Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

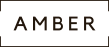

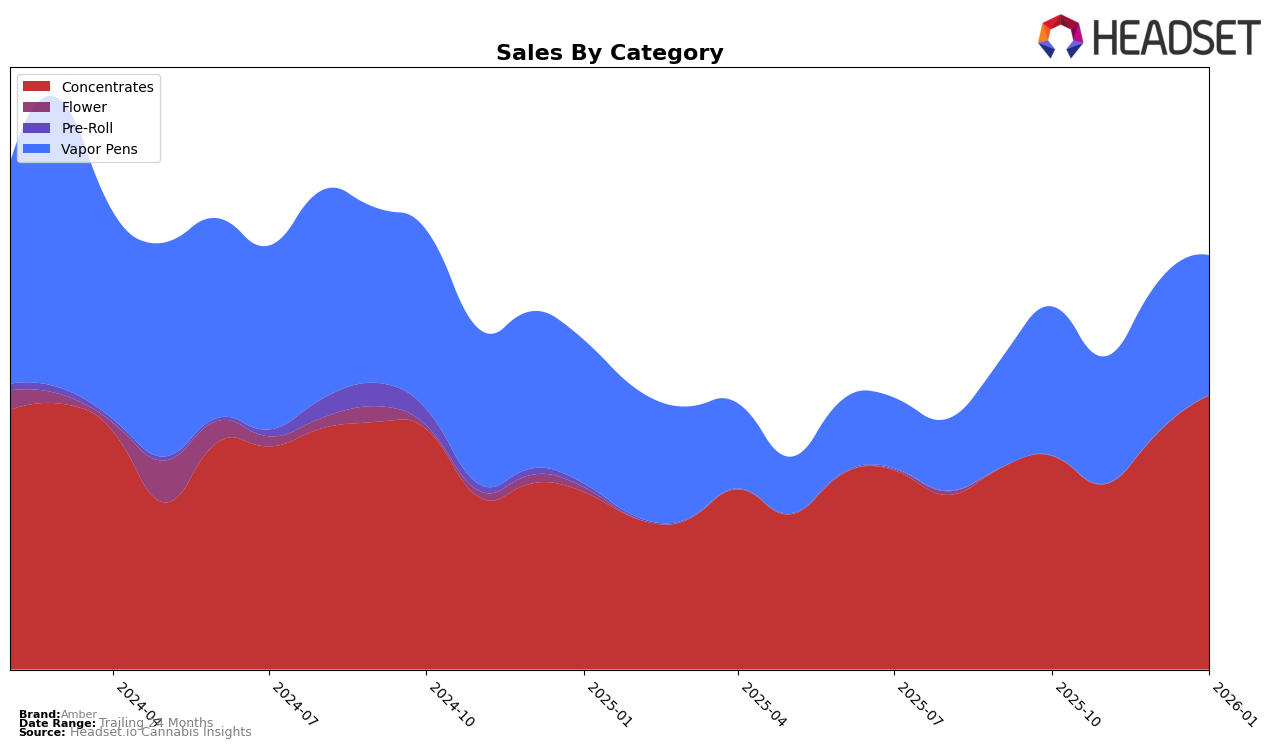

Amber has demonstrated varied performance across different states and product categories, with notable achievements and areas that require attention. In Colorado, Amber has maintained a strong foothold in the Concentrates category, consistently holding the number one position from October 2025 through January 2026. This dominance is reflected in the steady increase in sales, peaking in January 2026. Meanwhile, their performance in the Vapor Pens category within Colorado has seen a positive trajectory, moving from the 24th position in December 2025 to 18th in January 2026, indicating a growing market presence. In contrast, the brand's absence from the top 30 rankings in California for Vapor Pens suggests a challenging market environment or a need for strategic adjustments.

In Illinois, Amber's position in the Concentrates category has been relatively stable, fluctuating slightly around the 25th and 26th positions over the observed months. However, their Vapor Pens category ranking has experienced a decline, slipping from 59th in October 2025 to 65th by January 2026, accompanied by a decrease in sales figures. This suggests potential competitive pressures or shifts in consumer preferences. On a more positive note, Amber's entry into the New Jersey market for Concentrates with a strong 20th position in January 2026 indicates a successful expansion effort. The brand's varied performance across these markets highlights both opportunities for growth and areas where strategic focus could enhance their market position.

Competitive Landscape

In the Colorado concentrates market, Amber has consistently maintained its top position from October 2025 through January 2026, showcasing its dominance in this category. Despite fluctuations in monthly sales figures, Amber's leadership remains unchallenged, with its closest competitors, 710 Labs and Nomad Extracts, consistently ranking second and third, respectively. Notably, while Amber experienced a significant sales increase from December 2025 to January 2026, both 710 Labs and Nomad Extracts did not show such a pronounced upward trend. This indicates Amber's strong market presence and ability to capitalize on consumer demand more effectively than its competitors. The consistent top ranking of Amber suggests a robust brand loyalty and effective market strategy, making it a formidable player in the Colorado concentrates market.

Notable Products

In January 2026, the top-performing product for Amber was Molotov Cocktail Wax (1g) in the Concentrates category, securing the number one rank with sales of 7,834 units. Secret Formula Wax (1g) followed closely as the second-highest seller in the same category. Chemdawg Wax (1g) showed a notable improvement, climbing from fourth place in November 2025 to third place in January 2026. Oreoz Wax (1g) and Strawpicana Wax (1g) rounded out the top five, maintaining steady positions at fourth and fifth, respectively. This indicates a strong preference for wax products within the Concentrates category for Amber during this period.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.