Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

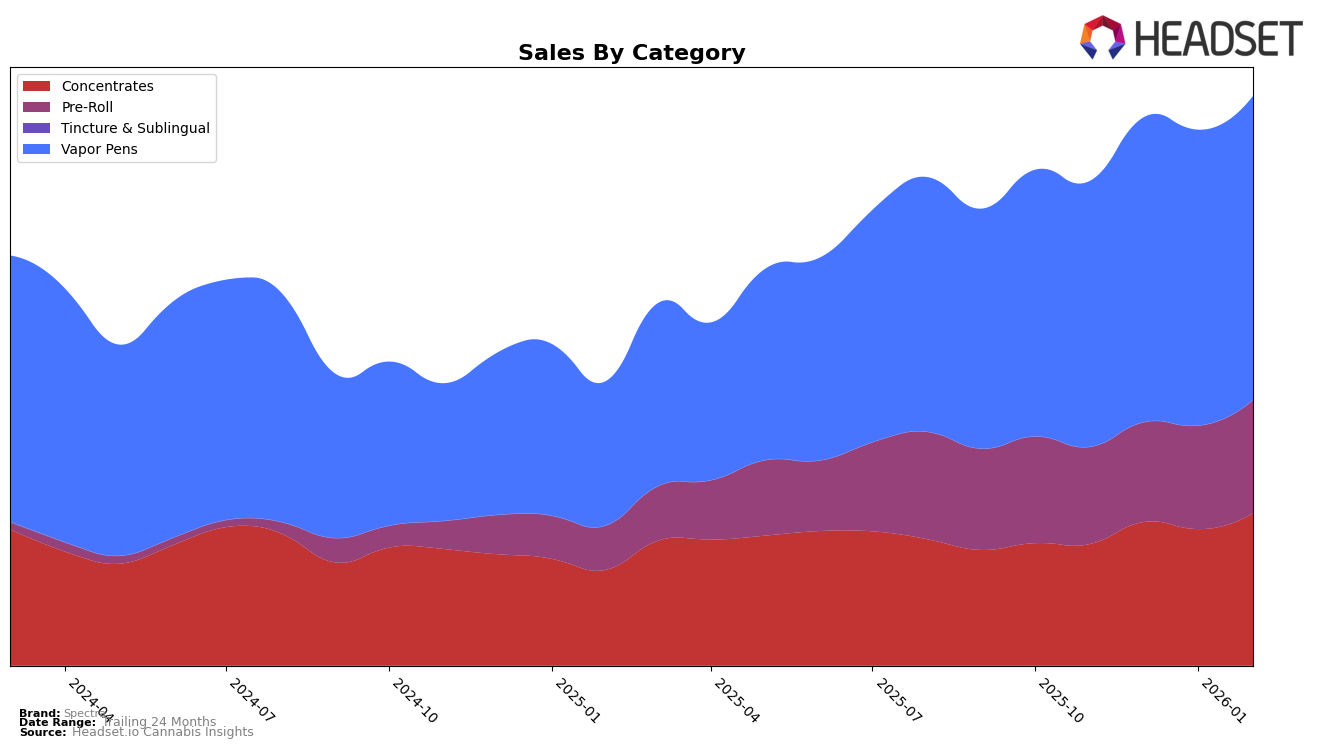

In the state of Colorado, Spectra has shown significant progress across multiple product categories, particularly in Concentrates. Over the four-month period from November 2025 to February 2026, Spectra climbed from a rank of 5th to 3rd in the Concentrates category, indicating a strong upward trajectory in a competitive market. This improvement is mirrored in their sales figures, which saw a notable increase from approximately $374,239 in November to $468,883 by February. Such a movement suggests a growing consumer preference for Spectra's Concentrates, likely attributed to either product quality, marketing strategies, or both.

Spectra's performance in the Pre-Roll and Vapor Pens categories also reflects positive trends in Colorado. In the Pre-Roll segment, Spectra advanced from 9th to 7th place, while in Vapor Pens, they maintained a solid position, fluctuating slightly between 6th and 8th place but ending on a strong note in February. This consistency in rankings, coupled with the upward trend in Pre-Roll sales, suggests a stable market presence and potential for further growth. However, it's worth noting that Spectra did not appear in the top 30 brands for other states or categories, indicating areas where there might be room for improvement or expansion.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Spectra has shown a commendable performance with a consistent presence in the top 10 rankings from November 2025 to February 2026. Spectra's rank improved from 8th in November 2025 to 6th in December 2025, indicating a positive shift in market positioning. However, its rank slightly fluctuated, settling back at 6th by February 2026. This performance is notable when compared to competitors like Green Dot Labs, which experienced a steady decline in sales and rank, dropping from 6th to 8th place over the same period. Meanwhile, Craft / Craft 710 demonstrated strong sales, maintaining a top 5 position and even climbing to 4th place in February 2026. Batch Extracts also showed resilience, although it dropped from 4th to 5th place in February 2026. The dynamic shifts in rankings highlight the competitive pressure in the Colorado vapor pen market, with Spectra's stable performance suggesting a solid consumer base and potential for growth amidst fluctuating competitor standings.

Notable Products

In February 2026, Freeworld Miracle Wax (1g) emerged as the top-performing product for Spectra, securing the number one rank with notable sales of 2472 units. Plant Power 6 - Granddaddy Purple Distillate Cartridge (1g) followed closely in second place, showing a significant rise from its previous fourth position in December 2025. Plant Power 9 - White 99 Infused Blunt (1.5g) maintained its third-place ranking from January 2026, demonstrating consistent performance. The Plant Power 9 - Alien Bubba x Super Lemon Haze Infused Blunt (1g) entered the top ranks at fourth place, marking its first appearance in the rankings. Plant Power 6 - Lemon Kush 510 Distillate Cartridge (1g) completed the top five, highlighting a strong debut for this product in February 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.