break into the competitive landscape of New York's beverage sector.

The absence of rankings in other states and categories indicates that Altua's current focus or success might be concentrated in New York, particularly in the beverage market. This could signal either a deliberate strategy to dominate a specific niche before expanding or a challenge in gaining traction in other areas. The fact that they were not in the top 30 in any other category or state during these months could be seen as a limitation or opportunity for growth, depending on their strategic goals. Observing how Altua's presence evolves in the coming months will be crucial to understanding their broader market strategy.

Competitive Landscape

In the competitive landscape of the New York beverage category, Altua experienced a notable shift in its market presence by December 2024. While Altua was not ranked in the top 20 from September to November, it achieved a rank of 9 by December, indicating a significant upward trajectory in sales performance. This improvement suggests a successful strategy or product launch that resonated with consumers. In contrast, competitors like MyHi and Weed Water maintained consistent ranks at 4 and 5, respectively, throughout the same period. Despite their stable positions, Altua's emergence into the rankings highlights its potential to disrupt the market dynamics, especially if it continues to build on this momentum. This shift underscores the importance for Altua to capitalize on its recent success to further enhance its market share and challenge the established players in the New York beverage sector.

Notable Products

In December 2024, the top-performing product for Altua was the Blood Orange Spritzer (5mg THC, 12oz) in the Beverage category, regaining its number one rank with sales reaching 1,164 units. The Passion Fruit Spritzer (5mg THC, 12oz) followed closely, dropping to second place after leading in the previous two months. The Pomegranate Infused Spritzer (5mg THC, 12oz) maintained its consistent third-place position across the last four months. The Pomegranate Spritzer (6mg THC, 12oz) remained steady in fourth place, showing little fluctuation in its ranking. This month saw a notable increase in sales for the Blood Orange Spritzer, marking a significant rebound from its dip in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.