Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

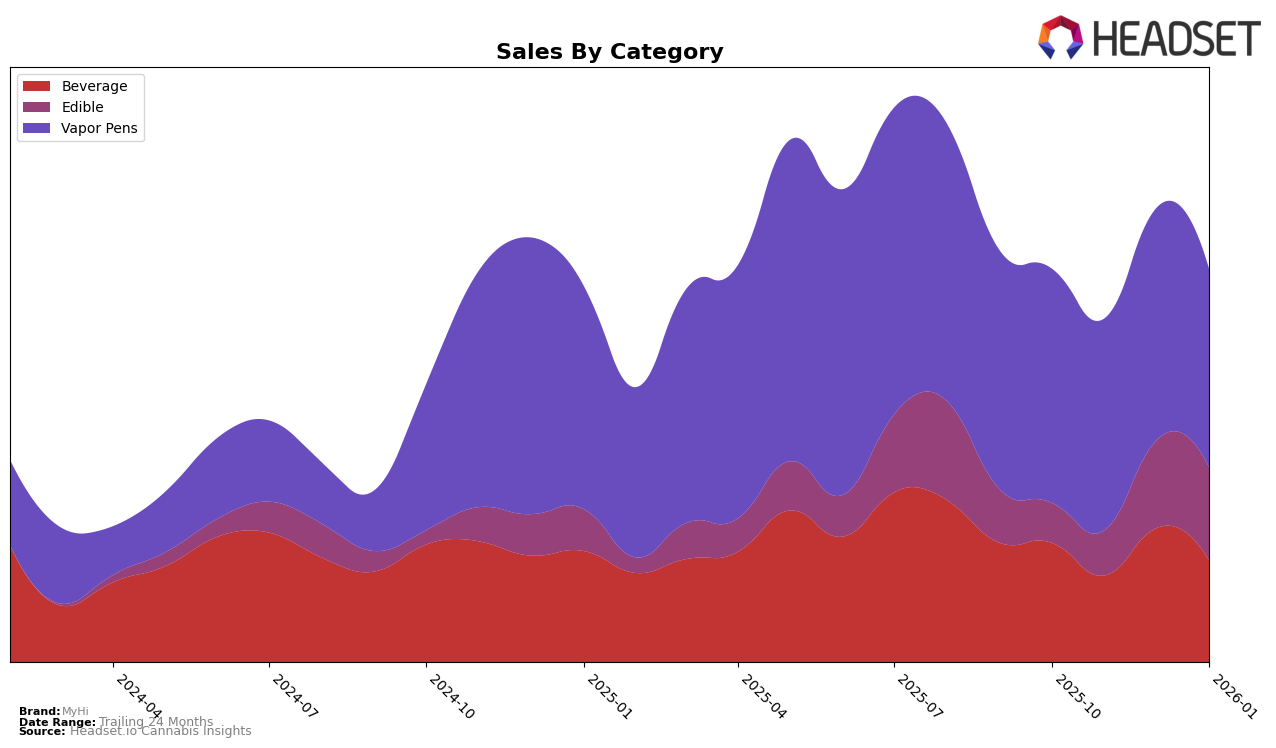

In the state of New York, MyHi has demonstrated consistent performance in the Beverage category, maintaining a steady rank of 7th place from October 2025 through January 2026. Despite fluctuations in sales figures, with a notable peak in December 2025, the brand has managed to hold its ground in the top 10. This stability in ranking indicates a strong foothold in the beverage market, suggesting that MyHi's offerings resonate well with consumers in this category. However, in the Edible category, MyHi has not been able to break into the top 30, although there has been a gradual upward movement in rankings from 53rd in October to 45th by January 2026, hinting at potential growth opportunities.

Conversely, MyHi's performance in the Vapor Pens category in New York has not been as strong, with rankings consistently outside the top 30, peaking at 59th in October 2025 and slightly declining to 61st by January 2026. Despite the lower rankings, the sales figures have shown some resilience, particularly in December 2025, which could suggest a niche but dedicated customer base. The data indicates that while MyHi has established itself firmly in the Beverage category, there is still significant room for growth and improvement in other categories like Edibles and Vapor Pens within New York.

