Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

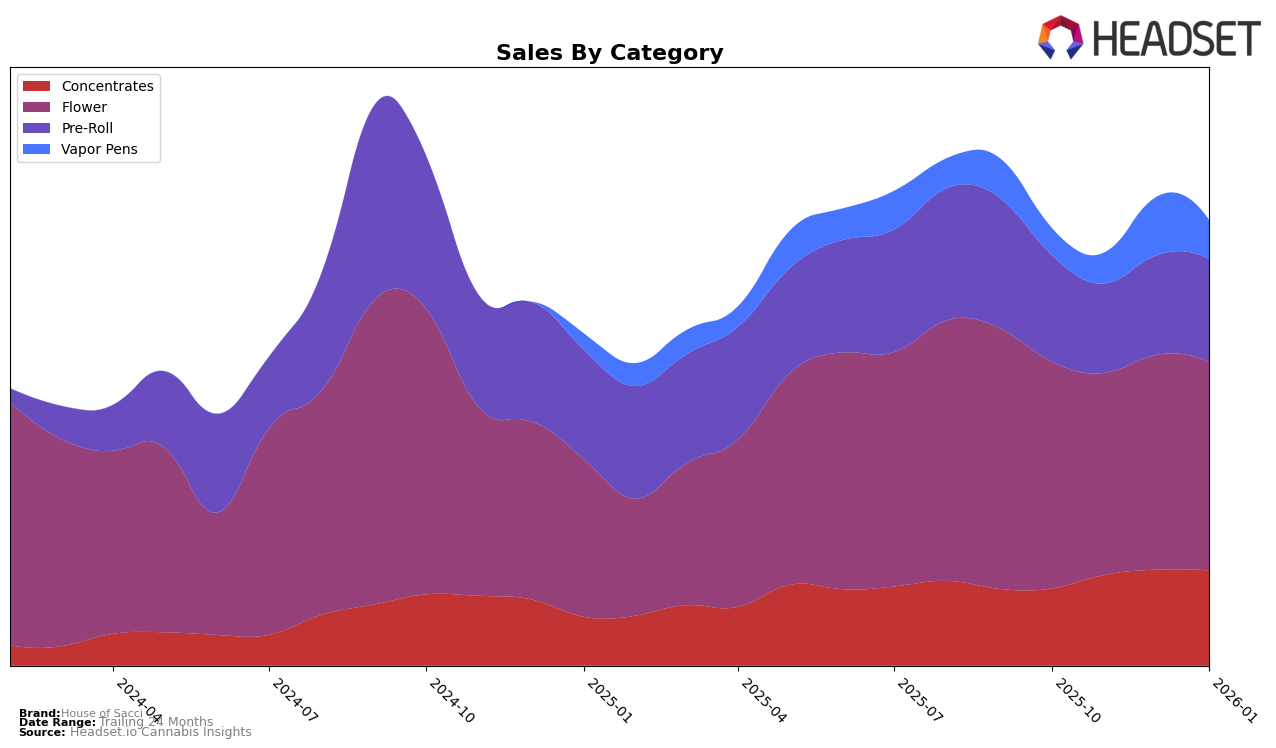

House of Sacci has shown notable performance in the New York cannabis market, particularly in the Concentrates category. The brand has maintained a steady presence within the top 15, moving from 14th in October 2025 to 13th in January 2026. This consistent ranking indicates a strong foothold in the Concentrates market, with a peak in sales during November and December 2025. Conversely, in the Flower category, House of Sacci has not breached the top 30, peaking at 41st in October 2025 before dropping to 55th by January 2026. This suggests that while they have a presence, there is significant room for growth in this segment.

In the Pre-Roll category, House of Sacci has experienced fluctuating rankings, starting at 58th in October 2025, slipping slightly in the following months, and then recovering back to 58th by January 2026. This volatility might indicate a competitive landscape or changing consumer preferences that the brand needs to address. Meanwhile, in the Vapor Pens category, House of Sacci has made a commendable leap from 86th in October 2025 to 71st in December 2025, before settling at 76th in January 2026. This upward trend, particularly the significant jump in December, suggests growing consumer interest and potential for further advancements if the brand capitalizes on this momentum.

Competitive Landscape

In the competitive landscape of the Flower category in New York, House of Sacci has experienced a notable shift in its market position over the past few months. From October 2025 to January 2026, House of Sacci's rank declined from 41st to 55th, indicating a challenging period for the brand. This decline in rank is mirrored by a decrease in sales, suggesting that House of Sacci is facing increased competition. For instance, Flav maintained a higher rank throughout the same period, despite its own sales fluctuations, while Lobo also experienced a drop in rank but still managed to outperform House of Sacci in terms of sales in some months. Meanwhile, High Peaks and UMAMII have shown resilience, with UMAMII notably improving its rank to 54th in January 2026. This competitive pressure suggests that House of Sacci may need to reassess its strategies to regain its footing in the New York Flower market.

Notable Products

In January 2026, the top-performing product from House of Sacci was Indica Brown Solventless Hash (1g) in the Concentrates category, which climbed to the number one rank with sales reaching 843 units. White Diamonds (3.5g) in the Flower category secured the second position, a notable debut in the rankings. Indica Blonde Hash (1g), also in Concentrates, maintained a steady third place, consistent with its ranking over the past few months. Tropic Cherry (0.7g) in the Flower category held the fourth rank, experiencing a slight decline from its peak performance in November 2025. Dog Walkers - Garlic Sauce Pre-Roll 7-Pack (3.5g) entered the rankings at fifth place, marking a new entry in the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.