Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

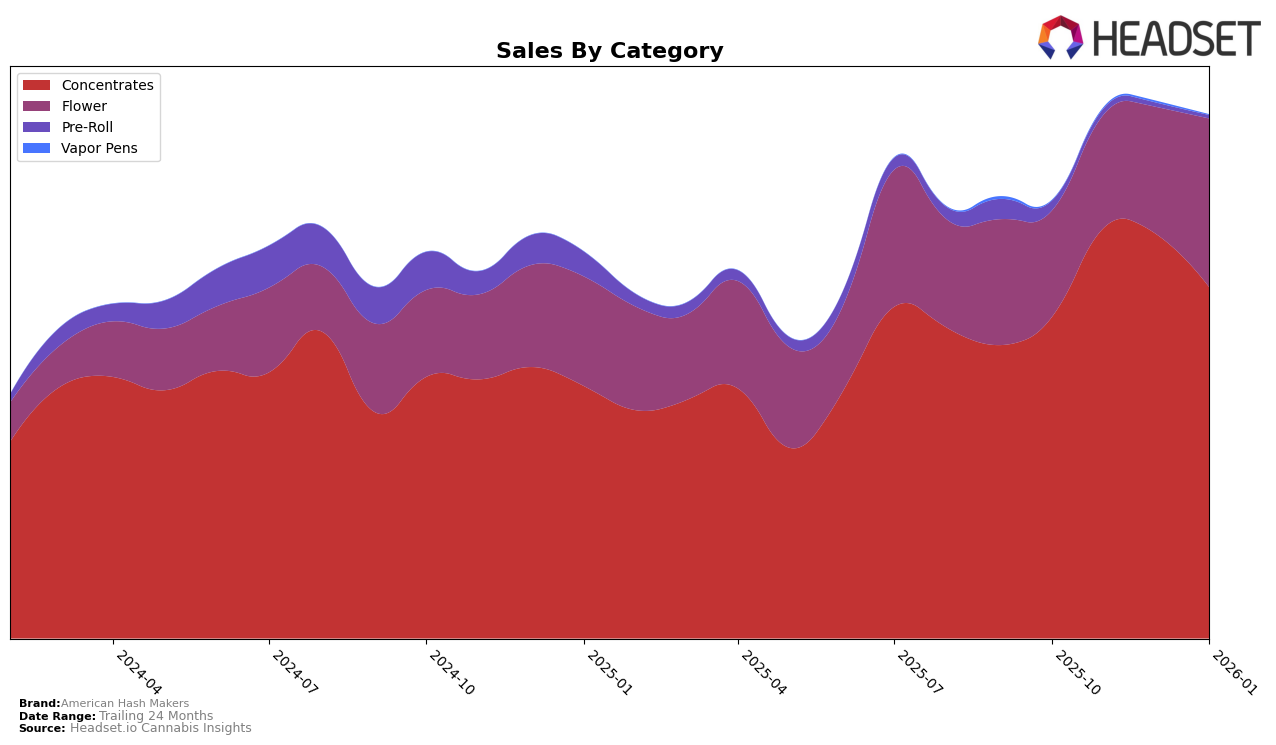

American Hash Makers has shown a notable performance in the Concentrates category across different states. In New York, the brand maintained a strong presence, ranking consistently within the top 10 for October and November 2025, before slightly dropping to 11th place by January 2026. This indicates a slight decline in their market share, although they have remained a significant player in the state's concentrates market. The sales figures in New York reflect a peak in November 2025, suggesting a seasonal or promotional influence that month, before experiencing a decrease in the following months.

In contrast, the performance of American Hash Makers in Washington presents a different story. The brand did not rank within the top 30 in the concentrates category for October, November, or December 2025, which could indicate a challenging market environment or a need for strategic adjustments. However, by January 2026, they emerged at the 95th position, marking their entry into the top 100. This improvement, albeit modest, could suggest early signs of growth or increased brand recognition in the Washington market. The absence of sales data for three consecutive months before January could imply limited distribution or market penetration challenges that the brand might be addressing.

Competitive Landscape

In the competitive landscape of New York's concentrates market, American Hash Makers has experienced notable fluctuations in its ranking and sales performance from October 2025 to January 2026. Despite maintaining a strong position in October and November 2025 with an 8th place rank, the brand saw a slight decline to 10th in December and further to 11th in January 2026. This shift is particularly significant given the performance of competitors like New York Honey (NY Honey), which consistently ranked higher, peaking at 7th in October and maintaining a stable position at 9th by January 2026, with sales figures notably higher than American Hash Makers during this period. Meanwhile, Olio and House of Sacci have shown varied performance, with Olio improving its rank to 10th in January 2026, while House of Sacci remained outside the top 10. These dynamics suggest that while American Hash Makers remains a key player, it faces increasing competition from brands like NY Honey, which could impact its market share if current trends continue.

Notable Products

In January 2026, American Hash Makers saw Lemon Skunk Classic Hash (1g) rise to the top spot in the Concentrates category, with impressive sales of 438 units, up from its third-place ranking in December 2025. Blue Dream Kief (1g) maintained a steady performance, holding onto the second position with 420 units sold. Cement Shoes Hash (1g) climbed to third place from fifth in December, indicating a growing popularity. Sour Gorilla Classic Hash (1g) experienced a slight decline, moving from third in November to fourth in January. Mandarin Butter (28g) made its debut in the rankings at fifth place, showcasing potential growth in the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.