Competitive Landscape

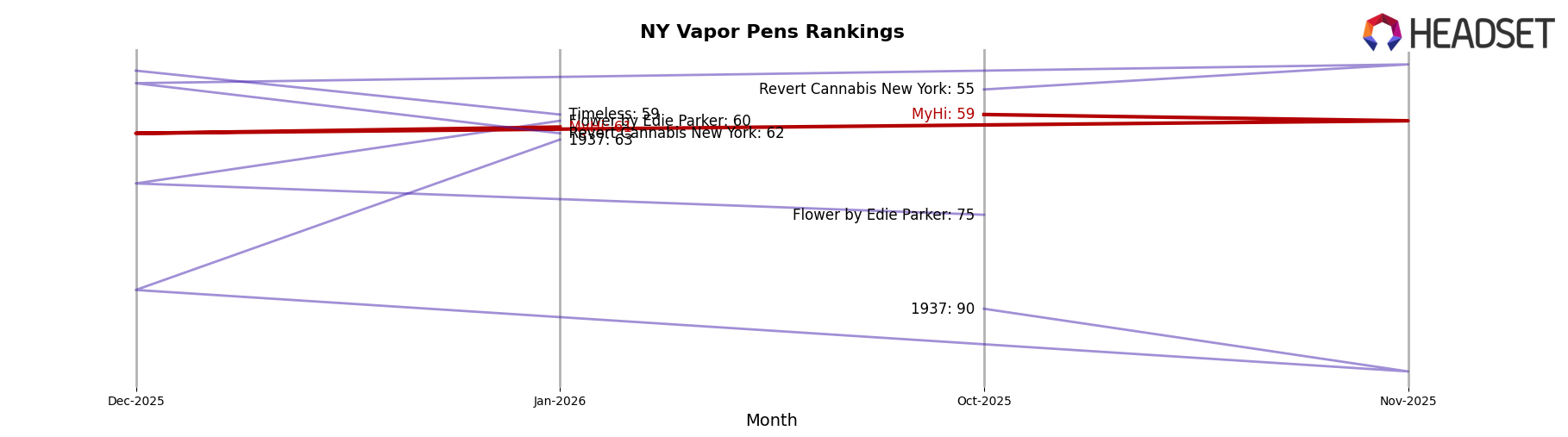

In the competitive landscape of vapor pens in New York, MyHi has shown a consistent presence, maintaining a rank between 59 and 62 from October 2025 to January 2026. Despite a slight dip in sales from November to January, MyHi's rank remained relatively stable, indicating a resilient market position. In contrast, Revert Cannabis New York experienced a more volatile ranking, dropping from 51 in November to 62 in January, yet their sales were initially higher than MyHi's. Meanwhile, Flower by Edie Parker showed a positive trend, climbing from an unranked position in November to 60 in January, with sales figures approaching those of MyHi. 1937 also improved its rank significantly from 100 in November to 63 in January, though its sales remained lower than MyHi's. These dynamics suggest that while MyHi holds a steady rank, competitors are making notable gains, potentially impacting MyHi's future market share and necessitating strategic adjustments to maintain its competitive edge.

Notable Products

In January 2026, the top-performing product for MyHi was the THC/CBD 2:1 Super Sativa Berry Gummies 10-Pack, which climbed to the first position with sales reaching 540 units. The THC/CBD 1:1 Relax Indica Grape Live Rosin Gummies 10-Pack maintained its strong performance, holding the second spot consistently since November 2025, with January sales at 498 units. The Simply Flavorless Stir Stick 10-Pack moved up to third place, showing a steady increase in sales from December to January. The THC/CBD 2:1 Super Tangerine Gummies debuted in the rankings at fourth place, indicating a positive reception. Meanwhile, the Boisterous Berry Stir Stick 10-Pack dropped to fifth place from its previous third-place ranking in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.